The NEPOOL Markets Committee will vote in January on two proposals to modify ISO-NE’s generator retirement rules, which the proposals’ sponsor contends are “the most onerous and difficult … in the country.”

Sigma Consultants’ William Fowler told the committee Thursday that his proposals would address New England’s large generation surplus. Fowler says the RTO’s plans to eliminate the minimum offer price rule (MOPR) is likely to cause an influx of new state-sponsored resources, which could exacerbate the surplus without rules to enable efficient exit. (See Monitor, Merchants Challenge ISO-NE Plan to Eliminate MOPR.)

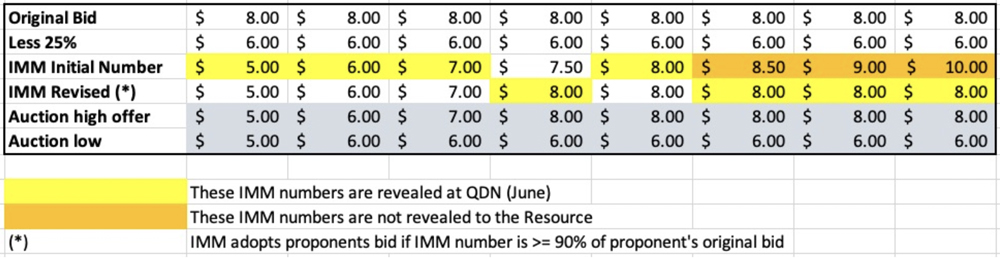

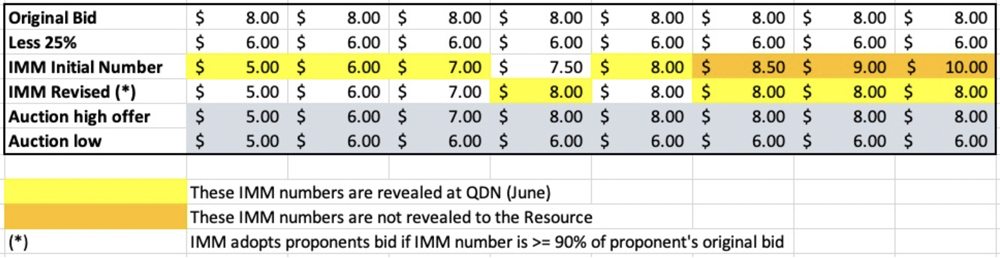

Under current rules, retirement bids are due in March, 11 months before the annual Forward Capacity Auction, and cannot be updated to reflect changes that occur between then and the FCA. “This adds significant, unnecessary risk to the process,” Fowler said in a presentation.

He proposed allowing bids to be updated prior to the auction in mid-October, as is permitted for static delist bids.

Offer prices could be no more than 25% below the initial submission. Upward adjustments would not be permitted.

Fowler said he will seek an MC vote on his proposal at its Jan. 11-12 meeting, immediately after it votes on the MOPR elimination. He said the bid flexibility rules would be contingent on FERC eliminating the test price for Competitive Auctions with Sponsored Policy Resources along with the MOPR or a transition package.

Fowler said he hopes the new rules will be filed with FERC prior to the March bid submission deadline for FCA 16, allowing a commission order before the June auction election deadlines. He also plans to seek an MC vote at the same meeting on a second proposal intended to create a “meaningful” mothball option.

Examples of how bid modification would work. | Sigma

Examples of how bid modification would work. | Sigma

Current rules require generation owners seeking to temporarily take a unit out of the capacity market to “string together a series of one-year delists,” Fowler said. “But that has many limitations. Also, once retirement is accepted, [there is] no meaningful way to return to service if there are major regional changes.”

He proposed modifying the “repowering rule,” which requires that the generation owner make a minimum financial investment in the plant to re-enter the market. He also suggested a three-year waiting period — including two consecutive FCAs after the one in which it retired — calling it a “reasonable balance.”

“Three years is [the] longest waiting period that can allow for changed circumstances before risking permanent actions that may frustrate [the unit’s] return,” he said. A shorter waiting period could allow generators to “toggle” into and out of the market, “fishing” for a reliability-must-run designation entitling it to cost-of-service compensation.

Fowler has withdrawn a proposal to eliminate a rule that requires resources that submit retirement bids and fail to clear in that FCA to continue submitting retirement bids until they do clear. He also has withdrawn a proposal to relax Internal Market Monitor reviews in certain situations.

Increased Penalties for Failed Capacity Resources

Competitive Power Ventures will early next year put forward its proposal to increase financial penalties for capacity resources that fail to reach milestones prior to their delivery year and commercial operation.

CPV will be seeking votes at the next Budget and Finance Subcommittee meeting Jan. 26 and at the succeeding MC in February, said Joel Gordon, CPV’s vice president of external and regulatory affairs.

Gordon said existing financial assurance (FA) requirements, designed to keep barriers to entry low, are insufficient to ensure that resources that win capacity supply obligations (CSOs) actually deliver.

Current rules do not distinguish between a project meeting all its milestone commitments, a delayed project and a totally failed project because there are no financial penalties until after the resource has failed to meet its commercial operating date (COD).

He cited ISO-NE’s Nov. 4 filing asking FERC to terminate Killingly Energy Center’s CSO for FCA 16, after the developer failed to advance its project despite participating in three consecutive auctions, FCAs 13 to 15. (See ISO-NE Seeks to Terminate CSO for Conn. Power Plant.)

Failed capacity projects impact other capacity sellers by artificially increasing apparent “supply,” reducing clearing prices and increasing performance risks, he said. He said Killingly’s failure reduced clearing prices by a total of $380 million over three auctions, an average of 31 cents/kW-month.

Currently, the RTO collects a “base” FA — equivalent to one month of net cost of new entry (CONE) — prior to the primary FCA and before the first and second subsequent auctions.

Following a failed project in FCA 10, the RTO also added a “trading” FA that collects any positive trading revenue from resources that engage in “cover” transactions for their CSOs.

CPV proposes to add a “milestone” FA for projects that don’t meet pre-COD obligations and a “delay” FA for projects that fail to meet their obligations at their commitment date:

- Resources that have not achieved their financing milestone or their demand reduction value before the first subsequent FCA would be required to post an additional one month of FA.

- Resources that have not achieved substantial site construction or achieved their demand reduction value before the second subsequent FCA would be required to post an incremental two months of FA (three months total).

- Resources that have not achieved substantial site construction or achieved its demand reduction value before the third subsequent FCA would be required to post an additional three months of FA (six months total).

All milestone FA would be released upon catchup to active construction; projects that meet their commitments would face no increase in FA requirements.

Forfeited FA payments from the new requirements would be distributed pro rata to other CSO holders. Forfeited base and trading FA would continue to be allocated to load, as under current rules.

IMM Reports Summer Energy Costs up 48%

A large increase in natural gas prices and slightly higher loads pushed New England wholesale energy costs up by 48% last summer compared to the same period a year ago, according to the ISO-NE Internal Market Monitor’s quarterly markets performance report.

Wholesale market costs totaled $2.19 billion, up $710 million from summer 2020, according to the report presented by Donal O’Sullivan, IMM supervisor of surveillance and analysis.

The year-over-year increase was large because summer 2020 saw historically low natural gas prices as a result of warmer weather and reduced consumption from the pandemic-driven economic shutdown.

Average day-ahead and real-time hub LMPs were $41.29/MWh (+84%) and $40.22/MWh (+79%), respectively. The average natural gas price was $3.39/MMBtu, more than double the summer 2020 price of $1.62/MMBtu.

The average hourly load of 15,298 MW was up by 0.3% (320 MW), driven by increased humidity and less behind-the-meter solar generation. Capacity market costs totaled nearly $530 million, down by $73 million (-12%).

Summer 2021 was the first quarter of the FCA 12 commitment period, with clearing prices of $4.63/kW-month for Rest of System, compared to an FCA 11 price of $5.30/kW-month.

Gross real-time reserve payments more than doubled to $9 million.

Ten-minute non-spinning reserve (TMNSR) and 30-minute operating reserve payments increased by $1.9 million and $432,000, respectively.

Non-zero TMNSR pricing occurred in 386 hours in summer 2021, down from 506 hours. However, the average non-zero spinning reserve price increased from $9.81 to $14.27/MWh.

Total regulation payments were $7.6 million, up 19%.

The higher average real-time hub LMPs led to a $1 million increase in regulation capacity payments.

Net commitment period compensation (NCPC) costs totaled $10 million, up $3.1 million (+44%). But as in summer 2020, NCPC costs represented less than 1% of total energy costs. Economic payments made up 77% ($7.7 million) of the total, up by $2.1 million from the same period a year ago.

Economic out-of-merit payments increased by 34% to $4.98 million. Local reliability payments were $1.6 million, up 72%.