FERC received dozens of comments Monday, the final day for stakeholders to answer questions on the future of PJM’s capacity market and solutions for the expanded minimum offer price rule (MOPR).

A total of 40 stakeholders issued comments on a series of questions the commission posed after its technical conference in March on capacity markets and the role the MOPR plays in PJM’s (AD21-10). (See FERC Seeks Comments on PJM Capacity Market.)

The stakeholder comments almost universally criticized the MOPR and urged both PJM and the commission to come to a resolution to improve the design of the capacity market to ensure reliability while incorporating state goals for more renewable energy resources.

PJM’s Comments

In its comments, PJM cited the Board of Managers’ letter from April 6 emphasizing a desire for stakeholders to reach consensus on any changes to the MOPR. PJM said it currently anticipates filing amendments to the current MOPR in a Section 205 filing by July 16.

“Although PJM retains Section 205 rights to make filings concerning changes to the capacity market, consensus is clearly desirable both to ensure a durable solution and to lessen the litigation burden on parties and the commission, particularly given the accelerated timeline to address these complex issues,” the RTO said in its comments.

PJM said it wanted to restate that the expanded MOPR in its current form “may not prove to be a durable solution in the long term” and also “may have paradoxically unintended consequences over time and may result in less economic efficiency.”

Some of PJM’s concerns related to the expanded MOPR included:

- the potential for consumers to pay for resources that meet public policy objectives while not receiving credits for the resource contributions in the capacity market;

- procuring more capacity than needed;

- interference with state policy objectives; and

- the potential removal of load from the market, diminishing the economic efficiencies of a regional and competitive wholesale market.

PJM said that even though the expanded MOPR should be amended to better accommodate state policies in the capacity market, other areas of the Reliability Pricing Model (RPM) also need to be examined by stakeholders and FERC “immediately” after to “ensure the continued reliability of the PJM system given the evolution of PJM’s resource mix and composition of capacity resources.”

The RTO cited aspects related to the appropriate level of capacity procurement and a possible option for clean capacity and energy auctions to allow for procurement of clean resources.

PJM said the expanded MOPR is expected to have “limited impact” in the upcoming 2022/23 Base Residual Auction scheduled for May, but it “may not be a sustainable and durable long-term solution” because of its lack of ability to “adequately accommodate state policy objectives” and also address the exercise of buyer-side market power. (See PJM Sets BRA for May 2021.)

“PJM urges the commission to monitor PJM’s stakeholder process and defer any action of its own until it first examines PJM’s expected Section 205 filing,” the RTO said in its comments. “PJM further requests the commission to ensure that any action it is contemplating will not further delay the already delayed December 2021 Base Residual Auction and subsequent auctions, each of which are already occurring without the benefit of producing the full three-year forward price signal that remains a key component of the capacity market design.”

Utilities and Stakeholder Groups

The incumbent utilities that loom large in PJM also urged FERC to take swift action on correcting the expanded MOPR.

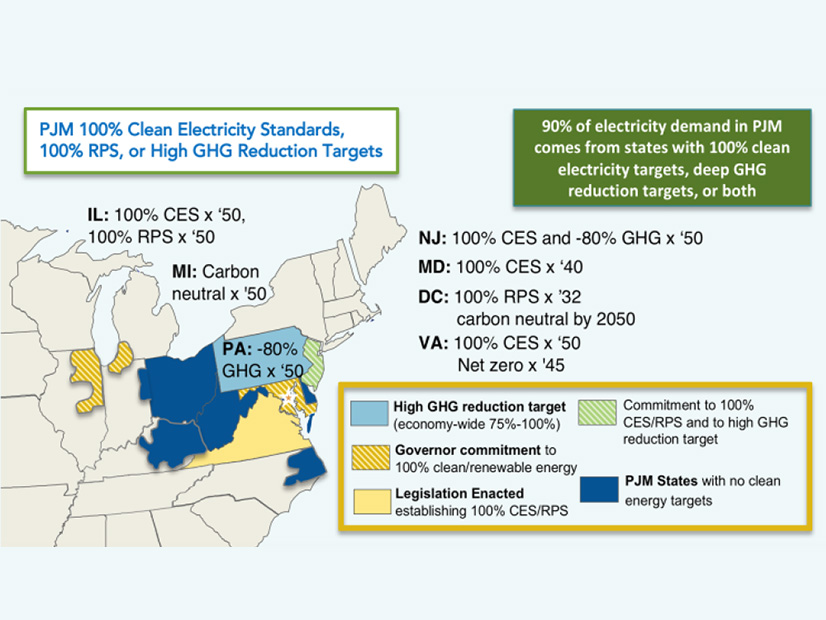

Exelon’s said states have been at the forefront of the transition to clean energy through the adoption of clean and renewable portfolio standards “in the absence of robust and timely federal action addressing the climate crisis.” Exelon said states have retained and procured clean electricity sources and adopted targets for reducing greenhouse gas emissions, with more than 90% of electricity demand in the PJM region located in states that have adopted some form of clean energy standards.

Current PJM market rules “stand starkly in the states’ path,” Exelon said, with capacity market results differing from state clean energy goals because of the design purpose “to satisfy resource adequacy targets based solely on reliability considerations.” Exelon said the expanded MOPR makes state clean energy procurement issues even harder by “undermining” actions to support clean resources outside of the capacity market.

“The expanded MOPR will force PJM to retain an increasing amount of unneeded fossil generation and transfer potential capacity revenues from the clean resources that states wish to preserve to the fossil units they desire to use less,” Exelon said. “While the challenge of accommodating state goals and objectives exist in all eastern centralized capacity markets, they are most acute in PJM.”

Public Service Enterprise Group said it’s “incumbent” upon FERC to direct immediate steps by PJM to “eliminate or significantly modify the expanded MOPR.” A failure to take action, PSEG said, will hinder states in addressing their environmental goals through the implementation of renewable resources.

PSEG said it would prefer changes to the MOPR to be directed toward “preventing the exercise of buyer-side market power through funding by states or local governmental entities of combined cycle resources intended to suppress competition in the capacity market.” The company indicated the expanded MOPR could also be modified to include a unit-specific fixed resource requirement alternative that could “facilitate states’ ability to avoid MOPR impacts” or to not to interfere with actions taken by state and local governments “consistent with the federal government’s valuation of the social cost of carbon.”

“Neither the PJM energy market nor the PJM capacity market incorporates a price on carbon notwithstanding its documented impact on the environment,” PSEG said. “This is a serious market design flaw that understates the costs of fossil fuel plant operations.”

In its comments, the PJM Industrial Customer Coalition (ICC) said an increasing share of stakeholders “favors an accommodative, rather than a punitive, approach to state public policy decisions around resource adequacy.” The ICC said the capacity construct “must benefit” retail customers, while any reforms and accommodations of state goals should not penalize customers and require them to pay more for resource adequacy.

As PJM looks to accommodate state resource adequacy policies in the capacity market, the ICC said, FERC should direct the RTO to maintain “reliability at the lowest cost” as the guiding principle. The ICC said PJM “must preserve the consumer and price-disciplining benefits of competitive wholesale markets” even as state resource adequacy decisions are contemplated.

“At this time, PJM ICC is not advancing a specific answer or solution to how PJM ensures competitive wholesale markets while accommodating state policy decisions,” the ICC said in its comments. “As PJM is encouraged to allow for accommodation of state policy decisions, PJM ICC members are acutely aware that subsidies are contagious and can undercut the ability of the capacity market construct to work effectively.”

The PJM Power Providers (P3) Group said in its comments that it agreed with the opinions of other stakeholders that FERC “should strive to create durable solutions” related to the MOPR and the capacity markets. P3 said PJM’s capacity market construct has been “lacking” stability because of uncertainty around the MOPR and the continual delays of the capacity auctions.

Capacity markets work best when “orderly entry and exit is managed by price signals” reflective of market conditions, P3 said, and “preserving the integrity” of PJM’s capacity market price signal will allows consumers to make “appropriate decisions regarding energy efficiency, demand response and energy management.” P3 said producers also benefit from the price signals by “knowing a future revenue stream upon which decisions can be made regarding construction of new facilities or upgrades to existing facilities.”

“While PJM’s capacity construct is not without its challenges, the general framework has worked well to achieve resource adequacy at just and reasonable rates,” P3 said. “The commission should look to build upon the work that has been done to date as opposed to answering the calls of those who would seek to rip apart its foundation.”

NRG Energy said the grid is evolving with “significant technological advances and changing energy policies that often, though not always, prefer low- and no-carbon resources.” NRG said. It is reasonable for all market participants “to expect the market to evolve too.”

“NRG remains open to further constructive adjustments to MOPR so long as market protections remain in place while those adjustments are being contemplated and implemented,” the company said. “The tensions between state electric generation policy preferences and wholesale market efficiency will not go away simply with a snap of one’s fingers. The MOPR drew a bright line between the domains belonging to the federal and state jurisdictions.”

Calpine’s said that several states in PJM have established “aggressive targets and mandates” to reduce carbon emissions, including contracting with zero-carbon resources “at above-market pricing to encourage resource development or to ensure existing zero-carbon resources stay on the system.”

Calpine said the impact on the competitive market from the state mandates is “significant and growing,” and traditional generation resources do not receive similar subsidies but “continue to participate in the same markets as subsidized units.” When subsidized suppliers participate in markets along with unsubsidized suppliers, Calpine said, the “market results become skewed.”

The commission is faced with a “difficult balancing act,” Calpine said, and it’s not clear that “anything has changed since the June 2018 and December 2019 orders to impact or negate the commission’s findings that the expanded MOPR is needed to protect the capacity market from price suppression.”

“While Calpine believes that the expanded MOPR is an appropriate and necessary mechanism to protect market pricing, Calpine would also accept elimination of the MOPR’s application to state-subsidized resources provided that other mechanisms are put in place that ensure fair and adequate compensation in the capacity market for those resources needed for reliable operation of the power grid,” the company said.

Consumer Advocates and Regulators

Consumer advocates, including the D.C. Office of the People’s Counsel, the Citizens Utility Board, the Delaware Division of the Public Advocate, the Maryland Office of People’s Counsel and the New Jersey Division of Rate Counsel, jointly commented that the expanded MOPR is “not sustainable and will neither serve the PJM region’s nor its consumers’ needs” and that it “must be rescinded as expeditiously as practicable.”

The group said a “significantly curtailed MOPR” complementing state policies is necessary but is not “sufficient to ensure a just and reasonable resource adequacy construct.” It said the development of a resource adequacy construct that is just and reasonable while maintaining reliability and cost efficiency will “require several significant reforms.”

“Markets must be designed holistically,” the joint consumers said. “While competitive, wholesale markets are the foundation for addressing resource adequacy, these markets do not and should not operate in silos. Changes to one market, be it energy, capacity or ancillary services, necessarily impact the other markets, and these impacts must be reflected in market design.”

The Maryland Public Service Commission said its support for renewable resources has complicated its relationship with the PJM capacity market. Even as the RTO’s markets evolve to incorporate more state preferences for renewable resources, the PSC said, the “most immediate and critical action” FERC should take would be to “reinstate the accommodation of state preferences inherent in the RPM since its inception” and prevent the possibility of double payments for capacity.

“Until then, resource developers should be allowed to continue to recognize foundational entry and exit signals based on legitimate state policies, as expressed in state statutes and regulations that identify preferred resource type, location, timing and price,” the PSC said.

Maryland is currently in the second phase of its offshore wind development process, the PSC said, involving offers for “three sequential 400-MW tranches of projects.” It said meeting the state’s OSW targets “would be exceedingly difficult” if the ratepayers are required to pay twice for capacity.

“The sooner MOPR is reformed, the sooner new cost-effective resource adequacy paradigms can be earnestly pursued,” the PSC said.