ISO-NE Discontinues Feedback on Certain MOPR Elimination Proposals

ISO-NE plans to discontinue feedback on three stakeholder proposals as part of discussions on eliminating the minimum offer price rule, the RTO said during a two-day meeting of the NEPOOL Markets Committee last week.

In a memo to the committee, Mark Karl, vice president of market development and settlements for ISO-NE, said that while the RTO’s current proposal is focused on removing the MOPR and addressing related market risks, “participants have also raised a notable number of market proposals during the committee discussions.”

“Over the last few months, the ISO has consulted with and provided feedback to each of the sponsors of various conceptual stakeholder proposals,” Karl wrote. “Some proponents have removed their proposals from the MOPR discussions onto separate tracks, while others primarily consist of feedback rather than developed conceptual proposals at this point.”

Karl said it is not the RTO’s intent to “completely dispense” with further discussion of the proposals from FirstLight Power, Energy Market Advisors (EMA) and Jericho Power. But FirstLight’s capacity performance payments (CPP) proposal and EMA’s balancing resource constraint concept appear to be independent of the elimination of the MOPR, according to Karl, and are “complex relative to the time available to finalize the necessary and important design details.”

EMA also presented concepts covering transition mechanisms, and ISO-NE is open to them. Still, the RTO does not support reinstating a price floor mechanism as an alternative to eliminating the MOPR and could not keep that as a part of any transition proposal, Karl said.

Jericho’s demand curve scaling factor proposal and Pay for Performance (PfP) and accreditation modifications also do not appear to hinge on eliminating the MOPR, Karl said. However, the RTO said accreditation would be addressed better when discussing resource capacity accreditation.

Tariff Changes Proposed for E&AS Markets for Order 2222 Compliance

For distributed energy resource aggregations to participate in the energy and ancillary services markets, ISO-NE is proposing tariff revisions as part of its Order 2222 compliance filing due in early 2022.

Each substantive change to the tariff is linked to one or more of the 11 compliance directives, including:

- allow DER aggregations to participate directly in RTO/ISO markets and establish aggregators as market participants;

- register aggregations under one or more participation models that accommodate the physical and operational characteristics of the DER aggregations; and

- address distribution factors and bidding parameters for DER aggregations.

Because of the structure of its markets, ISO-NE is considering two effective dates for the proposed tariff changes, one for the Forward Capacity Market changes and a second for the remainder of the changes that impact the energy and ancillary services markets. The latter changes are more extensive and impact electric distribution companies and potentially their state regulators.

ISO-NE will send its compliance filing on Feb. 2, 2022, and it will likely take FERC several months to review it and issue an order. The Forward Capacity Auction 17 qualification process will be entirely or primarily completed when an order is given on the compliance filing. As a result, FCM changes could be effective for FCA 18, which will run in February 2024 for the capacity commitment period beginning on June 1, 2027. That would require the FCM portion of the design to be implemented by the start of the FCA 18 qualification process in spring 2023.

The RTO said it is confident that it can achieve that, assuming an order is issued by FERC accepting the proposed FCM design by the end of 2022. Thus, changes to the energy and ancillary services markets could be in place by the fourth quarter of 2026, ahead of the 2027 CCP. State regulators may also need to establish rules, requirements or cost recovery mechanisms associated with EDCs under Order 2222.

Monitor: Spring Wholesale Market Costs Rise

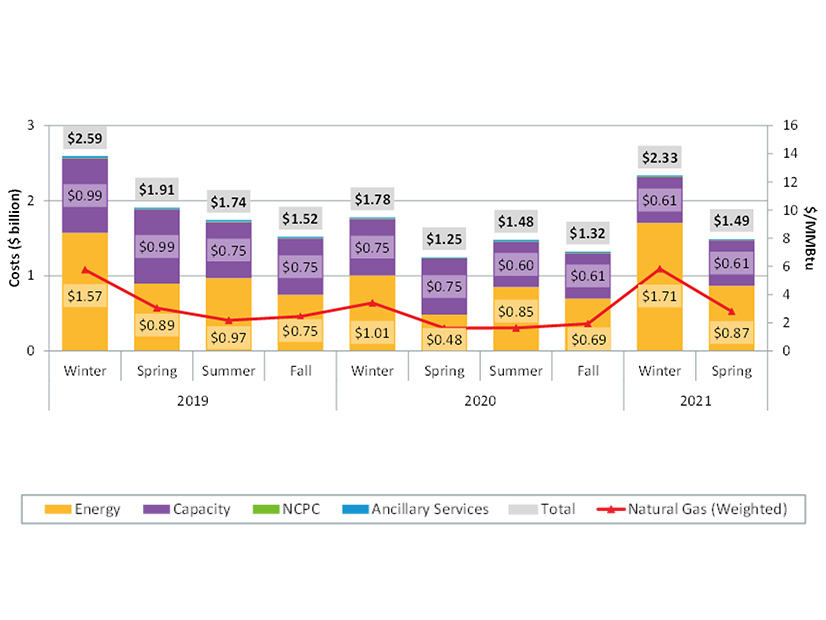

ISO-NE’s spring wholesale market costs totaled $1.49 million, an increase of more than 19% from the previous spring because of higher natural gas prices, the RTO’s Internal Market Monitor said in its quarterly markets report.

Average day-ahead and real-time hub LMPs were $28.69 and $27.89/MWh, respectively, 66% and 58% higher than the same period in 2020, according to IMM Economist Donal O’Sullivan, who presented a summary of the report. Last spring, lower prices resulted from decreased residential and industrial demand during the economic shutdown amid the COVID-19 pandemic.

There also was a special section of the report that reviewed the performance of Competitive Auctions with Sponsored Policy Resources (CASPR) to examine if it is working as designed. CASPR has been in effect for the past three FCAs, though the RTO has seen limited entry into the FCM. To date, only 12 existing resources have entered the auction as eligible to participate in CASPR. Seven of those resources obtained a capacity supply obligation in the primary auction, which they could potentially trade to a new sponsored resource in the substitution auction. Still, only one of those resources (54 MW) successfully retired via CASPR.

Test price mitigation, which is supposed to prevent policy resource subsidies from suppressing the primary auction price, does not appear to have been a determining factor in low participation from existing resources in the substitution auction. Instead, the RTO said in its opinion that the primary driver is low primary prices that reflect a system that currently has a moderate surplus of capacity.