NYISO Business Issues Committee Briefs: Nov. 6, 2019.)

Thinh Nguyen, senior manager for interconnection projects, presented the proposed changes, which would hasten the class year portion of the interconnection study and also limit the potential for delays from some projects.

Nguyen said a key objective of the proposal is to identify system upgrade facilities for projects to reliably interconnect, including detailed design, engineering and construction estimates. It also seeks to produce binding, good-faith cost estimates that provide reasonable closure on upgrade costs, as well as equitable allocation of upgrade costs.

Matt Schwall, director of market policy and regulatory affairs for the Independent Power Producers of New York, thanked the ISO for providing a “thorough and well-run stakeholder process.”

Competitive Entry Exemptions

The committee also voted unanimously to recommend the board approve Tariff changes to competitive entry exemption (CEE) rules. The proposal would make CEE available to existing generators — called “examined facilities” — requesting additional capacity resource interconnection service (CRIS) megawatts in a manner consistent with the underlying rationale for the exemption. Those facilities are currently subject to the mitigation net cost of new entry offer floor.

Senior ICAP Mitigation Analyst Jonathan Newton presented the revisions to the CEE rules, which would also facilitate the repowering and replacement of existing generators by allowing existing portfolio owners that have entered into competitive short-term hedging contracts to qualify for the CEE.

The proposal also includes a change in the consequences for withdrawing a CEE request or providing false and misleading information.

NYISO intends to make the proposed rules effective for class year 2019 projects, Newton said. If the board approves the queue redesign proposals in December, the ISO anticipates making Federal Power Act Section 205 filings with FERC on or before Dec. 20, seeking a decision by the third week of February 2020.

New System Software by March

Chief Information Officer Doug Chapman said NYISO is working to deploy by February or early March a new energy management system (EMS) and business management system, both delayed last month because of problems related to both stability and synchronization of data. (See NYISO Management Committee Briefs: Oct. 30, 2019.)

“We expect to have the software in a completed state in mid-December, at which point we’ll resume the parallel testing, which we expect to be completed by mid-January,” Chapman said. “We’re targeting a cutover to EMS in the first week of March but want to be ready in case we can move sooner, in February, as we’re keen to begin testing new energy storage software.”

The testing is projected to take six months and will lead to deployment of the new software in September 2020. The deployment could potentially be moved to August — weather permitting — if detailed test planning results in a shorter test period than the projected six months.

Chapman noted that FERC “would throw a wrinkle in our schedule” if it directs NYISO to make changes to its Order 841 energy storage compliance proposal. The ISO has not yet received an order from the commission after submitting a May 1 letter in response to questions about its storage plan. It is the only RTO/ISO whose compliance filing has yet to be ruled on. (See related story, Storage Plans Clear FERC with Conditions.)

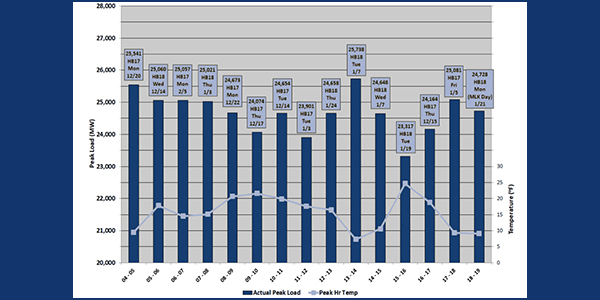

Grid Ready for Winter

NYISO expects to meet reliability criteria throughout the coming winter with projected capacity margins of 10,900 MW for 50-50 peak winter conditions and 9,299 MW for 90-10 conditions.

“While we are projecting 10,900 MW of surplus available installed capacity, the day-ahead market only commits and schedules sufficient capacity to meet the next-day peak load forecast plus the reserve requirement; hence we would not expect to have 10,900 MW of excess capacity in real-time operations,” said Vice President of Operations Wes Yeomans, who presented the winter capacity assessment. “The projected 10,900 MW of surplus installed capacity indicates more than sufficient capacity is available for the NYISO to schedule generation resources for cold-weather conditions.”

The ISO’s baseline forecast shows total capacity resources of 43,346 MW, minus assumed unavailable capacity of 5,703 MW, for net capacity resources of 37,643 MW to meet a total capacity requirement of 26,743 MW.

NYISO also models natural gas supply limitations scenarios and projects a 2,156-MW capacity margin for 90-10 peak winter conditions and loss of all gas supplies, and 4,067 MW for 90-10 peak winter conditions and retaining only units with firm gas supplies.

Existing minimum oil burn procedures defined by the New York State Reliability Council’s Reliability Rules and Compliance Manual establish fuel-switching requirements for certain generators at specific cold-weather thresholds to secure electric reliability for both New York City and Long Island gas pipeline contingencies.

Seasonal generator fuel surveys indicate oil-burning units have sufficient start-of-winter oil inventories along with arrangements for replacement fuel.

NYISO has performed on-site visits of generating stations to discuss past winter operations and preparations for the upcoming winter, Yeomans said.

— Michael Kuser