By Rich Heidorn Jr.

Rising state subsidies for renewable and nuclear power require PJM to revamp its minimum offer price rule (MOPR) to address price suppression in its capacity market, FERC ruled Friday.

The commission ruled 3-2 that the rule, which now covers only new gas-fired units, must be expanded to all new and existing capacity receiving out-of-market payments, such as renewable energy credits and zero-emission credits for nuclear plants. Democrats Cheryl LaFleur and Richard Glick dissented, calling the ruling hasty and counterproductive.

The commission’s ruling — a rejection of PJM’s April “jump ball” capacity filing (ER18-1314) and a partial grant of a 2016 complaint led by Calpine (EL16-49) — initiated a Section 206 proceeding in a new docket (EL18-178).

The commission rejected both PJM’s capacity repricing proposal and the Independent Market Monitor’s MOPR-Ex proposal, saying neither was just and reasonable. It agreed with Calpine that the existing MOPR was also unjust and unreasonable but declined to adopt the company’s proposed remedy.

Instead it consolidated the two cases into the new docket for a “paper hearing” on an alternative approach in which PJM would expand the MOPR to all subsidized resources with “few to no exemptions.” FERC also recommended creating a mechanism similar to the fixed resource requirement (FRR) allowing states to pull subsidized resources — and associated loads — from the capacity auction.

Comments on the commission’s proposal are due in 60 days, with reply comments 30 days after that. The commission said it hoped to issue a final ruling by Jan. 4, 2019, in time for the 2019 Base Residual Auction.

PJM spokesman Jeff Shields released a statement saying the RTO “is pleased that the commission is taking action to address the price-suppressive impacts of resources that receive out-of-market payments.”

“The order appears to be a positive step to change competitive electric market design while recognizing the important role states play in influencing the resource mix through retail energy policies,” it continued. “We will begin work immediately to develop the kind of bifurcated capacity construct envisioned by the commission and actively engage stakeholders, including the states, within the timetable laid out by the commission. We seek to ensure markets continue to deliver reliability at the lowest cost, drive investment without imposing risk on consumers, align generator performance with grid operations, support economic development and encourage technology innovation.”

The commission said PJM’s capacity market has become “untenably threatened” by out-of-market payments resulting from state initiatives.

“What started as limited support primarily for relatively small renewable resources has evolved into support for thousands of megawatts of resources ranging from small solar and wind facilities to large nuclear plants,” the commission said. “As the auction price is suppressed [by subsidized resources], more generation resources lose needed revenues, increasing pressure on states to provide out-of-market support to yet more generation resources that states prefer, for policy reasons, to enter the market or remain in operation. With each such subsidy, the market becomes less grounded in fundamental principles of supply and demand.”

All PJM states excluding West Virginia, Kentucky and Tennessee have renewable mandates or goals.

| PJM

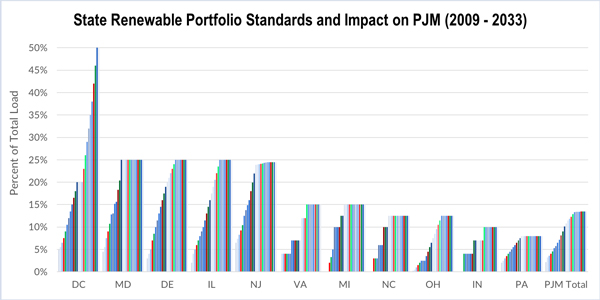

According to an analysis by Anthony Giacomoni, PJM senior market strategist for emerging markets, the percentage of the RTO’s load subject to renewable portfolio standards has risen to 8% from 2.15% in 2009. Giacomoni said the percentage will reach almost 13.5% in 2033, with New Jersey, Maryland, Delaware and Illinois hitting 25% and D.C. rising to 50%.

PJM’s Board of Managers submitted the “jump-ball” filing after stakeholders lobbied against capacity repricing, under which the RTO would have accepted bids from subsidized resources in its capacity auctions but then isolate them during a second stage and reset the price without them. Stakeholders were more supportive of the Monitor’s MOPR-Ex proposal, which would have extended the MOPR to all units indefinitely, with carve-outs for states’ renewable portfolios and public power self-supply. (See PJM Capacity Proposals to Duel at FERC.)

Capacity Repricing

The commission said the capacity repricing plan would disconnect the determination of price and quantity in the BRA, undermining its price signals.

“Though the second stage price may not be suppressed by uncompetitive offers from resources receiving out-of-market support, the higher price — created by repricing — would signal that the market would buy capacity from higher-cost resources than actually clear the market and receive capacity commitments,” FERC said. “This would make it more difficult for investors to gauge whether new entry is needed, or at what price that new entry will clear. … Market participants would see the final, second-stage clearing price but would have limited information on which resources received commitments and the first-stage price.”

The commission said the plan would result in a “windfall” to subsidized resources, which “would not only receive the same clearing price as competitive resources, but would then further benefit from the higher price set in stage two of the auction.”

“PJM’s proposal therefore will increase prices for load … [and create] an unjust and unreasonable cost shift to loads who should not be required to underwrite, through capacity payments, the generation preferences that other regulatory jurisdictions have elected to impose on their own constituents.”

The commission rejected PJM’s contention that its approach was similar to ISO-NE’s Competitive Auctions with Sponsored Policy Resources, a two-stage capacity auction to accommodate state renewable energy procurements, which FERC approved in March. (See Split FERC Approves ISO-NE CASPR Plan.) “CASPR does not allow [subsidized] resources unfettered access to the market, [and] it retains and strengthens ISO-NE’s MOPR for all new resources by phasing out the renewable technology resource exemption,” FERC said.

The commission also found that PJM failed to support its proposed materiality threshold for initiating repricing, which it set as either 5,000 MW of unforced capacity across the region or 3.5% of the reliability requirement for any locational deliverability area.

MOPR-Ex

The Monitor’s MOPR-Ex proposal would have extended MOPR to all fuel types while exempting self-supply, public power and electric cooperative resources — which the RTO said were unlikely to suppress prices — along with RPS resources.

The commission said PJM failed to justify the RPS exemption.

PJM said the 5,000 MW of renewables needed to meet RPS requirements in 2018 will grow to 8,000 MW by 2025. The RTO also said the Illinois and New Jersey ZEC programs could subsidize 4,760 MW of nuclear generation and that New Jersey and Maryland have authorized a total of 1,350 MW of offshore wind procurements.

10 of 13 PJM states and D.C. have renewable portfolio standards or goals. | NCSL

“PJM has not shown that the exempted resources have a different impact on its capacity market than those which are not exempted. Moreover, PJM’s assertion that the RPS exemption was based on deference to public policies favoring renewable generation resources is inconsistent with the well-established desire of some states in PJM to support other resources, such as nuclear plants,” FERC said. “In addition … it is unclear why state programs limited to offshore wind should not be eligible for the RPS exemption given that such resources would likely have a market impact similar to other exempted state-sponsored renewable resources.”

The commission acknowledged that it has approved MOPR exemptions for renewables in NYISO and ISO-NE but said those grid operators minimized price suppression by capping the amount of generation eligible for their set-asides.

Calpine Complaint

The commission agreed with a 2016 complaint by Calpine and 10 other generating companies, which alleged PJM’s MOPR was unjust and unreasonable because it failed to address price suppression by existing subsidized resources. (See Generators to FERC: Expand MOPR for Subsidized FE, AEP Plants.)

The company filed the complaint in response to ratepayer-funded subsidies then under consideration in Ohio. Although the Ohio subsidies were later withdrawn, Calpine amended its complaint in response to Illinois’ ZECs program.

“The increase in programs providing out-of-market support, such as ZEC programs, has changed the circumstances in PJM, such that it is no longer possible to distinguish the treatment of new and existing resources in the context of PJM’s MOPR,” FERC said.

But the commission rejected Calpine’s proposal that it immediately extend the MOPR to additional resources and direct PJM to conduct a stakeholder process to develop a long-term solution.

Addressing Double Payments

Although it has previously approved ways for customers to avoid paying twice for capacity because of state policy decisions, the commission cited appellate court rulings that it is not required to do so. “Nonetheless, we do not take this concern — or the states’ right to pursue valid policy goals — lightly,” FERC said.

As a result, it proposed a resource-specific “FRR Alternative” option allowing the removal of subsidized resources from the capacity market along with a commensurate amount of load.

FERC said its approach will improve transparency.

“Though the capacity market side of the bifurcated capacity construct will be relatively smaller, the expanded PJM MOPR will ensure that all resources participating in the capacity market, whether or not these resources receive out-of-market support, offer competitively. Further, the bifurcated capacity construct should make more transparent which capacity costs are the result of competition in the capacity market and which capacity costs are being incurred as a result of state policy decisions. Finally, depending on how load is selected for the new resource-specific FRR Alternative, this capacity construct should help confine the cost of a particular state policy decision to consumers within the state that made that policy decision, whereas the status quo requires consumers in some PJM states to subsidize the policy decisions of other PJM states.”

Dissents

The majority opinion quoted LaFleur’s earlier warning of “‘unplanned reregulation,’ one subsidy and mandate at a time.”

But LaFleur dissented from the ruling, calling the rejection of PJM’s current rules “a troubling act of regulatory hubris that could ultimately hasten, rather than halt, the reregulation of the PJM market.”

LaFleur said 90 days was insufficient time to determine “the most sweeping changes” to PJM’s capacity construct since its inception 12 years ago. She said she would have rejected capacity repricing while calling for further development of MOPR-Ex.

The FRR Alternative “presents resource owners and states with choices that could be difficult to make in advance of the May 2019 BRA, particularly given that some of the state programs are statutory in nature and could require legislative action to reform,” LaFleur wrote. “I do not share the majority’s confidence that this proposal is the obvious solution to the challenge before us, in no small part because it is not clear to me how this construct will actually work.”

In a separate dissent, Glick said the commission rejected PJM’s current Tariff based on “theory alone.” The RTO’s capacity surplus suggests prices are too high, not too low, he said.

He called the commission’s solution “arbitrary and capricious,” reciting a list of federal and state policies that subsidize or reduce the costs of nuclear power and fossil fuels.

“The commission’s real aim is to support certain resources that do not benefit from state efforts to address environmental externalities,” he wrote. “Doing so puts the commission on the wrong side of history in the fight against climate change.”

Commissioner Robert Powelson, who sided with Chairman Kevin McIntyre and Commissioner Neil Chatterjee in the majority, wrote a concurrence defending the ruling as long overdue.

“The issue of out-of-market support for preferred resources is not a new one. In 2013, the commission opened a proceeding to discuss the interplay between state public policy decisions and wholesale markets. In May 2017, the commission continued that effort by holding a two-day technical conference to further explore the issues. After years of open dialogue unconstrained by ex parte restrictions, the commission failed to provide guidance on one of the most pressing issues facing wholesale electricity markets,” he said. “Failure to take decisive action would be a disservice to PJM, its stakeholders and ultimately consumers.”

Next Steps

The commission acknowledged many details remain to be determined, inviting comment on issues including:

- The scope of out-of-market support to be mitigated by the expanded MOPR, and how resources become eligible for the FRR Alternative.

- How to identify the load removed from the capacity auction.

- What MOPR exemptions should be permitted. “For example, should an exemption be included for self-supplied resources used to meet loads of public power entities? Alternatively, should those resources have the option to use the resource-specific FRR Alternative? What, if any, exceptions should be added to the MOPR for existing resources in the capacity auction?”

- The length of time resources choosing the FRR Alternative must remain outside the capacity market and the mechanism by which they can return.

- How the FRR Alternative would accommodate required reserves and whether any changes to the demand curve are necessary.

- Whether federal sources of out-of-market support should be addressed by the commission and how the capacity market changes will interact with PJM’s fuel security initiative.

The commission acknowledged the magnitude of the changes it proposed and said PJM may request a waiver to delay the 2019 BRA, as it did in 2015 during development of Capacity Performance.