Invenergy Vice President for Regulatory Affairs Nicole Luckey last week provided an update on her company’s efforts to win approval of the Grain Belt Express, which the company acquired this year after Clean Line Energy Partners abandoned it in the face of regulatory, legal and political hurdles.

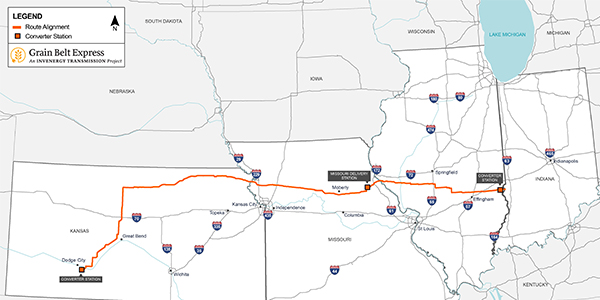

Invenergy is making a revitalized push for the approximately 800-mile HVDC transmission line that would carry 4,000 MW of wind energy from western Kansas through Missouri and Illinois to the Indiana border, Luckey told the Missouri Energy Initiative’s Midwest Energy Policy Series on energy infrastructure and economic development.

She said that because wind and solar resources “require quite a bit of land … we have to build transmission lines to access them.”

The main political obstacle has been the potential use of eminent domain, which has stoked landowner opposition in Missouri. State courts have upheld regulators’ approval of the project and its subsequent sale to Invenergy, though the state legislature introduced a bill this year to block the project’s use of eminent domain.

“The existing infrastructure in these areas, because they’re sparsely populated, just isn’t there, so think of it like building an interstate highway system,” Luckey said. Projects like Grain Belt are needed “to decarbonize our electricity system along the timeline that many investors and customers are pushing their utilities to follow.

“This is not an either-or proposition,” she said.

According to a market analysis done by PA Consulting Group for Invenergy, the $2.3 billion project will enable up to $7 billion in electricity cost savings for the SPP and MISO regions of Kansas and Missouri between 2024 and 2045. The average residential customer would save $50/year, which accounts for the full cost to build the project.

PA’s analysis also found that Grain Belt would lower wholesale power prices in the states’ RTO regions. Around-the-clock power prices in western Kansas would be 38% lower in SPP and 45% lower than prices in Missouri’s MISO region from 2024 to 2039 on an average annual basis during off-peak hours. These pre-project price differences translate to average annual price spreads of $16.81/MWh for Kansas and Missouri’s SPP areas and $22.21/MWh for Missouri’s MISO section.

“It’s no secret that the best wind resource in the United States is located in western Kansas,” Luckey said. “Actually, western Kansas also has a really excellent solar resource, and getting access to the best resource means that you end up significantly lowering the cost of the energy that is produced by your wind or solar project.”

Missouri Rep. Travis Fitzwater (R) mentioned Grain Belt during a legislative panel and said “getting renewable energy across the state would be fascinating” but that the previous Clean Line project iteration was only going to deliver “a small percentage of the power” to the state.

The Invenergy iteration would deliver 2,500 MW of wind energy to Kansas and Missouri from the line’s 4,000-MW capacity. Previously, 500 MW of the transmission line’s capacity was slated for delivery to Missouri. With increased delivery to Missouri, including an expanded DC-to-AC converter station, Grain Belt would make as much as half or more of its total capacity available to Missouri.

“DC lines are just more efficient at moving large amounts of power long distances. You have fewer line losses than you do with AC lines, which again helps to ensure that you’re delivering energy at the lowest cost,” Luckey said. “There are definitely operational and reliability benefits associated with DC lines, which use a narrower right of way and fewer conductors than comparable AC lines, making more efficient use of transmission corridors and minimizing visual and land-use impacts that I know is a priority to landowners, local county officials and to elected officials in those areas.”

The project, which would stretch across 200 miles in Missouri, reached an agreement with the state’s Joint Municipal Electric Utility Commission to serve 39 cities. Luckey added that Missouri retail customers are expected to save $12.8 million annually on their electricity costs.

“We obviously cannot force our project on anyone. Incumbent utilities are the folks we’re talking to about taking service on the project, but they have to carefully weigh their options; [for example,] does it make more sense for their ratepayers or for reliability for them to have locally sourced projects versus taking power off Grain Belt?” Luckey said. She said Invenergy is engaged in Missouri utilities’ integrated resources planning processes that they go through and “talking to them about how we think the project could fit into their plans for decarbonization.”

Grain Belt has gained regulatory approval in Kansas and Indiana, but Illinois’ previous approval was overturned by the courts. Invenergy will seek approvals for expanded delivery to Kansas and Missouri and begin the first phase of project construction before Illinois regulatory approval, which Luckey said the company will pursue next year.

“Engineering design and environmental field studies are ongoing so that we can hopefully begin site work in mid-2022 and bring the project online by the end of 2024,” Luckey said.