Stakeholders at PJM’s Markets and Reliability Committee meeting on Thursday endorsed a proposal to allow market participants to use surety bonds as collateral that had been awaiting a vote for more than a year.

The proposal, originally endorsed in October 2018 at the Market Implementation Committee with 61% support, allows the use of surety bonds as collateral for all market purposes except financial transmission rights, with a $10 million cap per issuer for each member and a $50 million aggregate cap per issuer. It was endorsed Thursday through acclamation vote with three members voting “no” and three abstaining.

If the Tariff change is approved at the Members Committee meeting on June 18, PJM said it will require the use of bond companies on the U.S. Treasury Department’s certified list and a minimum credit rating of A with S&P Global Ratings, Fitch Ratings and AM Best, or A2 with Moody’s Investors Service. PJM also will require one-day payment demand terms.

PJM’s Kathleen McElwaine reviewed the proposal, which was deferred at the December 2018 MRC meeting until completion of the independent consultants’ report on the GreenHat Energy default. It was deferred again in April 2019 pending PJM’s appointment of a chief risk officer and a new chief financial officer. (See PJM Stakeholders OK Risk Management Task Force.)

PJM opposed a proposal by Exelon that would have allowed surety bonds as collateral for all market purposes including FTRs, citing limited experience in the use of surety bonds in FTR markets and the large size of past FTR defaults. The Exelon proposal also would have set a $20 million cap per issuer for each member and a $100 million aggregate cap per issuer.

Sharon Midgley of Exelon said her company supports the PJM package as an initial framework to introduce surety bonds into the market. Exelon maintains its proposal is better suited for the market and may consider proposing a change in the future, Midgley said.

She said the PJM package is “inferior” because its caps are more restrictive than those of ERCOT and NYISO. Greg Poulos, executive director of the Consumer Advocates of the PJM States, said the advocates had been struggling to find the best approach for the issue but found a “comfort level” with PJM’s endorsement.

“It’s been a good stakeholder process to allow PJM to get the expertise together and to help consumers make an informed decision on this,” Poulos said.

PMA Credit Requirements

Members endorsed a “quick fix” Tariff revision to address a regulatory change in Ohio concerning the billing of network integration transmission service (NITS). The change was endorsed through acclamation, with one abstention.

In 2015, the Public Utilities Commission of Ohio moved NITS and other related charges to a non-bypassable rider that is the responsibility of the electric distribution company. The change means competitive retail electric suppliers serving load in Ohio are no longer allowed to collect NITS or any other transmission-related charges from end-use customers.

PJM requires load-serving entities to sign NITS agreements and post collateral based on their peak market activity (PMA) and gives itself the ability to make changes to a participant’s PMA requirement when the RTO determines the PMA is not representative of expected activity. (See “‘Quick Fix’ on PMA Credit Requirements,” PJM MIC Briefs: April 15, 2020.)

Capacity Capability Senior Task Force Issue Charge

Members unanimously endorsed revisions to the issue charge of the Capacity Capability Senior Task Force in response to FERC orders issued April 10 concerning PJM’s methodologies for determining the capability of all resource types (ER20-584 and EL19-100).

PJM’s Andrew Levitt said that when the task force was launched on April 7, the RTO hoped FERC would hold the proceedings in abeyance until Jan. 29, 2021, when it planned to file Tariff changes applying effective load-carrying capability measurements for all intermittent and limited-duration resources. FERC instead gave a deadline of Oct. 30, Levitt said, requiring changes to the timing and the scope of the issue charge. Under the revisions, all resources will be considered in the first phase of the initiative rather than just wind, solar and storage. (See PJM MRC Moves Forward on Storage, Hybrids.)

Fuel Requirement Issue Charge

Stakeholders unanimously endorsed changes to the Fuel Requirements for Black Start Resources issue charge, removing the minimum tank suction level (MTSL) from the key work activities. The activity was added to the newly approved Black Start Unit Involuntary Termination & Substitution Rules issue charge.

The Independent Market Monitor recommends that only a proportionate share of the MTSL for oil tanks shared with other resources be allocated for black start units. (See “Black Start Issue Charge Endorsed,” PJM Operating Committee Briefs: May 4, 2020.)

Work on the black start issue is expected to take two to three months, and implementation of needed changes to governing documents is estimated to take about six months following the approval of Tariff changes.

Task Force Sunset

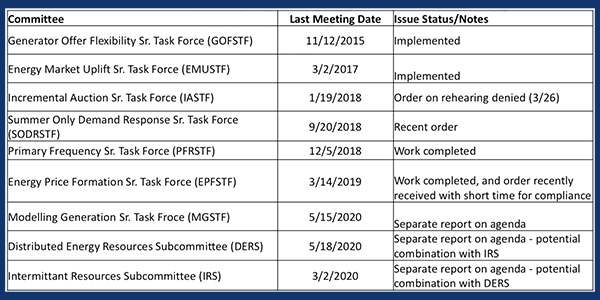

PJM’s Dave Anders presented a list of task forces the RTO is proposing to sunset because they have been dormant.

Anders acknowledged that some stakeholders are concerned about whether some of the groups that were being targeted would need to be reactivated because of new developments, including pending FERC orders.

Several of the task forces on the list have not met for several years, including the Generator Offer Flexibility Senior Task Force (last meeting November 2015), the Energy Market Uplift Senior Task Force (March 2017) and the Primary Frequency Senior Task Force (December 2018).

Anders highlighted a few of the task forces proposed for sunset that saw recent activity, including the Modeling Generation Senior Task Force (MGSTF) that last met on May 15 and the Distributed Energy Resources Subcommittee (DERS) on May 18.

Glen Boyle of PJM provided a report on the potential sunset of the MGSTF, as well as work completed regarding soak time and corresponding voting results. Soak time refers to the minimum period a unit must run from the generator breaker closure until it is dispatchable. (See “Modeling Generation Senior Task Force Recommendations,” PJM MRC Briefs: Dec. 19, 2019.)

The task force, created in 2017, developed the solutions to improve resource modeling for “complex resources” in PJM’s market clearing engines, including combined cycle units, coal units with multiple mills and pumped hydro. Boyle also presented a final report on the task force.

PJM’s Scott Baker discussed a proposal to consolidate the DERS and Intermittent Resources Subcommittee to create the DER and Inverter-based Resources Subcommittee (DIRS). The charter calls for providing a stakeholder forum to investigate issues and procedures related to distributed energy resources and inverter-based resources, including generation or electric energy storage resources connected to the distribution system and/or behind the meter.

Anders said stakeholders will be asked to endorse the task force sunsets at the next MRC meeting.