Merchant generators joined ISO-NE’s Internal Market Monitor on Tuesday in warning that the RTO’s proposal to eliminate the minimum offer price rule (MOPR) will suppress prices.

Other stakeholders debated whether the implementation of the RTO’s plan should be delayed until it approves long-term market rule changes on capacity accreditation and reserves.

The NEPOOL Markets Committee is scheduled to vote on the RTO’s proposal at its first meeting next year, Jan. 11-12. Stakeholders interested in proposing amendments should notify the committee secretary by Jan. 3 for inclusion on the agenda.

The RTO’s proposal was prompted by calls by FERC Chair Richard Glick and Commissioner Allison Clements to abolish the MOPR, which they said were undermining state decarbonization efforts. (See ‘Good Riddance’ to Old PJM MOPR, Glick Says.)

The IMM’s David Naughton and Michael Redlinger outlined their concerns with the RTO’s proposal at a daylong MC meeting, acknowledging that the MOPR prevents some state-sponsored renewables resources from clearing the Forward Capacity Market (FCM), undermining decarbonization efforts and causing “over-procurement.”

But they said the rule has been effective at limiting the impact of below-cost offers on the capacity market. “Inadequate mitigation rules may undermine the efficiency of the FCM in performing its function and ability to produce just and reasonable rates,” they said in a presentation.

They also acknowledged that efforts to address the tension between price formation and states’ generation preferences — such as the renewable technology resource (RTR) exemption and substitution auction under the Competitive Auctions with Sponsored Policy Resources (CASPR) — “have had limited results.”

But they said the RTO should be pursuing long-term market changes that could help, saying “net carbon pricing” could reduce the “missing money” for low-carbon generation while being compatible with the current broad MOPR.

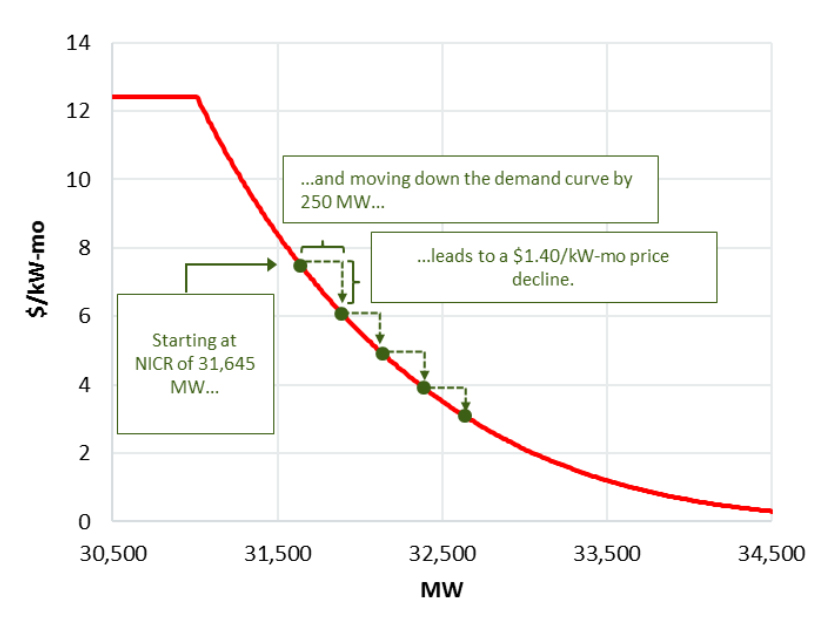

Allowing sponsored resources to clear the auction “leads to essentially walking down the FCA [Forward Capacity Auction] demand curve,” they said. “MOPR elimination will allow [subsidized] resources to offer at a lower cost than they otherwise would absent the subsidy, in many cases down to $0.”

The price suppression and volatility could result in premature retirements and lead investors to demand higher returns on investment, shorter pay-back periods or long-term contracts, they said.

ISO-NE’s proposed buyer-side mitigation (BSM) rules would exempt subsidized resources, resources of 5 MW and less, energy efficiency, and projects whose sponsors self-certify they have no load obligations that could benefit.

The Monitor said the BSM rules would focus on uneconomic conduct that impacts prices for the benefit of a “net” or “leveraged” position. Project sponsors would have the option to demonstrate that there is no incentive — no net financial benefit — to exercise buyer-side market power.

“But the exercise of market power can take many forms, and the IMM is focused on the impact on price formation from below-cost offers regardless of whether to benefit a load position,” it said. “Mitigation needs to address market power in whatever form when it would impair competitive market outcomes.”

The Monitor said the focus on sponsors’ lack of incentive to suppress prices would allow the sponsors to decide what information to provide to the monitors.

“This limits the IMM’s ability to evaluate and determine whether the declaration of no material net benefit is accurate and hence the lack of mitigation warranted,” it said. Current rules, it noted, require market participants to provide “all” relevant information.

Merchants Share IMM Concerns

Bruce Anderson, of the New England Power Generators Association (NEPGA), said his group shares the Monitor’s concerns.

“The conditions under which the FCA would need to clear to produce just and reasonable rates … appear to create significantly increased risks to either reliability, market efficiency (reliability-must-run agreements) or perhaps to both,” NEPGA said. “Alternatively, those risks do not materially increase, but the market produces unjust and unreasonable rates.”

NEPGA said the RTO should not eliminate the MOPR until it implements long-term rule changes such as effective load-carrying capability (ELCC) and wholesale market designs that compensate resources for reliability services the RTO doesn’t pay for now. “These necessary market reforms would provide some measure of balance in a proposal that at present fails to balance consumer and investor interests,” Anderson said.

Anderson questioned why the RTO is pushing the MOPR elimination given that FERC has not issued an order requiring such action. “The proposal attempts to satisfy a mandate and deadline that does not exist,” he said.

Andrew Weinstein of Vistra (NYSE:VST) took a similar position. Vistra proposed a transition, which Weinstein said “buys time for long-term durable solutions to better align with complete MOPR elimination.”

Long-term solutions such as ELCC or a reserves product “cannot be achieved in the timeline set forth by ISO-NE,” he said. ISO-NE’s proposal, he said, could create “market risks that will remain unresolved until long-term designs can be approved.”

Vistra called for a two-year transition period for FCAs 17 and 18, with the MOPR eliminated for FCA 19.

The rule would remain in place with an RTR exemption of 300 MW for FCA 17 and 400 MW for FCA 18. Between 229 and 292 MW of sponsored resources cleared in FCAs 13 to 15. There would be no weighted average cost of capital adder while the MOPR is intact, and the net cost of new entry (CONE) would also remain unchanged until FCA 19.

Weinstein noted that the RTO has embraced several out-of-market designs to address reliability issues over the past decade, yet it has conducted no study of how removing MOPR would impact the ability to serve load.

“Given the reliability risks and legal and policy risks of immediate and complete MOPR elimination, regional consensus on a long-term durable solution is strongly preferable,” he said.

Enviros: No Need for Transition

The Natural Resources Defense Council and Conservation Law Foundation, however, said no transition is warranted. Because the region is currently oversupplied, they said, it has sufficient time to address the long-term market changes.

“We know where the region is headed, and new entry from state clean energy resources is known well in advance,” NRDC’s Bruce Ho said in a presentation. He said the failure of the CASPR initiative to integrate state clean energy resources “has already led to unnecessary delays and consumer costs.

“Delaying MOPR elimination could result in [an] FCM that fails to incorporate clean energy through the end of this decade,” he added.

While the groups said they support ISO-NE’s approach to removing the MOPR, they questioned the RTO’s proposal to adjust CONE financial inputs, noting that the normal CONE/net CONE cycle allows consideration of multiple market and rule changes.

“Tariff, policy and market changes happen every year, and we have never adjusted CONE between cycles to address them,” Ho said. “What makes this change so different?”

LS Power Responds to ISO-NE Criticism

LS Power used its time to defend its proposed Scarcity Event Reduction Framework (SERF), which it said would provide “incremental incentives” for investing in flexibility and reliability in time for FCA 17.

The construct would credit or charge resources for their energy and reserves supplied when real-time reserve prices are positive.

The proposal is based on the current Pay-for-Performance (PfP) design but would increase the instances in which performance is assessed. While PFP design assesses performance only when there is a capacity scarcity condition (CSC) — triggered by a shortage of a minimum real-time reserve requirement — SERF would apply the new credits and charges whenever there is a positive real-time price for reserves but no CSC.

LS Power’s Mark Spencer said changes are needed to restore the balance between buyers and sellers because “there is no tangible risk of a scarcity event, and the adverse selection problem raised in the 2014 PfP filing has yet to be addressed.”

He noted there has been only one event — lasting about 2.5 hours — in the last four summers, although the RTO predicted a handful of hours in every year. In the last five years, 7 to 9 GW of capacity resources that obtained a capacity supply obligation in the FCA — more than 20% of the total on average — did not participate in the peak load hour.

LS Power wants ISO-NE to go beyond eliminating the minimum offer price rule (MOPR) and embrace broader proposals to incentivize generator performance. In the last five years, 7 to 9 GW of capacity resources that obtained a capacity supply obligation — more than 20% of the total on average — did not participate in the peak load hour, it said. | LS Power

LS Power wants ISO-NE to go beyond eliminating the minimum offer price rule (MOPR) and embrace broader proposals to incentivize generator performance. In the last five years, 7 to 9 GW of capacity resources that obtained a capacity supply obligation — more than 20% of the total on average — did not participate in the peak load hour, it said. | LS PowerEliminating the MOPR will “further reduce the already miniscule probability of scarcity events,” he said.

Spencer said the proposal was an effort to address “a market in distress that requires immediate attention.” Market design efforts the RTO has in its work plan such as ELCC and day-ahead co-optimization “will not materially improve this situation,” he said.

In a Dec. 3 memo, ISO-NE said it opposed the proposal because it would incentivize resource owners to offer in the real-time energy market at prices below their marginal cost and ignore dispatch instructions.

Spencer said the RTO’s concern that some resources would offer below their cost when it anticipates a SERF event to avoid penalties is not realistic because it would require “perfect foresight” to make the strategy profitable. A resource would have to predict a SERF event at least 30 minutes in advance.

LS Power said SERF events would usually be less than one hour and may be spread over two delivery hours, while real‐time reoffers are binding for an entire delivery hour. “Frequently part of the hour would be unprofitable, offsetting the profit‐making potential in the rest of the hour.”

SERF events would occur infrequently — only 13 days, or 7.6% of the summer peak days — during the last two years.

“The ISO’s analysis … ignores the cost of those days when the generator submits a below-cost offer but a SERF event doesn’t occur,” Spencer said.

MC Vice Chair, Committee Secretaries

Also Tuesday, the committee re-elected Sigma Consultants’ William Fowler as vice chair. No other members expressed an interest in the position, the RTO said.

Earlier this week, ISO-NE announced committee secretaries for 2022:

- Dennis Cakert, who recently joined the RTO as a lead analyst in the NEPOOL Relations team, will serve as secretary to the MC. He previously was the senior manager of regulatory affairs and state policy with the National Hydropower Association (NHA).

- Marc Lyons, who has served as the Reliability Committee secretary for 12 years, will become secretary for the Transmission Committee.

- Nicholas Gangi. who recently joined the RTO as a lead analyst in the NEPOOL Relations team after working as an engineer with Eversource Energy, will be secretary of the Reliability Committee.