The D.C. Circuit Court of Appeals on Friday rejected FERC‘s logic for approving a 10% cost adder in PJM‘s capacity market but declined to vacate the commission’s 2019 ruling (No. 20-1212).

Circuit Judge Karen LeCraft Henderson wrote the opinion for the three-member panel, ruling that the commission’s approval of the 10% adder was not just and reasonable and that it “did not provide a satisfactory explanation for its approval, which reasoned decision-making requires.”

FERC approved the adder and other revisions to PJM’s capacity market rules in an April 2019 order following the RTO’s quadrennial revision. (ER19-105). (See FERC to PJM: Clarify Allowable Costs for Energy Offers.)

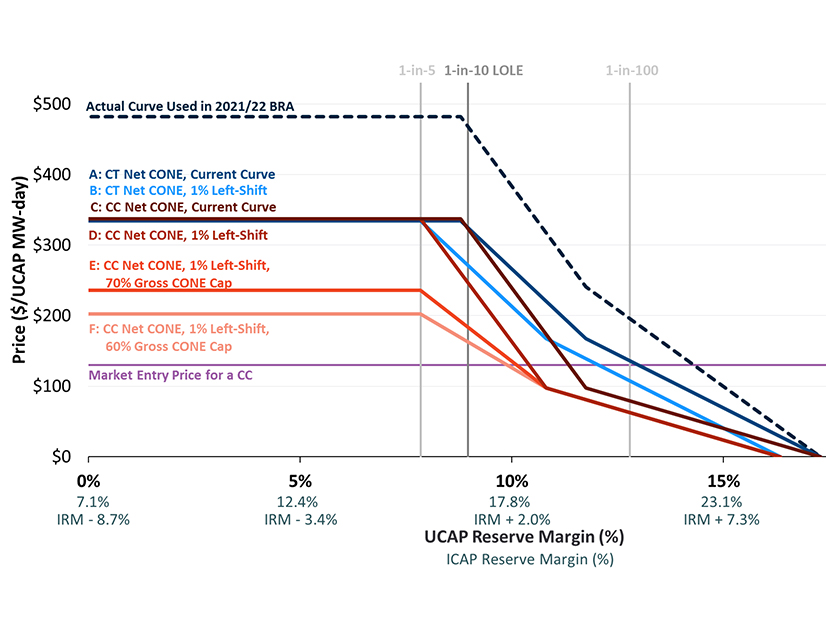

A report by The Brattle Group the previous year had suggested PJM change its capacity reference resource from a combustion turbine plant (CT), the standard used since the beginning of the capacity market, to a combined cycle plant.

Despite recommending the combined cycle plant, Brattle also acknowledged the rationale for staying with a “[combustion turbine]-based curve if PJM and stakeholders are highly risk-averse about ever procuring less than the target reserve margin.” PJM ultimately decided to keep the CT as its reference resource but updated the energy and ancillary services (E&AS) markets revenue estimate by increasing the value of the reference resource’s estimated offer to supply energy in the energy market by 10%.

The Sierra Club and consumer advocates for Delaware, Maryland and D.C. challenged the commission’s approval of the 10% adder and the continued use of the CT reference resource. FERC denied the petitioners’ request for rehearing. (See “Next Steps,” FERC: RGGI, Voluntary RECs Exempt from MOPR.)

Use of Adder Unlikely

In her ruling, Henderson said evidence brought to FERC indicated that CTs may not utilize the 10% adder in their energy market offers.

The court cited research by economist James Wilson that found that if the reference resource incorporated the 10% adder, its net E&AS revenues would decline by up to 32% because it would reduce its competitiveness in the energy market. Wilson also said that most CTs “would face the uncertainties that underlie the 10% adder ‘relatively rarely, if at all.’”

PJM’s Independent Market Monitor said that many gas-fired generation resources, like the reference resource, exclude the 10% adder from their offers.

Brattle said its research found “mixed reactions” as to whether combustion turbine plants would face costs requiring an offset from the 10% adder. In the report, Brattle recommended that “PJM investigate this further and consider applying the 10% cost offer adder.”

The court said if no or few CTs ever use the 10% adder, then it “makes little sense” to include the adder for a hypothetical combustion turbine plant’s E&AS revenue estimate.

“The net [cost of new entry] should estimate the costs and revenues of the reference resource based on accurate market signals and data,” the court said. “Whether the type of supplier the reference resource is based on would utilize the 10% adder, then, is a relevant consideration. Simply because suppliers are permitted to utilize the 10% adder — and recognizing there are good reasons for them to be so permitted — we do not think it reasonable to assume the suppliers will utilize the 10% adder, especially when the evidence here indicates that the use of the adder would run counter to a combustion turbine plant’s economic interest.”

The court said FERC found that utilizing the 10% adder “improves [the] accuracy” of the E&AS revenue estimate. But it said the commission did not assess whether CTs would utilize the 10% adder or explain why such an assessment would be unnecessary.

“The commission’s response to the contrary evidence can be described as little more than a hand wave,” the court said. “It approved the use of the 10% adder because the adder’s general use was already approved as just and reasonable and because including the adder would make the E&AS revenue estimate ‘consistent with existing energy market rules.’”

The court did side with FERC in approving PJM’s proposal to keep the CT as its reference resource. The petitioners suggested the use of a CT as the reference resource is unjust and unreasonable because a combined cycle plant would be “more just and more reasonable.”

But the court said it’s not its role to ask “whether a regulatory decision is the best one possible or even whether it is better than the alternatives.” It said FERC found that combustion turbine plants “continue to serve a role in PJM’s region,” with more than 1,600 MW of CT capacity built in the RTO since the capacity market was adopted.

“The commission articulated a satisfactory explanation for its decision that the use of a combustion turbine plant as the reference resource is just and reasonable and substantial evidence supports that decision,” the court said.