By Rich Heidorn Jr.

The 2nd U.S. Circuit Court of Appeals on Thursday upheld New York’s zero-emission credits (ZEC) for nuclear generation, rejecting claims they intrude on FERC jurisdiction (17‐2654‐cv).

“We conclude that the ZEC program is not field preempted, because plaintiffs have failed to identify an impermissible ‘tether’ under Hughes v. Talen Energy Marketing between the ZEC program and wholesale market participation; that the ZEC program is not conflict preempted, because plaintiffs have failed to identify any clear damage to federal goals; and that plaintiffs lack Article III standing as to the dormant Commerce Clause claim.”

In upholding a district court’s dismissal of the complaint by the Electric Power Supply Association and others, the appellate court said its finding was “consistent” with the 7th Circuit’s Sept. 13 ruling upholding Illinois’ own ZEC program. (See 7th Circuit Upholds Ill. ZEC Program.)

EPSA on Thursday asked the 7th Circuit to rehear its ruling, alleging the court had made legal and factual errors. “The panel overlooked or misapprehended three key legal arguments under which appellants would prevail,” EPSA said.

Threading the Needle

The New York Public Service Commission created the ZEC program in August 2016 as part of its Clean Energy Standard (CES), which set a goal of reducing greenhouse gas emissions by 40% by 2030. The PSC said it crafted the program to avoid the issues behind the Supreme Court’s April 2016 ruling in Hughes v. Talen, which voided Maryland regulators’ contract with a natural gas plant as an intrusion into federal jurisdiction over wholesale power markets. (See NY Attempts to Thread Legal Needle with Clean Energy Standard, Nuke Incentives.)

The court said that ZECs, like renewable energy credits (RECs), are certifications of an energy attribute separate from the purchase or sale of wholesale energy. Although the ZEC program “exerts downward pressure on wholesale electricity rates, that incidental effect is insufficient to state a claim for field preemption under the FPA [Federal Power Act],” the court said.

The court said the PSC avoided the defects of the Maryland contract for differences, which required the generator to participate in PJM’s capacity market.

“Plaintiffs point to nothing in the CES Order that requires the ZEC plants to participate in the wholesale market,” the court said. “ … As the district court concluded, a generator’s decision to sell power into the wholesale markets is a business decision that does not give rise to preemption concerns.”

“Until 2019, the ZEC price cannot vary from the social cost of carbon, as determined by a federal interagency workgroup. After 2019, the ZEC price is fixed for two‐year periods, and does not fluctuate during those periods to match the wholesale clearing price,” the court said.

The court also said the ZEC program was permissible under the dual federal/state regulatory system over electricity because it “does not cause clear damage to federal goals.”

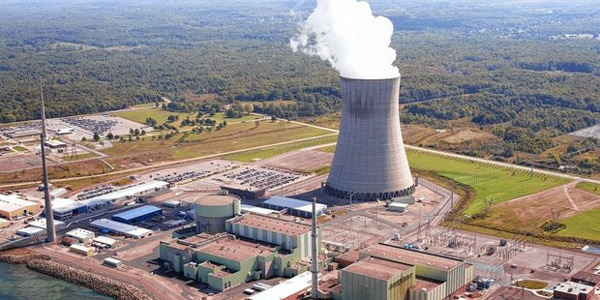

The PSC approved the program to prevent the premature retirements of three New York nuclear power plants, Exelon’s FitzPatrick, Ginna and Nine Mile Point.

Nine Mile Point Nuclear Plant | Constellation Energy Nuclear Group

EPSA and the other plaintiffs — the Coalition for Competitive Electricity, Dynegy, Eastern Generation, NRG Energy, Roseton Generating and Selkirk Cogen Partners — claimed they were harmed because the ZEC program allows “favored New York power plants to prevail in interstate competition against” their generation by underbidding them in the wholesale electricity markets.

“If the PSC awarded ZECs in a non‐discriminatory manner to out‐of‐state nuclear plants (as it may do in the future under the terms of the CES order), there would be no abatement in the injury plaintiffs claim to suffer from the general market‐distorting effects of the ZEC program. In short, plaintiffs’ injuries ‘would continue to exist even if the [legislation] were cured’ of the alleged discrimination,” the court said. “Because plaintiffs’ asserted injuries are not traceable to the alleged discrimination against out‐of‐state entities, but (rather) arise from their production of energy using fuels that New York disfavors, they lack Article III standing to challenge the ZEC program.”

Win for RECs?

“The decision is a win for both ongoing state efforts to preserve existing nuclear plants — New Jersey regulators expect to finalize a ZEC program by the end of the year — and long-standing renewable energy policies,” said Ari Peskoe, director of the Electricity Law Initiative at Harvard Law School. “The panel held that renewable energy credits (RECs), instruments that are used for compliance with renewable portfolio standards, are legally indistinguishable from ZECs. Today’s decision thus implicitly concludes that RECs are not preempted under the FPA, an issue which no court has ever squarely addressed.”