CARMEL, Ind. — MISO is canvassing feedback on two Independent Market Monitor recommendations that seek to improve the Planning Resource Auction.

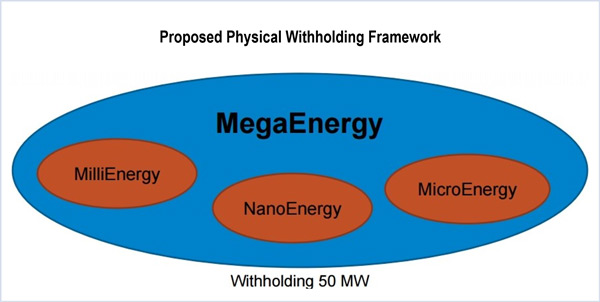

Manager of Resource Adequacy John Harmon said MISO agrees with the Monitor’s 2015 State of the Market recommendation to apply its 50-MW physical withholding threshold to affiliated market participants collectively, rather than to each individually. To do that, MISO would have to revise Module D of its Tariff, Harmon said at the Oct. 5-6 Resource Adequacy Subcommittee meeting.

The Monitor has said its proposal would prevent a supplier from dodging mitigation by creating multiple affiliates to increase its withholding threshold.

Consumers Energy’s Jeff Beattie said he thought the proposal might be discriminatory, as his company cannot talk to its generation affiliates anyway because of requirements set by the Michigan Public Service Commission.

“It’s like Dynegy over there. I can’t collude with them!” he hollered across the room at Mark Volpe to lightheartedly make his point.

Michigan PSC staffer Bonnie Janssen confirmed that both Consumers and DTE Energy have to file paperwork with the commission promising not to communicate with affiliates.

Harmon said MISO wants all stakeholder feedback by Oct. 21.

MISO is also tackling the Monitor’s 2013 suggestion to remove “inefficient barriers” for generators to participate in the PRA. The change would involve allowing a generation owner with an Attachment Y retirement request to participate in the auction and have the ability to postpone or cancel the retirement if it clears, which is not allowed under current Tariff language.

MISO adviser Neil Shah said the RTO will set aside time for discussions on the issue in future RASC and Planning Advisory Committee meetings to see if a rule change is warranted.

Minnesota Public Utilities Commission staff member Hwikwon Ham said he hoped changes to the rule would not further delay projects in MISO’s interconnection queue.

MISO to Move Ahead with Brattle Demand Curve for Forward Auction

MISO’s forward capacity auction proposal for merchant supply is nearly ready to be filed with FERC, and the RTO is using the final weeks to make presentations to support its stance.

Jeff Bladen, MISO’s executive director of market design, said there have been more than 200 questions, comments and suggested edits since the redesign of the capacity market was first proposed. He said he didn’t anticipate “dramatic changes” at this point.

“We are closing in on that Nov. 1 filing date,” Bladen said. “It is late in the day to be bringing up issues, and we don’t anticipate new issues because we’ve gotten such a robust response so far.”

Bladen said the only unfinished business is MISO working with the Monitor to make any necessary additions to Module D Tariff language pertaining to the Monitor’s role in both the new auction and the PRA.

Meanwhile, some stakeholders are criticizing as too low The Brattle Group’s sloped demand curve price cap of 1.4 times net cost of new entry (CONE). (See Brattle Endorses MISO Forward Auction Proposal, Designs Demand Curve.)

“In spite of the comments we’ve received, we’re still recommending the same curve,” Brattle analyst Sam Newell said.

Per stakeholder request, Brattle ran sensitivity analyses with higher price caps. Brattle analyst David Oates said moving the cap to 1.7 times net CONE moves the foot of the curve to the right but still manages to maintain reliability, at 109% of MISO’s planning reserve margin requirement. Moving the cap to two times net CONE results in procuring 106% of the planning reserve margin requirement.

But Oates also said that with higher price caps, price volatility increases by 30 to 80% compared with Brattle’s proposed curve. The two higher caps attract 100 MW and 220 MW, respectively, more merchant supply than Brattle’s 1,800 MW.

Newell again backed MISO’s forward proposal over the Monitor’s prompt, two-stage hybrid auction. “What most impresses me about this approach and the prompt hybrid that’s been discussed is that this approach allows all different suppliers to compete,” Newell said. “The hybrid proposal actually discriminates; it pays a much lower price to [regulated] supply than merchant supply. … It’s economic waste to buy a $150/MW-day resource when a lower-cost one is available.” He added that while relying solely on a sloped demand curve to price the marginal value of megawatts is “elegant,” it’s not realistic.

Jim Dauphinais of Illinois Industrial Energy Consumers said “it would make sense” to have a discussion to urge MISO to delay the Nov. 1 filing. “I’ll be frank: The word on the street is MISO is anxious to file this before FERC. The question is can some of these issues be worked out before the filing? There are certainly unresolved issues at this point.”

Dauphinais said delaying the filing to the end of the year might clear up issues. He is concerned that MISO’s Tariff language might be unclear, leading to a messy back-and-forth process with FERC, he said.

“I’ve also been walking on the streets and heard some people saying that,” Madison Gas and Electric’s Gary Mathis said. He said some were concerned that while implementation was delayed by a planning year, the filing date was only delayed by four months.

“I don’t think there’s uncertainty around the details. There’s disagreement about the details,” Bladen said. “It’s our conclusion that another month would not bring stakeholder consensus.”

Bladen said that MISO was already uncomfortable with the original “compressed” timeline to implement in planning year 2017/18. “The time we have in front of us is actually less than people realize,” he said. “We expect FERC to take 120 days to get back with an order. We expect it might well include guidance, maybe a technical conference; it might not. We need time to build the conclusion FERC orders. We have to have our systems up and running in the fourth quarter in 2017 in order to register units.”

Other stakeholders urged MISO to get language in front of FERC by Nov. 1 as planned.

MISO is also still weighing accelerating the creation of external resource zones in time for the 2017/18 PRA, ahead of the redesign implementation. Harmon said MISO was going to come back at the November meeting with a suggested approach, even though five of nine responding stakeholders were in favor of holding off on external zones until the 2018/19 planning year.

Dynegy’s Volpe said MISO not making a decision by October would make a 2017/18 implementation out of the question, though Harmon disagreed. In response to another question from Volpe, Harmon said it was possible that Tariff language would be presented by the next RASC meetings.

— Amanda Durish Cook