The New England Power Pool Reliability Committee on Tuesday narrowly approved changes to ISO-NE’s gross load forecast reconstitution methodology, recommending Participant Committee approval next month in order for Tariff changes to be filed with FERC with a requested effective date of Oct. 5.

The committee voted 60.62% in favor of the motion, just over the required 60% threshold. If approved by the PC and the commission, the RTO anticipates starting to use the methodology in the fourth quarter for its 2021 Capacity, Energy, Loads and Transmission (CELT) forecast.

A primary objective of the gross load forecast is to ensure that passive demand resources (PDRs) are not double-counted in the Forward Capacity Auction. PDRs receive compensation as a supply-side resource and reduce demand; thus, their demand-reducing impact becomes embedded in historical load data.

As presented by ISO-NE Load Forecasting Manager Jon Black, the proposed methodology ensures that PDRs are appropriately embedded in the gross load forecast by creating a smooth historical reconstitution time series.

“The smoothing enables us to include recent auction outcomes that extend beyond the historical period,” Black said. By calibrating the amount of PDRs being reconstituted to the capacity supply obligations (CSOs) from the most recently completed FCA, there are a couple of associated improvements, he said.

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to clarify their presentations.]

“No. 1 is what we originally set out to improve upon, which is we shall not be reconstituting energy efficiency installations that are in excess of their CSO, so the accounting would no longer reflect the overperformance,” Black said.

Second, smoothing in conjunction with using the most recently completed primary auction outcomes enables the capture of more recent trends, especially expiring EE measures that are no longer participating as supply in the Forward Capacity Market, he said. The new methodology provides a framework to adjust the gross load forecast to reflect differences in FCA CSOs and those of annual reconfiguration auctions.

“I see these as very significant improvements that I believe are needed in the current forecasting environment in New England,” Black said.

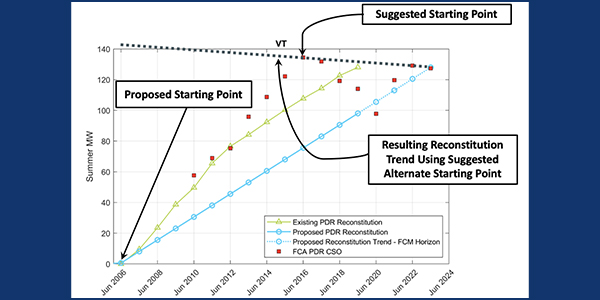

At the June RC meeting, a stakeholder asked whether June 2016 rather than June 2006 would serve as a better starting point for the development of the reconstitution history.

Black said that using June 2016 as a starting point results in a reconstitution trend line with a negative slope, suggesting a decreasing amount of PDR over time, which does not reflect the longer-term CSO trend.

“Using all of history is better, right out of the gate,” Black said. “Picking sub-trends within the overall history of all the FCA outcomes is probably ill-advised.”

The revised reconstitution methodology needs to be implemented for all long-term gross forecast modeling, which is performed for the region and all states separately, and for both summer and winter months, Black said.

Changes to Operating Procedures

The RC discussed proposed changes to several operating procedures, starting with a redline review of changes to OP-17, which describes how ISO-NE monitors and performs analyses to determine allowed load power factor.

If approved by the RC next month and in September by the PC, the changes would be effective Sept. 3.

ISO-NE would use supervisory control and data acquisition system information to perform a survey that would allow it to examine points for every hour of the year instead of the current six selected annually for monitoring, said Dean LaForest, the RTO’s manager of real-time studies.

It would also determine noncompliance based upon adverse impacts to reliability or unit commitment, and would relieve market participants from having to submit annual load power factor survey data, except in cases of noncompliance to determine responsible parties.

The RC also accepted revisions to OP-12 Appendix B to support data change updates in a revision last month to OP-12 related to voltage and reactive control, effective July 20. The changes allow more frequent updates to OP-12B data by using a new format and notifying the RC of changes by email instead of their inclusion on the monthly agenda.

Lastly, the RC discussed changes to OP-21 regarding energy forecasting and actions during an energy emergency, with a proposed effective date of Oct. 18 if approved by the committee in September and the PC in October. The revisions leave existing processes substantively unchanged but would incorporate the annual Generator Winter Readiness Survey process in order to enhance ISO-NE’s situational awareness of generator pre-winter preparations.

The revisions also would incorporate the annual Natural Gas Critical Infrastructure Survey process in order to ensure critical infrastructure of the interstate natural gas system is not on electrical circuits subject to automatic or manual load-shedding schemes.

Committee Actions

The RC’s notice of actions included approval of several motions, noting that all sectors had a quorum.

The RC approved the 19.8 MW SR Litchfield Solar Project proposed plan application (PPA) in Harwinton, Conn. from Eversource Energy (ES-20-G167); the 7 MW BD Solar Winslow II Solar Project from Central Maine Power (CMP-20-G40); the Wareham Transformer #2 Addition Project in Wareham, Mass. from Eversource (ES-20-T33); the 10 MW SR Stonington Solar Project in North Stonington, Conn. from Eversource (ES-20-G168); the Gravel Pit Solar Generation and related Transmission Project from Gravel Pit Solar and Eversource (ES-20-G169; ES-20-T34; ES-20-T35); and the Vineyard Wind Revisions Project PPAs from Vineyard Wind (VW-19-G01-Rev. 1; VW-19-T01[through 5]-Rev. 1.

The RC also approved $6 million in Pool-Supported PTF cost recovery for transmission upgrades to address asset condition issues at the Berlin Substation of the Vermont Electric Power Company (VELCO).