By Michael Kuser

ISO-NE is “in a race” to relieve natural gas pipelines constraints and interconnect new generation before New England loses older, uneconomic resources, CEO Gordon van Welie said Tuesday.

“If there’s a mismatch between the speed of those two or three activities, we’re going to have to do something to slow things down so that we keep the grid reliable,” van Welie told reporters in an online briefing on the state of the region’s power grid.

“The more we constrain oil, the more complicated, the more tenuous it makes our operations,” he said. “We have resources that are retiring, we have state environmental regulations that are aggressively lowering the amount of emissions that can be produced by fossil generators, and we have the states moving forward aggressively to invest in behind-the-meter resources, including energy efficiency and new renewable resources.”

In January, the RTO released an Operational Fuel-Security Analysis that examined 23 fuel-mix scenarios and concluded that inadequate fuel supplies would cause power shortages under 19 of the scenarios by winter 2024-25. Those shortages would require emergency actions such as voluntary energy conservation and involuntary load shedding, or rolling blackouts. (See Report: Fuel Security Key Risk for New England Grid.)

Smoker of a Cold Snap

During two weeks of bitter cold surrounding New Year’s Day, New England generators burned through nearly 2 million barrels of oil, more than twice the amount used by the region’s power plants during all of 2016, van Welie said.

Oil supplies at plants around New England declined rapidly during the cold spell as gas prices spiked and dual-fuel plants switched to oil, but the RTO avoided serious reliability issues thanks to LNG shipments. (See FERC, RTOs: Grid Performed Better in Jan. Cold Snap vs. 2014.)

Contributions from other types of generators were crucial during the cold snap, according to the RTO’s analysis.

“For instance, electricity produced by the Millstone nuclear station during the cold spell is equivalent to what could be produced by about 880,000 barrels of oil, and the power from the Mystic 8 and 9 units in Boston, which are fueled by LNG from the nearby Distrigas import facility, was the equivalent of more than 360,000 barrels of oil,” van Welie said.

High oil consumption means higher emissions. At the end of the cold snap, just one week into 2018, several oil-fired generators were already nearing their annual emissions limits, he said.

“The region can pay the bill for its fuel-security risks periodically, in spiking wintertime prices and potential energy shortages, or the region can pay the costs proactively and avoid reliability risks by investing in infrastructure, firm fuel contracts and other incentives,” van Welie said.

That new infrastructure could include further efficiency measures, transmission lines, renewable energy resources, storage facilities for liquid fossil fuels and gas pipeline infrastructure.

“Clearly, as one makes some of these infrastructure investments, you begin to lower the costs of the reliability services that the ISO seeks to procure,” van Welie said.

As oil resources retire — including those solely fueled by oil — the grid becomes more dependent on imported LNG or dual fueling, he said.

“I think the dual fueling becomes more constrained given the emissions constraints in the region,” van Welie said. The solution is “really a combination of electricity imports from neighboring regions and LNG as the balancing fuels as we put more and more renewables on the system, and that’s assuming we make no more investment in the gas infrastructure.”

Since 2000, the share of oil- and coal-fired generation in the region’s power production has fallen from 40% to less than 10%, while natural gas has risen from 15% to about 50%, he said.

Wind and CASPR

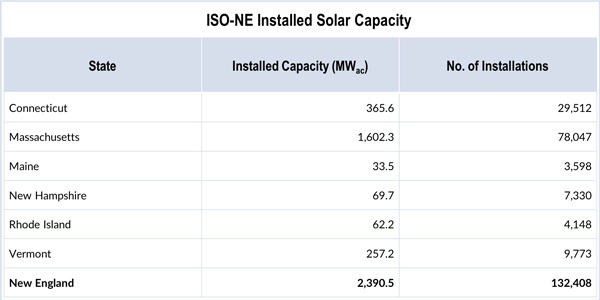

Solar has “exploded” in New England, largely because of state incentives, van Welie said, growing from 250 MW to 2,400 MW in just five years. Most resources are located in more than 130,000 small installations on homes or businesses.

And last year, wind power for the first time surpassed natural gas for the volume of generation seeking interconnection in the RTO’s queue. About 4,000 MW of that proposed wind would be located offshore of Massachusetts, with most of the remaining 4,500 MW onshore in Maine. (See Mass. Receives Three OSW Proposals, Including Storage, Tx.)

As the amount of wind and solar power continues to grow, in part driven by state policies, the RTO in January proposed a new two-stage capacity auction, Competitive Auctions with Sponsored Policy Resources (CASPR), to enable its Forward Capacity Market to accommodate state policy-sponsored, clean energy resources in the wholesale market, while maintaining a viable economic model for existing power plants. (See ISO-NE Defends CASPR Against Protests.)

CASPR, which the RTO proposes to implement on June 1, would “fully integrate demand response resources … into the competitive energy and reserves markets, where they can compete with conventional generators,” van Welie said. “ISO New England will be the first in the country to fully integrate DR into energy dispatch, building on its longstanding commitment to DR.”

The most effective way to achieve the states’ environmental objectives is to put an appropriately high price on carbon, van Welie said, because it would spur investment in cleaner resources.

“That could be the most efficient way of doing it through a wholesale market mechanism,” van Welie said. “It would allow us to avoid making this CASPR proposal that we recently filed at FERC. But we do understand that’s not the preferred choice of the states, and we respect that, and hence we have come up with this method for accommodating what they’re doing through above-market contracts.”