By Tom Kleckner

FERC on Friday rejected SPP’s request to remove its day-ahead must-offer requirement, saying the RTO had not provided “sufficient support” for its proposed Tariff revisions (ER17-2312).

“SPP’s proposal removes the only direct penalty, beyond referrals to the commission’s Office of Enforcement, for physical withholding and associated manipulative behavior in SPP’s day-ahead market,” the commission said. It also pointed out the RTO didn’t suggest additional protections going forward.

“Removing the limited day-ahead must-offer requirement in its entirety would make monitoring and capturing potential physical withholding in the day-ahead market even more important,” FERC said.

MMU, Golden Spread Raise Concerns

SPP’s Market Monitoring Unit and member Golden Spread Electric Cooperative both supported the proposal, though not without reservations.

The MMU raised concerns about the potential for physical withholding without the requirement and requested the removal on an interim basis for 18 months — allowing the Monitor and SPP to determine whether it does result in increased withholding.

The MMU recommended in its 2014 State of the Market report that SPP remove the limited day-ahead must-offer requirement, establish a phased penalty structure for physical withholding, update the defined thresholds for physical withholding and revise the generator capability thresholds. However, those proposals failed to pass the stakeholder process.

Golden Spread’s issues were with the day-ahead market’s competitive operation without a must-offer requirement. The co-op said it is “unsound” to rely only on the expectation that the withholding rules will catch improper behavior. The co-op also argued the Tariff should be clear on what constitutes physical withholding, so market participants aren’t subject to an “information gap.”

Without access to the shift factors and other information SPP collects, market participants have no warning on the impact of their offers, forcing them to make guesses regarding resource demand and market clearing prices, Golden Spread said.

It also said that without the must-offer requirement, market participants may offer into the day-ahead market to avoid failing ambiguous physical withholding tests, rather than basing their decisions on economics.

‘Anectodal’ Evidence

FERC said SPP referred to “anecdotal” evidence that there is little reason to fear physical withholding but did not “provide further support for this assertion.”

The commission said that while SPP assured it that there is ample resource participation in its day-ahead market, “sufficient resource participation is not a safeguard against physical withholding and associated market manipulation.” FERC said a generating resource could hold local market power because of a transmission constraint, despite a large market-wide surplus.

“The must-offer requirement is the physical withholding analog to the market power mitigation rules to address economic withholding,” the commission said.

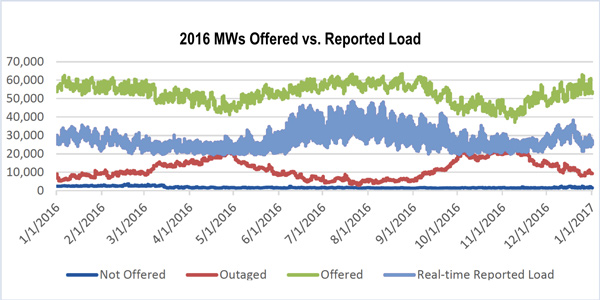

SPP filed the request in August, saying the must-offer requirement was no longer needed and that its reliability needs are met “at all times” by the full must-offer requirements for its reliability unit commitment processes and real-time market. The RTO said the MMU’s eye on physical withholding in the day-ahead market has a “more significant impact on market participant behavior” and, based on three years of observational data, “robust” participation in the day-ahead market resulted in capacity offered in the day-ahead market “consistently exceeding” reported load by about 50%.

SPP’s request was the result of a directive from FERC when it conditionally accepted the RTO’s Integrated Marketplace in 2012. The commission asked SPP to revise its Tariff to create a process in which it or the MMU would:

- Verify that market participants had not exceeded a predetermined acceptable load forecasting error; and

- Establish noncompliance penalties if market participants’ estimations exceeded the acceptable range of load forecasting error.