By Chris Brown, CEO, BHE Infrastructure Group

A recent column by Steve Huntoon regarding Berkshire Hathaway Energy’s proposed power solution for Texas included inaccuracies that completely misrepresent our proposal. His comments align with the disingenuous arguments shared by other critics of our proposal, who despite their criticisms have yet to offer a viable solution. (See Counterflow: Beware Those Bearing Gifts.) We believe our proposal brings real benefits to Texans — an emergency power reserve is the lowest cost, most effective way to ensure Texans never again face catastrophic blackouts.

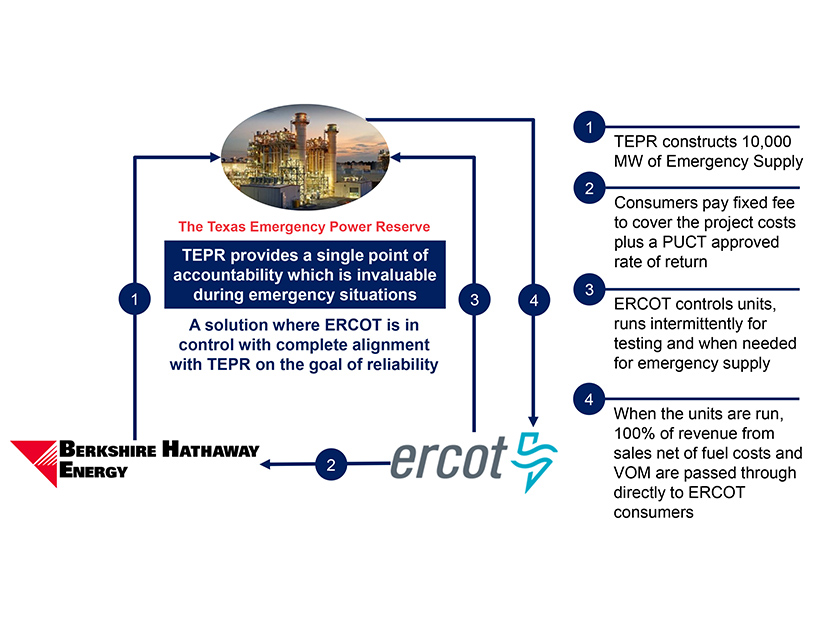

For context, I’d like to provide background on the solution we have introduced to prevent future prolonged blackouts. Berkshire Hathaway Energy is proposing to fund $8.3 billion for the construction of the Texas Emergency Power Reserve, which would include 10 new 1,000-MW gas-fueled generating stations that are available to run during times of an emergency. This power would effectively act as blackout insurance, ensuring that future extreme hot or cold weather does not result in blackouts of longer than three hours.

Contrary to Mr. Huntoon’s view, our proposal does not make the claim that 10,000 MW would alleviate the peak load shed of 20,000 MW that Texas recently experienced. Instead, adding the 10,000 MW of reliable emergency power reserve generation fueled by on-site liquified natural gas (LNG) would have provided sufficient generation to prevent rolling blackouts lasting for longer than three-hour periods, which would have maintained heat in homes and helped avoid the loss of more than 100 lives caused by winter storm Uri.

Moreover, if this emergency power reserve were available during winter storm Uri, the units would have generated over 1,000,000 MWh during the five-day event, resulting in revenues in excess of $9 billion ($9,000/MWh x 1,000,000 MWh = $9 billion), all of which would have been returned to Texas customers — fully paying for the entire cost of the facilities.

Mr. Huntoon surprisingly states that a performance guarantee of up to $4 billion isn’t such a good deal. What’s missing from this opinion is that, as is typical in traditional rate-regulated structures, financing is done on a 50/50 debt to equity method. As such, Berkshire Hathaway Energy is putting 100% of its equity at risk with the guarantee to Texas if we fail to deliver. To our knowledge, no other generators in Texas provide a guarantee that they will start — in fact, 30,000 MW did not perform during winter storm Uri when called upon, and no generators paid damages as a result.

In his column, Mr. Huntoon also asks how a project costing $8.3 billion has a lifetime cost of $3.55 billion. The answer is simple: the net cost of the project factors in the benefits that the plants provide when operating for testing (two weeks per year (336 hours)) over their 40-year design life. The proposal ensures that 100% of all revenue received during testing flows back to customers as a credit on their bill, which reduces the lifetime cost of the project to $3.55 billion.

Mr. Huntoon wrongly asserts that winterizing will cost a “pittance.” In reality, estimates for fully winterizing thermal power plants will cost an estimated $3 billion and result in most units being offline for two months. Additionally, winterizing power plants does not add a single megawatt of new capacity to the system. Even if 100% of the thermal units were operating at full load during winter storm Uri, there still would have been load shedding, as there was not sufficient dispatchable capacity to meet demand. Our proposal fixes this problem.

While Mr. Huntoon offers “modest” proposals at the end of his article, they are lacking substance.

Our proposed emergency power reserve plants will not rely on critical gas infrastructure. They will be fueled by on-site LNG facilities with sufficient capacity to operate the plants at full load for seven days.

We agree the winterization of existing plants is something that should be done. But Mr. Huntoon does not mention that even if all the assets in Texas were winterized, there still would not have been enough generation during winter storm Uri.

In regard to Mr. Huntoon’s proposal to add a dual-fuel capability (like diesel or LNG), it is not possible to simply add diesel fuel to existing power plants without significant modifications to the air permit, and no existing facility is likely to add a 10-million-gallon diesel fuel tank with the expectation to never or rarely use it. Additionally, adding LNG to existing facilities does not add any desperately needed dispatchable generation to the Texas market. Our solution provides both: 10 GW of new, reliable natural gas generation and fuel resilient LNG facilities to be there when needed most.

We echo Mr. Huntoon’s best wish for Texas as it recovers from this tragedy. We strongly believe the Texas Emergency Power Reserve we’re proposing will prevent a similar event from ever happening again. Our proposal greatly serves the needs of Texans, and we have not seen any other proposals to date that truly solve the problems in the state. We are here and ready to serve as good stewards of these assets on behalf of Texans.