By Michael Brooks

WASHINGTON — By now, ERCOT’s low reserve margin heading into this summer has been a much-discussed topic.

The grid operator anticipates its reserve margin will be 8.5%, well below its 13.75% target, indicating a possibility it will need to issue an energy emergency alert at some point this summer. It’s forecasting a peak demand of 74.9 GW against 78.9 GW in available capacity. (See ERCOT: More Capacity, but Emergency Ops Still Expected.)

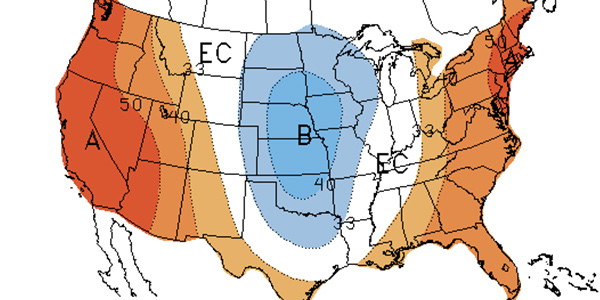

But ERCOT’s margin sticks out even more when compared to those of most other regions in the U.S., where their reserves are well above their reference levels. The Western Electricity Coordinating Council region will have reserves of more than 30% against a reference level of slightly less than 15%. PJM comes in second with a margin of slightly less than 30%. Only MISO expects reserves to be only slightly more than its target level.

The reserve margins for this summer were presented to FERC commissioners at their monthly open meeting Thursday as part of staff’s annual summer reliability report, using data from NERC’s Summer Reliability Assessment, which will be released on May 30, and from the Energy Information Administration.

Last year, FERC was similarly concerned about ERCOT’s low reserve margin: 10.92% at the time. But staff noted in their report that the grid operator “maintained system reliability with no load curtailments,” and ERCOT has reassured stakeholders repeatedly that it will do so again. (See FERC Keeps Eye on ERCOT, CAISO as Hot Summer Approaches.)

FERC is also still concerned about natural gas constraints in California because of low inventories at the Aliso Canyon natural gas storage facility. But “various preliminary assessments have found that the power system is in a better position this summer than during the summer of 2018,” staff said. And unlike last year, which saw a decrease in winter precipitation — and therefore less available hydropower — this past winter saw heavy snowfall, with snowpack over 160% of the historical norm as of April 1. (See related story, CAISO Predicts Plentiful Hydro, Gas Constraints.)

“Preliminary estimates suggest that higher available hydropower plant production this summer will reduce the reliability risk of insufficient operating reserves occurring due to a gas curtailment in California,” commission staff said.

Based on EIA data, FERC staff expect net new generation capacity to be about 4.1 GW, with about 6.7 GW to come online against 2.6 GW of retirements. Most of the retirements consist of coal resources (0.8 GW in PJM) and two nuclear plants — one each in ISO-NE and PJM — worth 1.5 GW.

Commissioner Richard Glick noted the high reserve margins in comments after the staff presentation. While he said it was good news that the U.S. doesn’t have a resource adequacy problem, the figures suggest that “it’s worth taking another look at” the way some regions are procuring capacity. “Because if we’re significantly over the targeted reserve margins, something’s wrong.”

He said he knew that some of the capacity was leftover and no longer receiving payments. “There’s also a lot receiving capacity payments; there’s not a lot of retirements going on,” he said. “We need to figure that out: how we can get closer to the targets.”

Asked about potential overcapacity and its costs to consumers, FERC Chairman Neil Chatterjee told reporters after the meeting, “It’s something that we’ll look at. My takeaway from the report is we’re in good shape for the coming summer, but we need to be vigilant regarding discrete issues,” particularly ERCOT and gas constraints in the West.