The NEPOOL Participants Committee last week acted on modified proposals for offer review trigger prices (ORTPs) used for Forward Capacity Market parameters in the 2025/26 capacity commitment period.

The proposals accommodate changes and extensions to the federal investment tax credit (ITC) for solar and wind developers passed by Congress in December.

At a PC meeting March 4, ISO-NE requested postponement of any action on its ORTP proposal, which was created in concert with consultants Concentric Energy Advisors and Mott MacDonald. The consultants modified their treatment of the ITC in the discounted cash flow model, resulting in a revised ORTP value for solar resources. The RTO also informed stakeholders that minor changes were also required to each of its proposed ORTP values for the 16th Forward Capacity Auction because of the updated performance payment rate (PPR) value.

Tariff revisions include $1.381/kW-month for solar and removal of ORTP values for solar-plus-batteries resources. Despite the modifications, the proposal did not pick up much support, with only 19.04% voting in favor in a sector-weighted vote.

The PC did approve modifications to ORTPs and tariff revisions from stakeholders. The first from the Union of Concerned Scientists on behalf of RENEW Northeast revised its lithium-Ion battery ORTP from $2.612/kW-month to $2.601. This reduction resulted from the ISO-NE modified PPR value for FCA 16. The second, from Advanced Energy Economy, Borrego Solar Systems, Enel X, ENGIE North America and RENEW Northeast, revised previously supported tariff revisions. They passed with 72.5% PC support.

Additional Action

ISO-NE also sought action on tariff revisions for its updated Cost of New Entry (CONE), net CONE and PPR values for FCA 16 after the RTO corrected a location error with the reference unit.

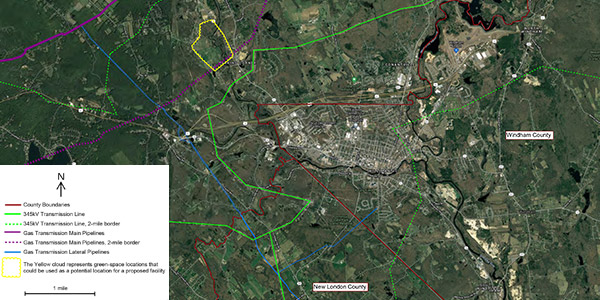

In preparing a response to FERC’s deficiency notice, ISO-NE discovered that the site must be located in Tolland County, Conn., not New London County, as the original modeling suggested.

A potential site for the CONE reference unit in or near Tolland County must be two miles from both a central natural gas line and an interconnection point to the electric grid. The RTO must also estimate emissions limits and whether those limits affect the reference unit’s revenue and offer additional support for the dispatch model’s assumption that the reference unit always runs on natural gas rather than oil. Submission of that information resets the deadline for FERC action on the filing.

However, the PC did not approve. ISO-NE’s modifications garnered 45.09% approval in a section-weighted vote, with no support from the generation and supplier sectors.

The RTO also proposed tariff revisions to support additional flexibility for permanent and retirement delist bids for FCA 16, unanimously approved with abstentions.

Upon FERC accepting the FCA 16 parameters, the Internal Market Monitor would perform mechanical adjustments to participant-submitted permanent and retirement delist bids and test prices relevant to the CONE, net CONE and PPR values. Updated bids and substitution auction test prices will be provided to lead market participants in the retirement determination notifications issued June 3.

Lead market participants would be allowed to withdraw bids and substitution auction demand bids after receiving retirement determination notifications, and associated test prices would be removed. Written notice to the Monitor is required for withdrawal during the existing window (June 3-10) for suppliers to choose conditional or unconditional retirement treatment. Withdrawal will remove the obligation for a supplier to resubmit a retirement bid for the next FCA.