The New England Power Pool Markets Committee on July 8 voted to recommend that the Participants Committee support ISO-NE Tariff revisions requiring solar resources to provide meteorological and operational data to support power production forecasting. One member from the Supplier Sector abstained.

The changes would also consolidate wind and solar data requirements within Market Rule 1 of the Tariff, as proposed by ISO-NE.

Analyst Jonathan Lowell presented the RTO’s case for the advisory vote on wind and solar data requirements in the large generator interconnection agreement. The RTO anticipates changes to Market Rule 1 to become effective no earlier than December.

The NEPOOL Transmission Committee at its June 13 meeting supported related changes to remove the existing wind data requirements from the LGIA, and the Participating Transmission Owners Administrative Committee will review and vote on the changes when it meets Sept. 24.

Easing Import Resource Transactions

The MC also voted to recommend that the PC support revisions to Market Rule 1, Manual M-11 and Operating Procedure No. 9 to simplify external transaction submittal requirements for capacity import transactions and to remove outdated Tariff provisions, as proposed by the RTO.

The motion passed based on a show of hands, with one opposed and two abstentions from the Supplier Sector, one opposed and three abstentions from the Generation Sector, one opposed and three abstentions from the Alternative Resources Sector, and two opposed from the End User Sector.

RTO staffer Matthew Brewster presented the proposed Market Rule 1 revisions, which would streamline the requirements for submitting external transactions associated with import capacity resources and better align the requirements with Pay-for-Performance rules. They also include clean-ups to remove outdated provisions relating to coordinated transaction scheduling and dynamic scheduling.

The updates were motivated by the technical project to replace the software platform for submitting external transactions, which is scheduled for implementation by October.

In voting against the motion, Brett Kruse of Calpine said that imports that count as capacity should be from a specific generating resource that owns point-to-point firm transmission, ensuring the import is treated the same as internal capacity and not exposed to external curtailment.

“Otherwise, I believe that this is a very liberal interpretation of ‘capacity,’” Kruse said.

Assessing ESI Impacts

Todd Schatzki of Analysis Group presented preliminary results of his firm’s assessment of the impacts of the RTO’s proposed energy security improvements (ESI).

The proposed changes potentially affect market participant resource decisions and economic offers in ways that improve energy security, he said, including by creating incentives for resources to secure fuel inventory to merit an ESI award.

The study will run two scenarios: one a business-as-usual (BAU) case and another that assumes both the presence of ESI market products and some change in the actions resources take to ensure they have inventory to meet an energy commitment, Schatzki said. The differences between the two model runs will provide an estimate of impacts.

Analysis Group will assume that ESI will incentivize generators to obtain a sufficient number of LNG forward contracts to utilize all available pipeline transport capacity, he said.

The firm will return to the committee July 30 to present further preliminary results, including comparison between future BAU and ESI scenarios. In August, it will present preliminary scenario results and respond to stakeholder feedback, and then present a draft report in September ahead of an October filing.

ISO-NE market development economist Chris Geissler presented the RTO’s analysis of ESI impacts on entry/exit decisions and Forward Capacity Auction outcomes.

Geissler said the RTO expects the introduction of ESI to push the resource mix in a way that improves energy security, but that various factors would influence the magnitude of that effect and the impact on FCA prices, including the extent to which resources that are marginal or nearly marginal under BAU increase or decrease their FCA bid prices under ESI; the degree to which resources that sell capacity under ESI provide more energy security than those they displace; and resource intermittency.

ESI could reduce the likelihood and size of positive real-time price spikes that may otherwise occur because of limited available energy, while the costs of taking actions to improve energy security (such as storing more fuel oil) are netted against incremental revenues.

Geissler highlighted that there could be many mechanisms by which ESI is likely to affect net revenues.

ESI Conceptual Design

The MC spent the second day of its meeting discussing ESI conceptual design elements as presented by ISO-NE Principal Analyst Andrew Gillespie and Lead Analyst Ben Ewing.

The RTO is continuing to assess approaches to mitigation, and detailed mitigation rules will be part of related efforts in 2020, subject to FERC approval of the core ESI design filing in October, Gillespie said.

An Internal Market Monitor memo supplied by David Naughton said that the Monitor understood that participation in the day-ahead market for ESI products will be voluntary.

The Monitor tried to strike a balanced tone in the memo, neither for nor against voluntary participation. It noted that a voluntary market will allow physical withholding, a substitute for exercising market power through economic withholding. The RTO may need to address physical withholding with ex ante market rules, which would be preferable to using claw-back mechanisms, Naughton said.

Speaking on the RTO’s proposed multiday-ahead market (MDAM), Ewing said it would use the same standard settlement logic of deviations used to settle the real-time energy market today.

A forecast energy requirement price (FERP) settlement quantity will be paid to all resources meeting the forecast energy requirement on the prompt day, Ewing said, adding that the FERP is paid to a resource’s full energy position on the prompt day and is not a deviation settlement.

The RTO will further address the relative benefits of MDAM and the single-day-ahead market (SDAM) with opportunity cost bidding at the August MC meeting.

Stakeholder Concepts

The MC on Wednesday heard and discussed stakeholder concepts to enhance energy security from NextEra Energy Resources, Calpine, FirstLight and Energy Market Advisors.

Michelle Gardner and Sam Newell of Brattle Group presented NextEra’s concept for strategic operating reserves, a physical reserve held by ISO-NE as backup to protect against adverse conditions, consistent with reliability objectives.

New products to be purchased by ISO-NE in the day-ahead market would include replacement energy reserves and generation contingency reserves. (See “NextEra: Reserve Products,” NEPOOL MC Debates Energy Security Models.)

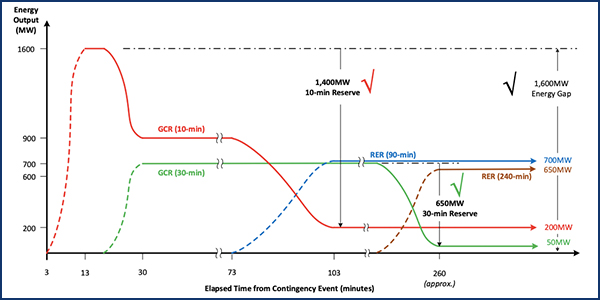

The RTO used a dashed line for the ramping of replacement energy reserves (RER) and generation contingency reserves (GCR) because it does not know their ramp pattern, but they do know where it should be at the end of 10 or 30 minutes. | ISO-NE

NextEra continues to evaluate the RTO’s proposal and still feels strongly that it doesn’t quite hit the mark — but emphasizes that it must see the benefits, Gardner said. Under NextEra’s proposal, units can have up to 12 hours notification time for deployment, and unlike traditional reserves, these units are valued because of their security, not because they are fast-start units.

Rebecca Hunter, senior analyst for government and regulatory affairs, delivered Calpine’s longstanding case for a forward enhanced reserves market (FERM) to retain resources at risk of retirement.

Calpine proposes that suppliers bid at auction for a total minimum or maximum amount of megawatt-hours they will commit to offer from stored fuel during an Operating Procedure 21, activated when the RTO declares an energy emergency event. (See “Calpine: More Precise; More Cautious,” NEPOOL MC Debates Energy Security Models.)

Hunter said the design changes and updates since June included making clear that natural gas resources would only qualify for FERM with firm transportation and a gas supply contract.

Calpine is also considering removing the cap for the eligible amount of megawatt-hours and establishing a floor to manage varying starting fuel inventory levels.

Tom Kaslow presented the FirstLight concept, which argues that the RTO can avoid sending inaccurate market signals at times when winter capacity is actually not in surplus by assuring that each procured megawatt can be fueled. (See “FirstLight: Filling Buckets,” NEPOOL MC Debates Energy Security Models.)

Mass. Attorney General Update

Christina Belew of the Massachusetts attorney general’s office quickly updated the MC on its proposal prepared by London Economics that recommends a simple auction format of sealed bids with a uniform clearing price. (See “Massachusetts AG: Simpler, More Physical,” NEPOOL MC Debates Energy Security Models.)

Belew said her office was still fleshing out the design details of its forward stored energy reserve proposal and that she may be back to present additional information at the August MC meeting.

Enhanced Storage Participation

ISO-NE Principal Market Development Analyst Catherine McDonough led a presentation and discussion of the RTO’s proposed manual revisions consisting of conforming changes to support implementation of the enhanced storage participation and FERC Order 841 compliance projects.

The proposed manual revisions reflect two sets of Tariff changes: the enhanced storage participation changes, which became effective on April 1, and additional Order 841 compliance changes, which will become effective on Dec. 3, pending FERC approval.

The proposed manual revisions also include changes to address a stakeholder concern from the June MC meeting about how the maximum discharge limit of an electric storage facility is set when it has less than one hour of available energy, which McDonough said she expects to become effective March 1, 2020.

Other proposed manual changes since last month include adding conforming and clean-up changes to Definitions and Abbreviations, conforming changes to Regulation Market, and clean-up changes to Registration and Performance Auditing.

Stakeholders said they wanted to focus on increasing the dynamic change function of the grid, so that a storage resource switching to charging is not necessarily cut off from being a source of power if the situation changes in five minutes, for example.

— Michael Kuser