By Steve Huntoon

I want to begin with a note about FERC Commissioner Kevin McIntyre’s passing. He and I (and my wife) worked together for years at the law firm Reid & Priest. He was a talented attorney and an all-around great guy. Kevin, thank you for your contributions to the energy bar, to the work of the commission, and to the lives of those who have known you. You will be missed.

Four years ago, I began writing on subjects in our industry that I hoped would be of interest. Mostly heresy about conventional wisdom.

I thought it might be worthwhile to take a look back at some of those scribblings, see what I got right, what I got wrong and what’s happened since.

Reliability Standards: Reality Check

My first article[1] challenged the conventional — and intuitive — wisdom that mandatory reliability standards had improved reliability. I argued:

- Mandatory reliability standards have had little apparent effect on reliability.

- Relatively few outages can be avoided/mitigated by reliability standards.

- Outage avoidance provides relatively little value to consumers.

- Mandatory reliability standards impose costs and potential adverse consequences.

- We should focus more on actual causes of outages and work backward on a true cost-benefit basis.

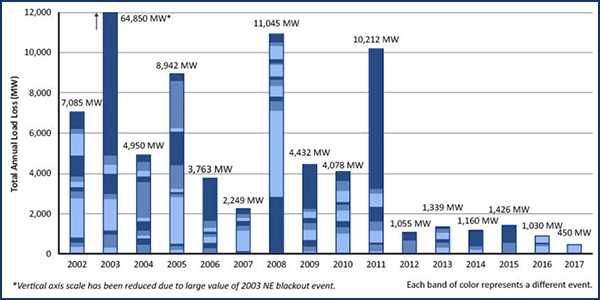

Since that article, NERC data suggest that transmission-related load losses have declined over the years. Its chart is below.

The apparent trend in transmission-related load loss is good. But it’s also worth pointing out that Transmission Availability Data System (TADS) outage events haven’t declined at all. There were 3,705 in 2009 and 3,790 in 2017.[2] The key reason for this, as I discussed in the article, is that the vast majority of outage events have causes beyond anyone’s control: e.g., lightning, other weather, equipment failure, foreign interference.

My basic concerns seem to remain valid. A meaningful reduction in transmission-related outages is questionable. Transmission-related outages are a small percentage of overall outages and, despite the media attention they receive, actually amount to relatively few dollars in terms of the value of lost load (VOLL). There also are compliance costs, and there can be potential adverse consequences if resource allocations are largely driven by compliance considerations.

Capital Spending Without Cost-benefit Analysis

But I think my last point from the article four years ago is the most important today. We now spend more than $20 billion on transmission infrastructure every year.[3] Each $20 billion of capital spending adds about $3 billion to consumer bills every year for decades into the future. The consumer cost keeps adding up. And virtually none of the cost is supported by cost-benefit analysis.[4]

This is not rocket science. In a competitive industry, investment is justified by the return expected to result from customer demand based on what customers are willing to pay. The parallel in a regulated industry should be investment justified by customer demand based on what customers are willing to pay.

In the electric utility industry, the proxy for customer willingness to pay must be the VOLL. In other words, every dollar of regulated utility investment should be explicitly supported by the customer VOLL that is produced by that investment. Nothing else makes sense.

Yet, cost/VOLL-benefit analysis continues to be ignored by regulators who bless $20 billion of new transmission capital costs every year.

Again, without a clue whether the cost imposed on consumers is actually worth it to consumers.

The Double and Triple Whammies

There’s a double whammy at work here. As I’ve pointed out before, regulators are allowing returns on equity vastly in excess of utilities’ true cost of capital.[5] Not only do the excessive returns burden consumers directly, but they create an enormous incentive for utilities to overspend on capital projects. You can follow the money on quarterly utility conference calls with Wall Street analysts — slides and talk about future capital spending, which drives earnings growth, which drives higher stock valuation.

There’s actually a triple whammy because the excessive returns also create an enormous incentive for utilities to fight competition in all forms, including competition in transmission. There is no doubt that competition in transmission is a staggering success (where it has been faithfully implemented), for reasons I’ve discussed before.[6] But because of excessive returns, utilities have added incentive to fight that competition by all possible means. And naturally they do.

Gotten Far Worse

This situation has, if you can believe it, gotten far worse in the past few years. It used to be that transmission capital costs would be justified for mitigation of reliability criteria violations. In other words, the transmission grid would be modeled for the future, and if the model forecasted overload of a given line, or other transmission element, then upgrade or other mitigation of the overload would be prescribed.

Nowadays, in PJM for example, most transmission capital costs are completely divorced from reliability criteria violations and instead are supported by violation of criteria unilaterally set by transmission owners. Here is a shocking chart showing this phenomenon:[7]

The dark blue is what the TOs unilaterally decide; the light blue is what is needed for reliability.

Now, you might ask: Isn’t allowing TOs to unilaterally decide the criteria for how much capital to spend, on which they get excessive allowed returns, putting the fox in charge of the henhouse? And you would be right to ask that question.

You just won’t get a good answer.[8]

- http://www.energy-counsel.com/docs/Have-Mandatory-Reliability-Standards-Improved-Reliability-Fortnightly-January2015.pdf. ↑

- https://www.nerc.com/pa/RAPA/PA/Performance%20Analysis%20DL/NERC_2018_SOR_06202018_Final.pdf, pdf pages 84-85. ↑

- http://www.eei.org/issuesandpolicy/transmission/Pages/default.aspx. There is $130 billion in planning or under construction. https://www.tdworld.com/transmission/drivers-and-challenges-transmission-investment. ↑

- FERC has developed “transmission metrics” but none of them involves cost-benefit analysis or the Value of Lost Load. https://www.ferc.gov/legal/staff-reports/2017/transmission-investment-metrics.pdf. At least one metric, “load-weighted transmission investment,” seems to imply that more transmission spending is inherently good. ↑

- http://www.energy-counsel.com/docs/Nice-Work-If-You-Can-Get-It-Fortnightly-August-2016.pdf. ↑

- http://www.energy-counsel.com/docs/FERC-Order-1000-Need-More-of-Good-Thing.pdf. ↑

- https://pjm.com/-/media/committees-groups/committees/mrc/20181220/20181220-item-08a-transmission-replacement-process-amp-odec-presentation.ashx, slide 7 (“Baseline” are upgrades driven by NERC reliability criteria violations; “Supplement” are upgrades attributed to unilaterally set transmission owner criteria.) ↑

- Unfortunately, the most recent FERC orders on unilateral transmission owner spending will further embolden the fox. California Public Utilities Commission v. Pacific Gas and Electric Co., 164 FERC ¶ 61,161 (2018); Monongahela Power Co., 164 FERC ¶ 61,217 (2018). Somewhere along the line, the basics seem to have been lost: The utility fiduciary obligation is to shareholders to extract maximum monopoly rents from consumers. The commission’s statutory obligation is to protect consumers from this utility fiduciary obligation to shareholders. ↑