Markets and Reliability Committee

CRF Endorsed

Stakeholders endorsed PJM’s proposed solution to update the value of capital recovery factors (CRFs) after a last-minute amendment at last week’s Markets and Reliability Committee meeting was shot down.

In a unanimous vote by acclamation, members endorsed the proposed solution and associated tariff revisions addressing the CRF for avoidable project investment cost determinations. PJM and the Independent Market Monitor had indicated the CRF values on a table in section 6.8 of Attachment DD of the tariff needed updating to reflect current federal tax laws. (See “Capital Recovery Factor Endorsed,” PJM MIC Briefs: March 10, 2021.)

Jeff Bastian, PJM senior consultant of market operations, said the current CRF values were “hardwired” into the table in the tariff and had been in place since 2007. Bastian said the hardwiring approach was problematic because it did not allow for a timely update of the values if federal tax laws change in the future.

The issue has been under review since the Monitor notified PJM in a Dec. 4 letter that the CRF values did not reflect the 2017 reduction in federal corporate tax rates and should have been updated in 2018. (See “Capital Recovery Factors Discussion,” PJM MIC Briefs: Feb. 10, 2021.)

PJM proposed to post the table of CRF values no later than 150 days before the beginning of the offer period of each capacity auction, beginning after the auction for the 2022/23 delivery year, which will be held in May. Bastian said the values would reflect federal income tax laws in effect for the relevant delivery year at the time of the determination.

Bastian also said PJM was moving forward swiftly on the updates to have the tariff changes approved by FERC and implemented by December’s auction for 2023/24.

Paul Sotkiewicz of E-Cubed Policy Associates said the tax laws are “not monolithic and provide flexibility.” The 2017 tax law passed during the Trump administration allows for accelerated depreciation, but Sotkiewicz said it may not be in the best interest of all the companies to take advantage of that.

Sotkiewicz said he is concerned that there may be different interpretations between PJM and the Monitor over the tax issues. He posed a situation in which a company could bring tax treatments to the RTO and IMM and be told the tariff doesn’t allow the different tax treatment. He suggested that PJM provide extra clarity in its filing to FERC on the rationale of the CRF values to avoid a potential deficiency notice.

“I’m worried that there’s something lacking in the language,” Sotkiewicz said.

Stu Bresler, PJM senior vice president of market services, said the RTO will consider Sotkiewicz’s advice for the FERC filing. Bresler said the process to formulate the solution was not ideal, as it had to be completed in a quick-fix approach for it to be in place before the December capacity auction.

While the CRF issue was originally listed for a vote on the consent agenda at the Members Committee meeting on the same say, Sotkiewicz made a motion to remove it to take a separate sector-weighted vote. He also offered a friendly amendment formulated after discussions at the MRC.

The amendment said, “Notwithstanding the use of the formula above, market sellers also have the option of providing alternate tax rates and or depreciation schedules consistent with the tax rate and depreciation used in filing taxes to arrive at a unit-specific CRF that appropriately matches the market seller’s actual tax and depreciation treatment.”

Monitor Joe Bowring said he disagreed with the amendment and that it complicated the CRF issue. Bowring said the reason for having a proposed manageable formula rate was to make it “simple, straightforward and equitable across all resources” and that it only applies to a small portion of the avoidable-cost rate, which are the capital additions necessary to keep a unit in operation.

Susan Bruce, counsel to the PJM Industrial Customer Coalition, also objected to the friendly amendment. Bruce said she was “mindful” that the process to make changes to the CRF table were done quickly and that they will have a significant impact, but she said she didn’t want to make another change so far along in the stakeholder process.

“I might be open to it when we have a fuller conversation,” Bruce said. “But I cannot in good conscience say I can do this on the fly.”

The original tariff revisions without the friendly amendment passed with a sector-weighted vote of 4.79 (95.8%).

Long-term 5-minute Dispatch Endorsed

Members unanimously endorsed the proposed solution and associated tariff and Operating Agreement revisions addressing long-term five-minute dispatch and pricing changes. Stakeholders had previously endorsed a proposal by PJM and the Monitor at the March Market Implementation Committee meeting on the long-term five-minute dispatch evaluation that was under consideration for several months. (See “5-Minute Dispatch Plan Endorsed,” PJM MIC Briefs: March 10, 2021.)

The tariff revisions were also unanimously endorsed on the consent agenda vote at the MC meeting.

Aaron Baizman, senior engineer for PJM, reviewed the solution proposal for the long-term five-minute dispatch and pricing issue worked on in MIC special session meetings. Baizman said there were no changes made to the proposed language presented at previous meetings and that the tariff changes were meant to “add clarity and additional transparency” for PJM business practices.

Baizman underscored the highlights of the long-term package, including the creation of new real-time security-constrained economic dispatch (RT SCED) instructions that utilize previous ones. He said PJM dispatchers will also be provided flexibility for exceptions for case-by-case approval caused by unanticipated conditions or application issues.

PJM will also discontinue the use of degree of generator performance (DGP), a software logic designed to determine how well a unit is following the dispatch signal. Baizman said DGP is being replaced with a less complex and more efficient software program.

Baizman said the long-term timeline implementation features software testing from May to June, parallel operations and evaluation from July to September, and a pilot evaluation and implementation by Nov. 1. He said PJM will file tariff and OA language updates with FERC after receiving stakeholder endorsement.

New Service Requests

Jason Connell, director of infrastructure planning for PJM, provided a first read of the problem statement and issue charge of the proposed solution to address new service requests deficiency review requirements. The issue has been discussed and debated for several months at Planning Committee meetings. (See “New Service Reviewed Again,” PJM PC/TEAC Briefs: April 6, 2021.)

Connell said PJM processes new service requests under several parts of the tariff and administers two new queue windows each year: one from April 1 to Sept. 30, and another from Oct. 1 to March 31. The tariff establishes a “fairly strict timeline,” Connell said, requiring PJM to review a new service request and issue a notice of any deficiencies within five business days.

Interconnection customers then are required to respond to a deficiency notice within 10 business days, Connell said, and PJM is provided an additional five business days to review the response to the deficiency notice.

PJM receives 50% or more of new service requests during the last month of a queue window, Connell said, leading to overworked RTO staff attempting to complete reviews and regularly seeking waivers from FERC to extend the deadlines.

Connell said the new service queue that ended Sept. 30 represented an approximately 27% increase in total number of requests over the previous queue. Of the September queue, Connell said, 340 of the 563 requests were filed in the last week, including 247 on the last day. The latest queue window that ended March 31 had a new record number of requests, he said, coming in at 691.

“We have a very short window to process a very large volume of requests,” Connell said.

PJM’s proposed solution is to change the five-day deadline to 15, Connell said, or to “use reasonable efforts to do so as soon thereafter as practicable.” Stakeholders encouraged the RTO to move up the closing of the new service queue by about three weeks to allow more review time of the applications by staff.

Connell said the proposed solution would also provide PJM with 15 business days to review the interconnection customer’s response to the deficiency notice.

Alex Stern, director of RTO strategy for PSEG Services, said several stakeholders had shared concerns that PJM’s original proposed approach could cause an even bigger backlog for staff. Stern said PJM responded to the stakeholder concerns and was able to make changes that will satisfy any uneasiness with the schedule changes.

“I think this revised approach seems to have benefits to all three core groups impacted: queue applicants, those with study responsibilities and PJM,” Stern said.

Public Distribution Microgrids

After a several month hiatus with PJM attempting to assuage stakeholder concerns, the RTO again brought proposed manual changes to respond to the growing interest in public distribution microgrids.

Natalie Tacka, PJM engineer in the applied innovation department, reviewed proposed revisions to Manual 11: Energy & Ancillary Services Market Operations, Manual 14D: Generator Operational Requirements and Manual 18: PJM Capacity Market. The committee will be asked to endorse the revisions at its next meeting.

The Operating Committee in December unanimously endorsed new rules, and the MRC received a first read at its meeting the same month. (See “Microgrid Rules Endorsed,” PJM Operating Committee Briefs: Dec. 3, 2020.)

Tacka said work on the issue first began in 2019 at the former Distributed Energy Resources Subcommittee and continued into the new DER and Inverter-Based Resources Subcommittee.

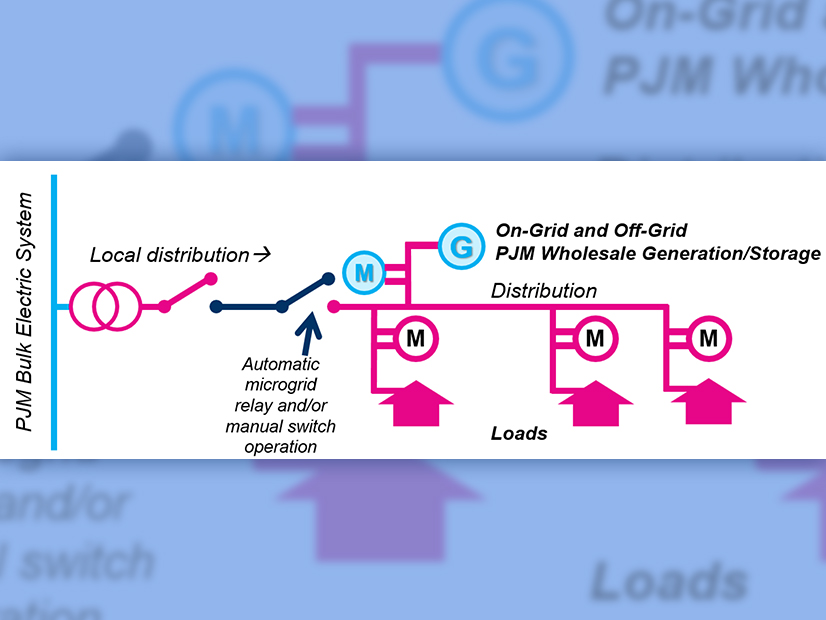

A microgrid is defined as a system of generating facilities and load that can operate both while connected to and off the main grid, Tacka said, and PJM is looking to define a public distribution microgrid as one that contains a facility that can generate while connected to and “islanded” from the broader grid and uses public utility distribution wires.

Tacka provided a summary of the proposed manual changes that differed from the December first read. She said stakeholder discussion led to updates to the public distribution microgrid definition to clarify the scope and establishment of a microgrid.

Language was also added to specify the coordination and consent between an applicable fully metered electric distribution company, an affected electric distributor and a public distribution microgrid operator in determining whether the load is reported to PJM as wholesale when it is islanded. Tacka said telemetry and notification clarifications were also made that consider additional data flow scenarios between a public distribution microgrid operator and generator.

Jim Davis, regulatory and market policy strategic adviser for Dominion Energy, thanked PJM for its work on the issue. Davis said Dominion was the “genesis” for requesting work on the issue and felt there needed to be more clarification in the manual language.

Steve Lieberman, assistant vice president of transmission and PJM affairs for American Municipal Power (AMP), said PJM “afforded a significant amount of time” to AMP to educate them on the public distribution microgrid issue and to work with them make some language changes.

Lieberman said the slower-paced approach and collaborative effort has put stakeholders “in a much better place” on the issue.

Manual 14D Revisions

Stakeholders endorsed the proposed revisions to Manual 14D: Generator Operational Requirements regarding the Resource Tracker ownership confirmation requirement in a vote on the MRC consent agenda. The OC unanimously endorsed a quick-fix proposal in March. (See “Resource Tracker Ownership Endorsed,” PJM Operating Committee Briefs: March 11, 2021.)

The proposal included changing “market participants are requested” to the “generation owner, or designated agent, is required” to confirm resource ownership by Nov. 1. PJM officials said owners of 60 resources, out of 1,503, did not confirm their information in 2020 by Nov. 1.

PJM will also refresh the user interface of the Resource Tracker application to align it with other tools used by the RTO and also add additional information fields to provide contacts associated with the resources.

Members Committee

Manual 34 Revisions Endorsed

Members endorsed revisions to Manual 34 to address motions and amendments in the stakeholder process.

The revisions, originally listed to be voted on in the consent agenda of the MC meeting, were pulled from the agenda and endorsed with a sector-weighted vote of 3.81 (76.2%). Under review for more than a year at the Stakeholder Process Forum, the revisions modify three sections in Manual 34, including a clarification on when members can bring an issue directly to the MC for a vote. (See “Manual 34 Revisions,” PJM MRC/MC Briefs: March 29, 2021.)

John Horstmann of AES Ohio originally presented the proposed Manual 34 revisions, saying the group in the Stakeholder Process Forum that worked on the issue wanted to ensure that no member has “undue influence” over the stakeholder process and to clarify when members can bring an issue directly to the MC for a vote.

The consensus-based issue resolution process was intended to be the mechanism for issues to be raised and discussed by stakeholders, Horstmann said, and an issue that was never discussed in the lower committees could be brought forward as an amendment at the MC for a vote without the manual changes.

Greg Poulos, executive director of the Consumer Advocates of the PJM States (CAPS), requested that the manual changes be pulled off the consent agenda and instead have a sector-weighted vote. Poulos said there’s always a concern from the consumer advocate perspective of adding to administrative requirements on the ability to bring items up in the stakeholder process and for a vote.

TLR Buy-through

Stakeholders approved proposed revisions to remove the transmission loading relief (TLR) buy-through congestion process from the OA in a vote on the MC consent agenda. TLR buy-through is a tool PJM uses to curtail interchange transactions that cause loop flow to the RTO around the time emergency procedures are being conducted to reduce the impact on a flowgate or a transmission facility. The process was created when PJM was fully within the Mid-Atlantic region and was issued more frequently than it is today, according to the RTO. (See “TLR Buy-through Quick Fix,” PJM Operating Committee Briefs: March 11, 2021.)