CAISO’s proposal to develop new capacity products through its day-ahead market enhancements (DAME) initiative could radically transform California’s resource adequacy landscape while not yielding expected benefits, a key skeptic of the plan said last week.

“I agree that in the vast majority of situations having a market price is an extremely valuable thing [and] I’m not trying to come down on either side of this one right now. I’m just saying it’s a philosophical change in the way these [RA resources] are being paid that we should think about,” Mike Castelhano, an analyst with the California Public Utilities Commission, said during discussion of the proposed capacity products at a CAISO Market Surveillance Committee (MSC) meeting Thursday.

The ISO launched the DAME effort earlier this year to expand its day-ahead market with two new nodal product offerings that would significantly alter market operations:

- a reliability capacity (RC) “up/down” product to help the ISO match its net load forecast (the load forecast minus the variable energy resource forecast) with sufficient non-VER supply for one-hour intervals; and

- an imbalance reserves (IR) product procured for 15-minute intervals “to provide flexible capacity to accommodate the increasing uncertainty and variability of real-time net load.”

Both products would be offered on a nodal basis, an approach CAISO thinks will best guarantee those supplies will be available when and where they’re needed to ensure flexibility on a grid increasingly dependent on VERs. The DAME straw proposal envisions co-optimizing procurement of both new products — along with day-ahead energy and ancillary services — to improve scheduling efficiency.

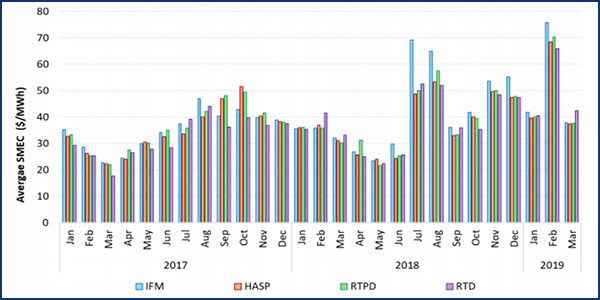

That new process would replace the existing residual unit commitment (RUC) process for ensuring resource sufficiency, in which the day-ahead market procures the incremental capacity needed to meet reliability requirements after the ISO has run its co-optimized integrated forward market (IFR) for day-ahead energy and ancillary services. The incremental capacity obtained through RUC represents the delta between what the IFR has cleared from economic bids and “the amount needed for reliability based on the net demand forecast and potential uncertainty,” the ISO notes in the straw proposal.

“The disadvantage of this sequential RUC process is that the capacity it procures is not co-optimized with the resource commitment and energy schedules produced by the integrated forward market,” CAISO said in explaining the move to the new model.

‘Vanilla’ RUC vs. Spot Market

While CAISO has counterposed two methods for compensating suppliers of the two new products, it clearly favors one option over the other.

Under the “vanilla RUC model” (as ISO Market Design Policy Specialist James Friedrich put it), resources that have been awarded contracts under the CPUC’s RA program could offer into the market at zero price and forego being paid market clearing prices for RC and IR. In that scenario, CAISO would assume the prices of RA contracts — which subject holders to a must-offer obligation (MOO) in the ISO market — “would, in part, reflect owner expectations about magnitudes and frequency of short-run costs incurred to provide RC/IR.”

According to the ISO, the RUC model approach to compensating the new capacity products would be the least disruptive to California’s current RA system because it wouldn’t require renegotiation of existing RA contracts, changes in CPUC rules around cost recovery for RA assets or revisions to CAISO’s MOO Tariff provisions. It would also avoid the need to mitigate market power for RC/IR offers.

Those advantages notwithstanding, CAISO — and the MSC — are advocating implementing a “spot market model” as much as possible to compensate providers of the new capacity products, with the hope that short-term market offers will more precisely reflect variable costs for making capacity available, including natural gas costs and the opportunity costs of not bidding into the real-time market. That arrangement would provide suppliers a stronger incentive to make resources available, according to the MSC.

Use of that model would also eliminate the must-offer obligation for contracted RA resources, which should reduce the number of zero-price offers and increase clearing prices (while also increasing the risk of double-payment before RA contracts can be renegotiated, CAISO acknowledged). That would have the upshot of opening up California’s capacity market to non-thermal resources, helping the state achieve its ambitious carbon reduction goals, one MSC member noted.

“One of the characteristics of the current design is that … demand response can’t compete to provide RUC capacity because thermal RA units are free,” said the MSC’s Scott Harvey. “And they’re not really free, but it gets rolled into the RA price, so you don’t see a separate price signal for [whether] demand response [could] provide this RUC capacity, which is really back-up capacity that we don’t need but we want to have in reserve in case we do need it. And that’s probably an ideal role for demand response … so that’s another long-run goal that could be achieved if we make this change.”

MSC member Jim Bushnell said a long-term focus of the committee is providing “short-run marginal incentives to reward units that provide truly valuable reliability capacity” and incentivizing resource availability.

“The problem with RA has been that we don’t know a year in advance and a month in advance exactly when and what types of units provide what type of value. That’s constantly changing, so the importance for short-run incentives is large here,” he said.

CPUC Concerns

CPUC’s Castelhano said he understood Harvey’s concerns about DR being unable to function as RA capacity in the CAISO market. But Castelhano noted that the RA zero-bid requirement is a CPUC capacity designation rule and not “really a RUC rule.” He cautioned CAISO against making changes that could alter the zero-bid practice in the wholesale market or pushing to revise market rules in a way that would allow DR to function as RA in California.

“The rules for RA and DR are not as well-developed, and that’s a process that’s ongoing, and I think we have to recognize that’s not something that should change at the CAISO necessarily,” Castelhano said.

“I wasn’t arguing for a change in the rules regarding DR that is RA capacity,” Harvey said, clarifying that his focus is on enabling DR — “whether or not it’s RA capacity” — to compete to provide RUC. “That’s the CAISO issue.”

Castelhano also called out CAISO for not discussing how transformative the ISO’s changes could be for California RA, potentially transforming the program from a structure based on contracts to one reliant on a spot market.

“Sure, it gets the costs out of the RA contracts, potentially, but it also then pays a market mechanism-based price to everybody that clears in that market, whereas right now the RA costs are individual” and cost based, said Castelhano. A system based on a clearing price could allow some suppliers to earn inframarginal rents — where a supplier gets paid above its costs in an otherwise competitive market.

MSC Chair Ben Hobbs acknowledged that consumers could benefit if the utilities contracting for RA hold prices down because of monopsony market power and pass on those savings. But he said it is not clear that would happen because visibility into RA contract prices “is not exactly a strong point” in California’s market.

“RA contracts tend to be near some market-clearing level, but from an efficiency point of view, hearkening all the way back to the early days of the California market of pay-as-bid versus market-clearing price, folks who have been on the MSC have tended to favor [a] single market-clearing price for its transparency and incentives,” Hobbs said. “But you might have a point. If the utilities can price-discriminate on RA perhaps there will be less ability to do that in the future, which might conceivably increase what consumers pay and provide more of the inframarginal rents to resources.”

Castelhano also questioned CAISO’s presumption that the new capacity products would reduce some of the “guesswork” behind calculating the costs of RA contracts because income for RA resources would be based on actual short-run costs rather than on a longer-term estimation of those costs.

“My speculation is that it would go very much in the opposite direction because right now part of the RA contract depends on one variable stream of income from sales into the ISO market, and you’re going to create another possibly more variable stream of income,” he said.

Hobbs countered that the proposal’s provision allowing RA resources to buy out their must-offer obligation or bid costs in the ISO market would reduce the cost risks of having a fixed MOO negotiated far in advance of potential deliveries.

“I guess that needs some more analysis, but I don’t agree with what you’re saying there,” Hobbs said.

Castelhano concluded with “a really big concern” that CAISO is considering limiting the participation of energy storage resources in the imbalance reserve markets. He noted that the CPUC’s integrated resource planning process is assuming that storage resources will play a key role providing flexibility needed to integrate variable renewables.

“If [storage] resources are not able to participate in this imbalance reserve market, then I’m very concerned about that,” Castelhano said. “If we’re paying hourly dispatchable resources instead of the stuff that can move really fast, then that’s another concern.”