NYISO on Thursday updated stakeholders on several market changes in the works to accommodate thousands of megawatts of state-solicited renewable resources coming online in New York over the next decade.

The measures range from carbon pricing and buyer-side mitigation to distributed energy resource participation models, including for storage, hybrid and co-located resources, all part of the ISO’s Grid in Transition initiative announced two years ago, NYISO Principal Economist Nicole Bouchez told the Installed Capacity/Market Issues Working Group.

The ISO also posted the final version of its 2022 Master Plan for managing the changes in the energy, ancillary services and capacity markets.

The state’s Climate Leadership and Community Protection Act (CLCPA) and other statutes set ambitious clean energy targets staggered every five years from 2025 to midcentury, with strict emissions limits that regulators recently cited in denying air quality permits to two gas-fired generator proposals in the Hudson Valley and New York City. (See NY Regulators Deny Astoria, Danskammer Gas Projects’ Air Permits.)

“This path of Grid in Transition is focused on market enhancements under three different areas, the first one being aligning competitive markets in New York with the state’s clean energy objectives,” Bouchez said. “The second one is valuing reserves for resource flexibility, and the third one is improving capacity market valuation.”

NYISO retained The Brattle Group to forecast future resource mixes and help inform planning for reliability and market design over the next two decades, with the final report presented in June 2020. (See ‘Astonishing’ Buildout Needed for Clean NY Grid.)

Stakeholders expressed concerns about how fast the ISO is able to incorporate new events and regulations into its capacity processes. For example, the gas-fired projects were turned down, but state agencies have approved two separate projects totaling 2,550 MW to bring solar, wind and hydropower south to the city, as well as offshore wind projects totaling 4,300 MW. (See Two Transmission Projects Selected to Bring Low-carbon Power to NYC.)

In addition to the projects proposed, the ISO also presented an update on leading indicator metrics, with the most recent data provided in September, Bouchez said.

Supporting Studies

In looking at what changes to the markets are needed to face a growth in intermittent resource penetration, the ISO relied on several studies it has conducted over the past few years, including the following:

- Power Trends 2021 (NYISO, May 2021)

- Preparing the Capacity Market for the Grid in Transition (NYISO, April 2021)

- Climate Change Impact Phase II (Analysis Group, September 2020)

- New York’s Evolution to a Zero Emission Power System (The Brattle Group, June 2020)

- 2020 RNA Report (NYISO, November 2020)

- 2021-2030 Comprehensive Reliability Plan (NYISO, December 2021)

Aside from work on buyer-side mitigation tests and capacity accreditation, the ISO deployed a software-defined wide area network (SD-WAN). Separately, the NYISO is developing a billing and settlement system and billing simulator code. The remaining code for the DER participation model will be developed in 2022, with deployment also scheduled for next year.

The ISO expects to implement its hybrid co-located model in mid-December and will work to integrate the rules and software needed to enable large‐scale weather-dependent and energy storage resources to participate as co‐located resources (CSR) behind a single interconnection point. FERC in March accepted the ISO’s rules allowing an energy storage resource to participate in the wholesale markets with wind or solar as a CSR, and NYISO has since been working on the market software. (See FERC Approves NYISO Co-located Storage Model.)

A regulation service project completed in September last year updated requirements, and the ISO will continue to monitor fleet changes and appropriately update statewide regulation procurement requirements in the future.

New Resource Integration

One critical area is related to new resource integration projects, Bouchez said.

She listed three: the DER participation model, the hybrid aggregation model — which is scheduled for a functional requirements specification in 2022 — and internal controllable lines, “obviously something that we need to work through,” she said.

The ISO anticipates starting to review the real-time market structure to start in 2025, “but we’re thinking that it might not be a bad thing to start those discussions [next year] about the existing structure and different ideas for what changes should be considered and why,” Bouchez said.

Reliability Risks

The ISO on Friday released its Comprehensive Reliability Plan (CRP), the culmination of the 2020-2021 Reliability Planning Process. The report concludes that the state’s bulk power system will meet all applicable reliability criteria from 2021 through 2030 for forecasted system demand in normal weather.

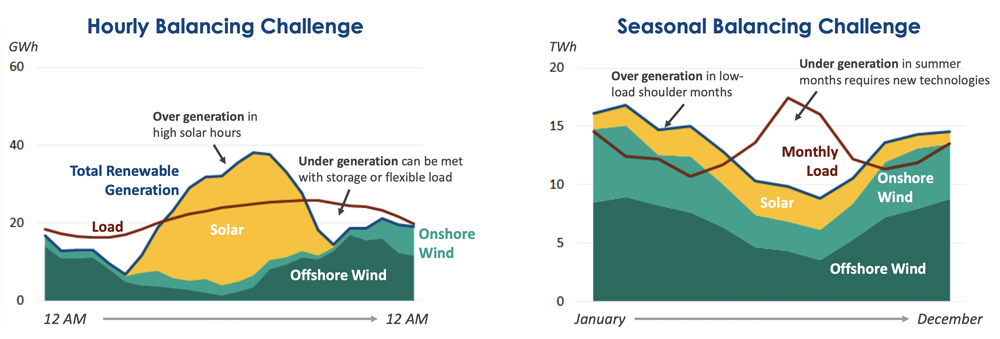

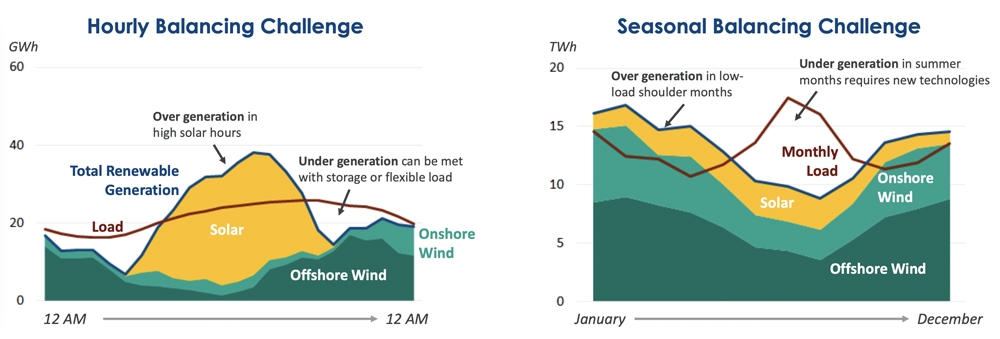

The figure shows typical load profiles with typical generation profiles for wind and solar resources; while there may be enough energy overall to meet demand, it will be necessary to shift the generation from the afternoon to the morning and evening hours. | The Brattle Group

The figure shows typical load profiles with typical generation profiles for wind and solar resources; while there may be enough energy overall to meet demand, it will be necessary to shift the generation from the afternoon to the morning and evening hours. | The Brattle Group

But it also “demonstrates that our reliability margins are thinning to concerning levels beginning in 2023,” Zach Smith, vice president of system and resource planning, said in a statement. “We have to move carefully with the Grid in Transition in order to maintain reliability and avoid the kind of problems we’ve seen in other parts of the U.S.”

The CRP recommends monitoring and tracking transmission projects and other risk factors in order to mitigate risks to BPS reliability. In addition, system margins are expected to narrow to such a level that warrants review of current reliability rules and procedures.

NYISO said it will administer its short-term reliability process to address generator deactivation notices and other system changes on a quarterly basis, and continuously evaluate on a forward-looking, five-year basis.

“The potential risks to reliability identified in the analyses may be resolved by new capacity resources coming into service, construction of additional transmission facilities, and/or increased energy efficiency, integration of distributed energy resources, and growth in demand response participation,” NYISO said.