By Rich Heidorn Jr.

No commenter delivered a more damning takedown of Energy Secretary Rick Perry’s call for out-of-market compensation for nuclear and coal generators last week than PJM.

PJM said the Department of Energy’s Notice of Proposed Rulemaking makes “a sweeping and unsupported conclusion that, solely in regions with capacity and energy markets, certain units, regardless of their location, performance history or competitiveness, deserve full cost recovery through out-of-market mechanisms” (RM18-1).

But the Independent Market Monitor and other critics say the alternative PJM proposed in its filing would also be expensive and also undermine the RTO’s markets. Where Murray Energy and its customer FirstEnergy appear to have influenced DOE’s call to aid coal, the Monitor suggests that PJM is acting in the interest of Exelon, which would be the biggest winner from a boost to nuclear plants.

Ott | © RTO Insider

In an interview Thursday at the Markets and Reliability Committee meeting, PJM CEO Andy Ott said the RTO’s proposal will ensure LMPs “reflect which units are actually operational” but is “not going to benefit specific fuel types.”

In his comments on the NOPR, however, Monitor Joe Bowring said that PJM’s proposal appears “to reflect a desire to administratively alter the markets to favor nuclear and coal-fired generation.” Those generation types would receive a “disproportionately large increase in revenues,” he wrote.

Price Formation Report

PJM’s proposal, which would allow less flexible, traditionally baseload units to set LMPs, was first outlined in its June report, “Energy Price Formation and Valuing Flexibility.” (See PJM Making Moves to Preserve Market Integrity.)

“The PJM report claims that baseload — nuclear and coal — generation is undervalued in the market, that negative energy market offers have a pernicious effect in hastening the retirement of baseload generation and that an increasing reliance on capacity market revenues, rather than energy market revenues, results in a bias in the markets,” the Monitor wrote. “The PJM report provides no evidence supporting these claims.”

The Monitor is not alone in his suspicions of PJM.

“The real issue is not necessarily the proposed DOE rule, but what the RTOs like PJM will propose in its place,” Tyson Slocum, director of Public Citizen’s Energy Program and a harsh critic of the RTO rulemaking process, said in an email. “FERC will be far more inclined to endorse whatever the RTOs put forward. What PJM is saying here is that they are NOT opposed to coal/nuclear bailouts AS LONG as the ‘bailouts’ are conducted through the RTO’s ‘market’ rules. While everyone is distracted by the shiny DOE cost-of-service proposal … we cannot simply focus only on the DOE proposal, but what is coming next.”

That is why, Slocum added, Dynegy and NRG Energy filed comments opposing the NOPR even though they acknowledged they would benefit from it: “They love their odds of getting a market-based bailout through MISO and PJM.” (See related story, Vistra Energy Swallowing Dynegy in $1.7B Deal.)

John P. Hughes, CEO of the Electricity Consumers Resource Council (ELCON), said PJM’s June proposal is “simply an unsubstantiated directive to subsidize coal and nuclear plants with no consideration of the impact of the out-of-market costs on load. The one-price-clears-all nature of the market design also means that this gimmick will create a windfall for all generators that are dispatched. PJM is behaving as if it were captured by Exelon. PJM should be moving in the direction of improving market operation and price formation — not against it!”

PJM included in its filing a letter from Harvard economist William Hogan endorsing what he called PJM’s plan to “ensure that the incremental cost of serving load is reflected in LMP.” Hogan said it was “an appropriate step forward in price formation.” He added, however, “I do not expect it likely to produce a dramatic change or have as significant an impact as improved scarcity pricing.”

Consultant James Wilson, who often represents state consumer advocates in PJM, said in an email that it was “notable [that] Prof. Hogan does not support PJM’s proposal as described in the June whitepaper. While he supports some things discussed with PJM verbally, he does not mention or cite to the whitepaper.”

The Electric Power Supply Association (EPSA) told RTO Insider it is encouraged by PJM’s proposal and is hopeful it will be considered on an “accelerated time schedule.” (See sidebar, Reaction to PJM Price Formation Proposal.)

Three-Month ‘Compliance’ Process

The RTO said the DOE NOPR “incorrectly identifies a perceived problem and its cause, and seeks to impose a remedy that is not supported by the reliability and resilience concerns [it] claims to address.”

But while it was dismissive of the NOPR, PJM acknowledged it is behind other RTOs in adopting rule changes to improve price formation. It asked FERC to set a deadline for each RTO/ISO to identify “whether changes in the resource mix [have] created issues in their respective regions that are currently not addressed in the market” and propose solutions “within a commission-specified deadline that is in the near term.”

Asked to define “near term,” Ott said, “we’re thinking three months … would be appropriate.”

If FERC agrees to PJM’s request, said Ott, “We’d still have time to talk about it but it wouldn’t be the traditional … issue charge type” stakeholder process. It would likely be filed by the PJM Board of Managers under Section 206, he said.

Exelon’s Role

Ott said PJM’s proposal “is very consistent” with FERC’s price formation docket (AD14-14) and fast-start NOPR (RM17-3), but that the problem is manifested differently in PJM, which has fewer fast-start units and more large gas combined cycle units. “All we’re saying is it’s a bigger problem than just a few units — it’s not just fast-start units. It’s these others,” he said.

In its written comments, the Monitor suggested PJM is following the talking points of Exelon, noting the company is the RTO’s “largest participant.”

Bowring | © RTO Insider

Bowring said the proposal to extend the fast-start NOPR’s pricing concept to all resources “was not proposed by PJM in Docket RM17-3 but was included in Exelon’s comments in the docket.”

The Monitor said that while PJM “held no open stakeholder discussion of the proposals in the report,” Exelon discussed the RTO’s June report in its second-quarter earnings call. During the call, Joseph Dominguez, executive vice president of governmental and regulatory affairs, said the company would “push very hard” to make sure that PJM would propose its pricing reforms to the commission for implementation by summer 2018.

Bowring said this “aggressive timeline … would not likely be met for a significant market pricing proposal through the PJM stakeholder process.”

PJM did not respond to a request for comment regarding Exelon’s involvement.

An Exelon spokeperson responded: “Dozens of entities including the U.S. Department of Energy, [Edison Electric Institute) EPSA, PJM, Dr. Bill Hogan, and PJM states have similarly concluded that PJM’s energy market rules are flawed and reforms are needed to preserve critical resources for our customers. We will address in our reply comments a number of factual and analytical errors in the IMM’s filing.”

The Monitor said FERC should allow the regular stakeholder process and not rush to approve PJM’s proposal.

“The PJM report’s proposal, which would impose significant costs on customers to the benefit of the owners of nuclear and coal-fired generation, is not the result of the process designed to support independent, deliberate decision-making,” he wrote.

Extended LMP

PJM told FERC it is “actively exploring” the extended LMP method, which would bifurcate its security-constrained economic dispatch into separate dispatch and pricing runs, as is already done in MISO, ISO-NE and NYISO.

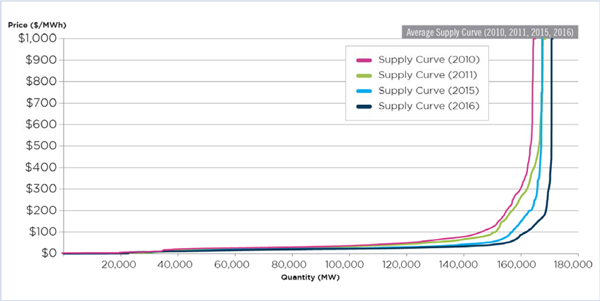

PJM says its flat supply curve has diminished generators’ incentives to follow dispatch instructions.| PJM

“Under our proposal, the flexibility would be called a separate product and then you would have the supply demand balance actually set the price,” Ott explained. “Under that scenario, the price of electricity would more reflect which units are actually operational. So it’s not going to benefit specific fuel types. But what it would say is the units that are actually running today, every day — and we have to have them — the pricing would reflect the fact that they are on.

“Today, for example, we may have a $30 unit running but the price is $27. … So the unit that’s $30 would get the $3 through uplift. If the price actually reflected that it was on, the forward prices would pick that up and it would be more economic.”

While coal plants cannot toggle on and off like modern gas-fired plants, Ott said they are flexible within their minimum and maximum outputs. “The challenge today is many of the gas units’ production costs are below all the coal,” he said. “So, the coal tends to sit at minimum.”

PJM said improved price formation “may help to ensure an appropriate mix of resources that can meet future grid demands and have clear incentives to follow dispatch instructions.”

Impact on Incentives

Ott said the only incentive for generators to offer load-following flexibility is the ability to set LMPs.

But PJM says the incentive has diminished because its supply curve has become too flat — particularly between 120,000 MW and 150,000 MW, where load typically peaks in summer and winter — because of “the competitive economics of combined cycle gas turbines, assisted by low-cost shale gas and increasing renewables with zero fuel costs.”

PJM’s winter capacity mix is less dependent on natural gas — and more reliant on coal and nuclear — than almost all other NERC regions in the continental U.S. | PJM

“When [resources are] all within the same 50-cent part of the curve, it’s like, ‘What do I care?’” Ott said. “So a gas resource is sitting here saying, ‘If I’m going to be flexible, I have to buy a flexible fuel contract that will cost me more money. I’ve got to spend more money on maintenance. And I’m not going to do that for 20 cents.’ That’s the reality we’re facing.”

The Monitor contends, however, that separating the real-time five-minute energy price from the five-minute energy dispatch instructions would eliminate the incentive for marginal units to follow the dispatch instruction. “The result would undermine PJM’s control of the system and further increase the cost of serving load,” he said.

Higher LMPs, More Uplift

Ott said the changes PJM has proposed will increase energy prices while reducing uplift and capacity prices. But he said he couldn’t say how it would affect the total cost to ratepayers or whether it would increase overall coal and nuclear revenues because the RTO hasn’t yet run any simulations.

“Obviously, under our proposal, electricity prices would go up. [We’re] pretty sure of that. As far as the magnitude, I think I’d rather wait until we see the proposal.”

The Monitor said, however, the PJM proposal to allow less flexible units to set price would result in higher LMPs and new uplift payments, raising “the cost to consumers of serving the same load in each market interval with no counteracting decrease to production costs.”

“The proposed pricing solution would raise the price to that of any inflexible unit that would provide the marginal megawatt-hour as if it were willing and able to change its output level, which it is not. The pricing solution is a fictitious solution that produces higher prices that are not consistent with the efficient dispatch of the market,” he said.

Jennifer Chen, an attorney for the Natural Resources Defense Council’s Sustainable FERC Project, cited an estimate that including no-load and start-up costs of inflexible units in LMPs would boost energy market prices by 10 to15%.

Bowring said Monday that would put the cost of PJM’s proposal at $3 billion annually, equivalent to paying 25% of the plants’ current replacement value. (See related story, Cost Estimates on DOE NOPR: $300 million to $32 billion+)

Better Options

The Monitor said it has discussed with RTO officials energy market price formation improvements that would not interfere with competitive outcomes. “Improvements to better reflect local scarcity due to transmission constraints, system scarcity and necessary reserves in prices would direct greater market value to the specific resources that support reliability. Some of these changes are already underway in the PJM stakeholder process, while others have made less progress,” the Monitor said.

PJM says the replacement of old coal units with new gas generation is improving — not harming — reliability, as illustrated by its declining EFORd.| PJM

The Monitor said it agrees with PJM on a need to consider changes to the operating reserve demand curves (ORDCs). The RTO said it is conducting the first broad review of its ORDCs since it implemented shortage pricing in 2012.

The ORDCs are based on the largest unit operating on the system. “As such, they do not accurately reflect the value of excess reserves on the system in a manner consistent with the reliability value of those reserves,” PJM said.

“When we developed the N-1 criteria, we were looking at storm-related outages and equipment failures,” Ott said. With the added concern of terrorist attacks on infrastructure, he said, the RTO is evaluating what areas of the grid are vulnerable. For example, Ott noted, NERC’s Critical Infrastructure Protection standard requires expenditures to protect substations designated as critical.

“Is there some criteria you can put around that to say we should be protecting against those types of risk?” Ott said, adding, “realizing that, of course, you can’t protect every piece of equipment.”

Could that mean contingencies based on large gas pipelines that supply multiple generators? “There’s a lot of discussion that has to occur before we get to that point,” Ott said.

Shortage Pricing

PJM said it also will propose new shortage pricing rules that would “incentivize appropriate behavior [and] could mitigate operational reliability concerns.”

The RTO currently institutes shortage pricing if its system is short of 10-minute reserves, “which from a reliability perspective would constitute a grave operating condition,” it wrote in its NOPR response. “Modeling and invoking shortage pricing for longer-term reserve products such as 30-minute reserves would provide better incentives and information to the market regarding potentially severe operating conditions by escalating energy and reserve prices earlier and incentivizing behavior that would ameliorate the condition,” PJM said.

ERS Problems?

Ott said PJM does not have a lack of “essential reliability services” as defined by NERC.

“The issue is not that we don’t have enough of resources that can provide these services. The concern that we have is that we’re not paying for them,” he said.

While PJM has a compensation scheme for some ERS such as black start, “We don’t pay for inertia. We don’t pay for voltage control, things like this,” Ott said. “We don’t have a problem with them today, but we aren’t paying for them. So we need to look at — if we continue to not pay for them — [whether] they’re going to go away.”

Ott rejected the notion that its proposals are designed to benefit the same uneconomic resources as the DOE NOPR. “What we’re saying is the price of electricity has to reflect the units that are actually running to serve load. It should be no more; it should be no less. We’re not saying anything about what fuel types,” Ott said. “There are a significant number of times when we have resources operating and the market price doesn’t reflect the fact that the resource is operating. Whether the resource is coal, nuclear or gas, that’s wrong in my opinion.”

Reaction to PJM Price Formation Proposal

RTO Insider invited numerous interest groups to comment on PJM’s proposed price formation proposal. Below is a summary of their responses.

John Shelk, CEO, Electric Power Supply Association

EPSA welcomes and supports PJM’s leadership and active pursuit of further market reforms that are needed in light of continued major changes in the region’s resource mix. The specific issues outlined in PJM’s recent DOE NOPR comments at FERC should be further developed and filed at FERC as soon as possible so that implementation of approved reforms occurs in 2018.

Pat Jagtiani, executive vice president, Natural Gas Supply Association

NGSA is supportive of proposals that provide clear, competitive market signals in a fuel-neutral manner, and we agree that it should be RTOs working with their stakeholder to achieve the best path forward. With that said, we haven’t seen enough detail around PJM’s proposal to provide a detailed comment on their proposal. We do wholeheartedly agree with PJM’s statements that put natural gas’ excellent record of reliability on the record.

Todd Foley, senior vice president of policy & government affairs, American Council on Renewable Energy (ACORE)

ACORE agrees with PJM’s comments on the importance of relying on competitive markets and regional flexibility to ensure system reliability, resilience and lowest possible electricity costs for consumers. We believe that FERC, working with PJM, other organized markets and stakeholders, should establish objective, market-based criteria in price formation to reward system flexibility. We need to see how PJM’s proposals reward system flexibility, since that is what is needed for grid modernization and managing higher penetrations of renewable resources.

Amy Farrell, senior vice president of government and public affairs, American Wind Energy Association

Grid reliability and performance have gone up, all while wholesale electricity prices have gone down, because PJM markets allow uneconomic inflexible units to retire and be replaced by new, efficient and flexible units capable of responding to market signals. Let’s not try to solve a “problem” of low-cost electricity.

The PJM proposal is still being developed, so we don’t have a final position on it yet. However, if PJM divorces payment from performance, ultimately keeping less efficient units online, that could distort the market in the long run. More market-friendly approaches exist. For example, MISO and other market grid operators have improved efficiency and minimized out-of-market payments by incorporating start-up and no-load costs into market prices.

Jennifer Chen, attorney, Natural Resources Defense Council’s Sustainable FERC Project

While we may be able to support shortage pricing and ORDC revisions, PJM’s proposal to allow inflexible resources (largely coal and nuclear) to set LMP raises both process and substantive concerns. From a process perspective, PJM has been working on its inflexible unit pricing proposal without input from the stakeholder body for some time now, and we still do not know the details of it. Yet PJM, in its RM18-1 comments, asked FERC for immediate action and appears to be seeking a near-term deadline to implement its proposal. … Reliability isn’t a justification and PJM didn’t invoke it. In fact, PJM has more than enough resources available with reserve margins hovering around 29% this past summer and the last [Base Residual Auction] clearing a reserve margin of 23.9%. FERC directive on any of these potential reforms would be inappropriate at this point.

We also have concerns about the substance of the PJM proposal based on what’s known about it. … Artificially inflating prices will attract new supply, which would in turn lower energy market prices, defeating an apparent purpose of the proposal to put more money into the energy market. If anything, PJM should act to reduce its oversupply, which would better achieve what PJM set out to do with its price formation proposal.

Tyson Slocum, director of Public Citizen’s Energy Program

RTOs’ constant rejiggering of their capacity markets to accommodate the needs of their powerful members to earn more money for their aging power plants isn’t any better just because they dress up their bailouts in difficult-to-understand pseudo-economic jargon. … So, it will be no celebration for consumers if the DOE cost-of-service remedy is simply substituted by an RTO capacity auction redesign that falsely calls itself as a more palatable “market” solution.

(No responses were received from the Organization of PJM States Inc. (OPSI); Consumer Advocates of the PJM States (CAPS); the PJM Industrial Customer Coalition; the PJM Public Power Coalition; the Solar Energy Industries Association; the Nuclear Energy Institute; the American Petroleum Institute; the National Mining Association; or the American Coalition for Clean Coal Electricity.)