By Michael Kuser

ISO-NE on Thursday defended its proposed two-stage capacity auction, responding to criticism by its External Market Monitor and others.

In its Feb. 13 response to protests, the RTO asked the commission to approve its Competitive Auctions with Sponsored Policy Resources (CASPR) program, saying the Monitor’s “proposed cure would be worse than the disease” (ER18-619). Monitor David Patton filed a protest Jan. 30 saying that he supports “the objective and approach” of CASPR but that the RTO’s proposal has a “critical design flaw” that will result in “inefficient investment and retirement decisions and over the long term … raise costs substantially to New England’s customers.”

Also filing protests in response to the Jan. 8 CASPR filing were Massachusetts Attorney General Maura Healey; municipal utilities (New England Consumer-Owned Systems); Connecticut; the Natural Gas Supply Association; a coalition of environmental groups (Clean Energy Advocates); the New England Power Generators Association; and several merchant generators. (See CASPR Filing Draws Stakeholder Support, Protests.)

The CASPR proposal grew out of the New England Power Pool’s Integrating Markets and Public Policy (IMAPP) initiative, launched in August 2016 to address state regulators’ concerns about ratepayer costs associated with policy-driven resources and generators’ fears that out-of-market procurements of renewable generation would suppress capacity prices.

Under ISO-NE’s proposal, it would clear the Forward Capacity Auction as it does today, applying the minimum offer price rule (MOPR) to new capacity offers to prevent price suppression. In the second Substitution Auction (SA), generators with retirement bids that cleared in the primary auction would transfer their obligations to subsidized new resources that did not clear because of the MOPR. The proposal would phase out the current Renewable Technology Resource (RTR) exemption, which has allowed ISO-NE to clear 200 MW of renewable generation in its capacity auction annually (to a maximum of 600 MW) without regard for the MOPR.

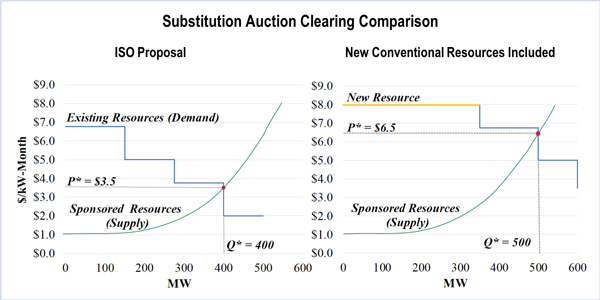

ISO-NE’s External Market Monitor included this example in its protest, saying excluding new conventional resources from the substitution auction (left) would clear only 400 MW of sponsored resources, with three existing resources retiring and sponsored resources foregoing $31.2 million in capacity payments. Under the Monitor’s proposal (right) 500 MW of sponsored resources would clear and only one plant would retire. Sponsored resources’ foregone capacity payments would total only $2.7 million. | Potomac Economics

Bad Cure

ISO-NE said it prohibited new conventional resources from participating in the secondary auction “to protect the Forward Capacity Market’s ability to guide competitive and cost-effective entry and exit decisions to maintain resource adequacy.”

But Patton’s Jan. 30 filing said the exclusion of new conventional resources from the SA will cause “new resources to clear and enter when they are not economic or needed and existing resources to retire that are economic to continue operating and whose costs of remaining in operation (i.e., going forward costs) are much lower than the entry costs of new resources that are entering.”

Patton would allow new conventional resources to clear through the SA “so they may be efficiently displaced by the sponsored resources.”

“This was a component of the ISO’s original proposal, but it decided to alter its proposal by excluding the new conventional resources from the Substitution Auction,” Patton wrote. “By doing this, the supply and demand (and prices) that will determine when a new conventional resource enters will ignore supply from the sponsored resources.”

The RTO retorted that “the EMM’s proposed cure would be worse than the disease” by creating “more, and more significant, problems than the overbuild problem it seeks to fix.”

One such problem would be fictitious entry, in which developers with no intention of building generation enter the FCA just to secure the severance payment in the second auction. The EMM’s fix? New conventional resources that are displaced by a sponsored resource would receive no payment.

The RTO said that could scare off new competitive generation, resulting in high capacity clearing prices — the “price blowout problem.”

Patton said that fear is “misplaced.”

“The risk described by the ISO is a risk that is common to all investment decisions and is efficient for the investor to consider in making its investment decision. Any time new resources are entering the market, whether they are sponsored resources or competing conventional resources, this will reduce the expected profitability and increase the risk to subsequent investment,” he wrote.

The EMM would modify the MOPR applied to sponsored resources in the primary FCA so that they can clear at a moderate price, potentially replacing the market-based clearing price with an administratively determined one.

“In addition to its complexity, this multilayered solution is both unfair and ineffective,” the RTO said.

Impossible to Win?

“In this situation, the conventional new resource has responded to the market’s price signal and succeeded in securing a capacity supply obligation (CSO) because it was willing to sell its capacity in New England at the primary auction’s clearing price,” the RTO said. “To strip such a resource of its award without compensation would alter the meaning of the clearing price, as a high price no longer would serve its fundamental purpose as a market signal to encourage commercial investment.”

The EMM’s proposal makes it impossible to “win” an auction, and the outcome differs fundamentally from “the outcome of a normal competitive auction in which an investor fails to clear because its offer price exceeds the market’s clearing price,” the RTO said.

ISO-NE also objected to the EMM’s proposed “price-setting by administrative dictate,” which it found “problematic, both practically and philosophically.”

Practically, the EMM methodology would create reliance on a predetermined estimate that may or may not reflect the true net cost of new entry (CONE), and “to the extent that number is wrong, FCM’s clearing price may be inflated or deflated,” the RTO said.

Philosophically, the EMM’s proposal would result in an outcome largely dependent on administrative parameters. The outcome, like that of the RTR exemption that CASPR seeks to replace, “ameliorates system overbuild but undermines the competitiveness of capacity prices,” ISO-NE concluded.

Applying the Monitor’s proposal to FCA 12 would have resulted in total costs of $4.15 billion, an increase of $908 million, or 28%, the RTO said.

“There can be no perfect solution that completely meets the objectives to maintain competitive pricing and accommodate state-sponsored resources,” ISO-NE said. “When required to trade between these competing objectives, the ISO prioritizes competitive prices.”

RTR Exemption

The RTO also defended its proposal to phase out the RTR exemption, calling it a “blunt instrument.”

The conditions that made the RTR exemption just and reasonable upon its adoption will no longer exist going forward, the RTO said: “Instead, load growth has slowed, the region has excess capacity, and, most significantly, the states have announced plans to contract for substantial amounts of sponsored capacity.”

NextEra Energy and NRG Energy insisted that the commission eliminate the RTR exemption immediately, saying it suppresses prices. CASPR would phase out the exemption by allowing the exempt megawatts that have accrued in earlier auctions — currently 481 MW — to be used over the coming three years through FCA 15.

NextEra argued that the three-year phase-out made no sense because the conditions that supported the exemption no longer exist. The RTO answered that a measured transition was necessary to maintain investor confidence and lower costs over the long term. It noted that the commission has accepted similar transition mechanisms in other capacity market proceedings.

Attorney General Healey opposed CASPR as not allowing “for any regular or reliable integration of sponsored policy resources” into the FCM. She recommended a mechanism like the “backstop” proposed by the New England States Committee on Electricity, which would guarantee entry of up to 200 MW of sponsored policy resources annually regardless of whether they were matched by retirements.

She also suggested the commission could remand the proposal to the RTO with an order to reinstate the RTR exemption.

The RTO said that, given current market conditions, a 200-MW RTR exemption would depress FCA clearing prices by up to 87 cents/kW-month. Continuing the RTR exemption or adding a backstop would undermine CASPR “because no sponsored policy resource would elect to sell capacity at a low price in the Substitution Auction when it could instead receive the higher primary auction price through the exemption,” ISO-NE said.