By Amanda Durish Cook

CARMEL, Ind. — For the first time, MISO has found a loss-of-load risk outside of summer months, and the RTO said it may be more evidence of the need for seasonal capacity supplies.

“We believe at least exploring a seasonal resource adequacy construct based on this is appropriate,” MISO planning adviser Davey Lopez said at a Resource Adequacy Subcommittee meeting Wednesday.

However, Lopez said MISO will conduct more analyses, probably through the end of the year, before it says for sure whether it needs seasonal resource accreditation or a seasonal capacity auction.

“We have done some analysis that shows material risk of loss of load outside of summer,” Lopez said at the July Resource Adequacy Subcommittee meeting, referring to six loss-of-load expectation (LOLE) sensitivity case studies MISO had recently completed. Three cases emulating poorly planned generation outages showed risk in September, while two cases assuming no load-modifying resource (LMR) participation in addition to the outages found risk in December, January and February.

MISO’s current LOLE study assumes all outages are ideally planned and LMRs are available outside of summer, when they’re not required.

At the RASC meeting Wednesday, some stakeholders said MISO’s analyses were unconvincing because it assumed the worst possible circumstances when searching for new loss-of-load risk.

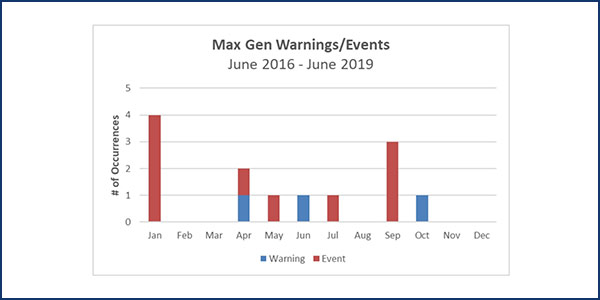

Of MISO’s last 10 maximum generation emergency events, Lopez said, only one has occurred in summer. Since 2016, the RTO has not completed a year without a maximum generation warning or event, amassing 10 emergency events and three warnings that didn’t culminate in emergency declarations.

Customized Energy Solutions’ David Sapper asked why MISO only used its current resource mix in the study and did not incorporate projected mixes.

Lopez said MISO would perform more sensitivities with different mixes, some pulled from its ongoing renewable integration impact assessment. (See MISO: Grid Can be Stable at 40% Renewables.)

Capacity Accreditation

To capture its newly discovered risk outside of summer, MISO plans to make changes to its capacity accreditation process.

Lopez said MISO may move to an “available capacity” paradigm instead of installed or unforced capacity measurements. The new measure of a unit’s capacity might involve the use of a historical availability component based on a unit’s prior economic or emergency maximum offers in the real-time markets, or an effective outage rate that includes a unit’s planned and forced outages.

But Lopez also said MISO might forgo a seasonal accreditation if its load-serving entities can show via a retroactive performance evaluation that installed capacity can meet actual load during peak hours. Some stakeholders said the suggestion sounded very similar to PJM’s Capacity Performance rules.

Lopez said MISO will make capacity accreditation changes first to fit the auction’s annual format, then refile its accreditation proposal to fit a seasonal capacity auction, if needed. The RTO’s proposal to implement a seasonal capacity auction has been pushed back to the 2022/23 planning year, as some stakeholders are asking it to create a cost-benefit analysis.

“Anything we do accreditation-wise, we don’t want to unwind if we implement a seasonal auction,” Lopez said.

MISO has said typical operating margins are “comfortable for the majority of daily peak hours but tighten May through September.” The RTO also said most systemwide ramping occurs in the final two hours prior to peak from November through April, when it typically relies more on coal generation to navigate the winter.

“We’ve got declining margins, a changing fleet and an increasing reliance on new supply and load-modifying resources,” MISO CEO John Bear explained during the July Informational Forum. Those changes signal the increasing need for an “availability margin” versus a reserve margin, he said, meaning MISO would take more care to ensure that its reserves are actually on hand when needed.