ISO-NE took several important steps to demonstrate its “alignment” with state climate policies in 2021. But the RTO’s stakeholder meetings remain closed to the public, and its board elections remain secret, falling short of calls for increasing transparency. And this spring, the states and the RTO will be debating differing market proposals for accomplishing the states’ clean energy goals.

Which design will prevail is just one of the questions facing New England in 2022, starting with whether it will have enough natural gas to keep the lights on through the winter. Among the others: whether Maine voters’ rejection of the New England Clean Energy Connect (NECEC) transmission line will stick, and whether the 650-MW gas-fired Killingly plant in Connecticut will get built.

Here’s a look back at the big issues of 2021 and what to expect in 2022.

Resource Adequacy Concerns

On Dec. 6, ISO-NE officials gave a sobering press briefing, warning that limited natural gas pipeline capacity and global supply chain issues put the New England grid at heightened risk of load sheds this winter.

The RTO said it can meet forecast peak demand of 19,710 MW during average winter weather conditions of 10 degrees Fahrenheit and 20,349 MW if temperatures reach below-average conditions of 5 F. But ISO-NE CEO Gordon van Welie said uncertainty over fuel supplies “could put the region in a more precarious position than past winters and force the ISO to take emergency actions up to and including controlled power outages.” Van Welie said the outages would be a last resort “to prevent a regionwide blackout, which would take many days or weeks to restore.” (See ISO-NE: New England Could Face Load Shed in Cold Snaps.)

Resource adequacy has been a recurring winter concern in New England because of difficulty siting new natural gas pipelines and electric transmission. The state-RTO tensions were on display at FERC’s technical conference on modernizing electricity market design in ISO-NE in May (AD21-10).

Katie Dykes, commissioner of Connecticut’s Department of Energy and Environmental Protection, complained that the RTO had failed to prevent the premature retirement of the Millstone nuclear plant, leaving her state to “shore up the reliability of the [ISO-NE] grid and the market” by approving subsidies funded by ratepayers.

Van Welie told the conference that markets are “never going to work very well” with inadequate infrastructure supporting them “or if policy objectives are not aligned.”

“We have to design the markets around those [pipeline and transmission] constraints,” he said. “That’s just where we ended up because of the choices we made over the last two decades.

“Until the region figures out how it wants to socialize some of these costs for reliability that are outside of the market, we’re going to stay stuck in that situation,” he added. “There’s no market design that will solve the problem that Commissioner Dykes wants us to solve.” (See Regulators, ISO-NE Discuss Market Changes at FERC Tech Conference.)

Progress on States’ Wish List

ISO-NE took several steps in 2022 to address the states’ demand for changes to the RTO’s wholesale market design, transmission planning and governance. The demands, first spelled out in a joint statement by five of the region’s governors in October 2020, was updated by the New England States Committee on Electricity (NESCOE) last August in its “Advancing the Vision” report.

ISO-NE’s Board of Directors responded to the states’ demands in September, saying it was “pursuing targeted governance and communications enhancements, consistent with its independence and oversight role.” It assured NESCOE that it is “aligned with the states on the clean energy transition,” citing a list of transmission planning and market rule initiatives that it was pursuing to enable the transition.

2050, ‘Future Grid’ Studies Highlight Transmission Planning Efforts

In November, ISO-NE presented the scope of its work for the 2050 Transmission Study, which will examine ways to incorporate clean energy and distributed energy resources beyond the RTO’s standard 10-year planning horizon. The study will seek to determine what transmission is needed to serve load while satisfying reliability criteria for 2035, 2040 and 2050, including high-level cost estimates to help the states evaluate different transmission options. The study was requested by NESCOE, which also was responsible for many of the study assumptions. (See ISO-NE Presents Preliminary 2050 Tx Study Scope.)

Work is expected to continue on the study throughout 2022. As also requested by NESCOE, ISO-NE on Dec. 27 filed proposed tariff changes to permit future state-led, scenario-based transmission planning as routine practice (ER22-727).

In addition, ISO-NE expects to release a report this spring on the RTO’s Future Grid Reliability Study (FGRS), which will identify potential reliability gaps in 2040 based on current state laws and policies. The FGRS, which is not a detailed transmission study, is largely based on assumptions developed by NEPOOL stakeholders, with input from NESCOE. A draft of the FGRS is expected to be presented at the Planning Advisory Committee in April and discussed at NEPOOL’s Markets Committee/Reliability Committee meeting in May.

The RTO also is conducting cluster studies to interconnect offshore wind on Cape Cod and a pilot study to proactively plan for growing levels of DERs, renewables, imports and energy storage.

Wholesale Market Design

In April, the RTO is expected to release its Pathways to the Future Grid study, which will evaluate alternative market frameworks for adapting to state energy policies. The analysis will include a forward clean-energy market (FCEM): a centralized, forward auction favored by states in which buyers (states, cities, retailers, companies and utilities) could voluntarily purchase clean energy attribute credits.

The study also will examine the RTO’s net carbon pricing proposal, which would require suppliers pay for each unit of carbon they emit to generate electricity, as a supplement to the Regional Greenhouse Gas Initiative.

A third alternative to be considered is a hybrid of the net carbon and FCEM proposals. (See ISO-NE to Study Additional Model for Capacity Market.)

Order 2222, MOPR Removal

Stakeholders and ISO-NE staff spent many meetings during 2021 discussing the RTO’s Order 2222 compliance filing and eliminating the minimum offer price rule (MOPR).

In December the NEPOOL Markets Committee approved ISO-NE’s proposed set of market rules to implement Order 2222 — which requires RTOs to allow DER aggregations to provide all wholesale services that they are technically capable of providing — and rejected several amendments opposed by the RTO.

The compliance filing passed the MC with unanimous support from the Generation, Transmission and Publicly Owned Entities sectors and most Suppliers. Alternative Resources were split, and End Users, who had supported unsuccessful amendments by Advanced Energy Economy, were unanimously opposed.

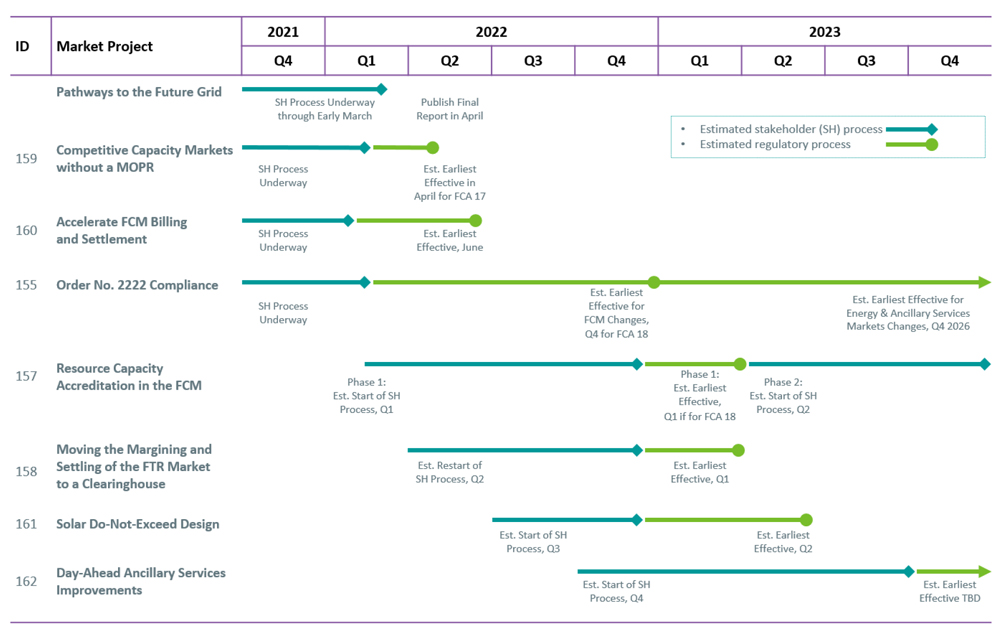

Assuming that FERC accepts the compliance filing by the fourth quarter, distributed capacity resources will be able to participate in Forward Capacity Auction (FCA) 18 in February 2024. The RTO proposed a fourth-quarter 2026 effective date for the energy and ancillary services markets.

The Participants Committee is scheduled to vote on the Order 2222 changes Thursday. The filing is due Feb. 2.

Meanwhile, the Markets Committee is scheduled to vote on the RTO’s proposal to eliminate the MOPR at its first meeting of the new year, Jan. 11-12.

NESCOE, FERC Chair Richard Glick and Commissioner Allison Clements all favored eliminating the MOPR, which they said was undermining state decarbonization efforts. Stakeholders approved the change in November, despite warnings from merchant generators and ISO-NE’s Internal Market Monitor that it will suppress capacity prices. Other stakeholders debated whether the implementation of the RTO’s plan should be delayed until it approves long-term market rule changes on capacity accreditation and reserves. The MOPR would be eliminated beginning with FCA 17 in 2023. (See Monitor, Merchants Challenge ISO-NE Plan to Eliminate MOPR.)

State-RTO Communications

ISO-NE’s September response to NESCOE said the RTO’s board is “making changes that are consistent with the ISO’s core requirement for independence and its role as an oversight board.”

It pledged the board will hold an annual open meeting beginning in 2022 — focused on the electricity markets on even-numbered years and transmission planning in odd-numbered years — in addition to meetings the board holds with the states and NEPOOL sectors throughout the year.

The board said it would hold other meetings as needed to discuss consumer implications of its proposals and that if the states have a majority position on an RTO proposal, “management will include consideration of a state majority position in filings to FERC.”

It also noted that the CEO’s monthly board reports — which summarize recent board and board-committee meetings — are public and that states can question van Welie about board activities at NEPOOL Participants Committee meetings.

But the board did not take action on NESCOE’s request to establish a standing board committee on state and consumer responsiveness. “The board is continuing discussions with the states about this request,” ISO-NE said in an email to RTO Insider. “The board and several of its committees already review state and consumer issues in various ways, and the board is continuing to consider other targeted enhancements.”

Nor were there any changes to how ISO-NE selects its board members. NESCOE had called on FERC to revise Order 719 to ensure “that states and consumers in New England are meaningfully represented” in the composition of the board and the Joint Nominating Committee process that governs board nominations. State officials have only one vote on the 14-member committee, through the New England Conference of Public Utilities Commissioners.

“The Joint Nominating Committee is governed by the Participants’ Agreement between the ISO and NEPOOL stakeholders,” the RTO said. “The board cannot make unilateral changes to the process for selecting new members. Any changes would need to be pursued through the NEPOOL stakeholder process and approved by FERC.”

In September, ISO-NE announced the election of four board members for three-year terms: incumbent Michael Curran and newcomers Caren Anders, Steve Corneli and Catherine Flax. The board also elected former FERC Commissioner Cheryl LaFleur as its chair, replacing the retiring Kathleen Abernathy.

Transparency Still Lacking, Critics Say

Critics were unimpressed with the RTO’s modest changes on transparency, noting that New England remains the only region in the U.S. whose RTO/ISO stakeholder meetings are closed to the public.

ISO-NE and NEPOOL have “essentially privatized public policymaking,” Tyson Slocum, director of Public Citizen’s energy and climate program, said at the RTO’s quarterly Consumer Liaison Group meeting in September. “There is inadequate transparency and accountability in these institutions that don’t reflect the public interest nature of what they’re doing.”

Rebecca Tepper, chief of the Energy and Telecommunications Division in the Massachusetts Attorney General’s Office, also lamented the lack of progress. “I think it would be good to see that move forward and have some real dialogue about how the governance process can be more accommodating to people.” (See Stakeholders Still Seeking Transparency from ISO-NE, NEPOOL.)

FCA 16

In the near term, capacity market watchers are waiting for a FERC ruling on ISO-NE’s request to prevent the 650-MW natural gas-fired Killingly Energy Center in Connecticut from participating in FCA 16 in February and to terminate its capacity supply obligations (CSO). Killingly, which initially secured a CSO in 2019’s FCA 13 for the 2022/23 capacity commitment period, failed to meet its development milestones, the RTO said (ER22-355).

Developer NTE Energy responded that ISO-NE made an incorrect assumption regarding a financing milestone date, claiming that its financing is “imminent.” In its Dec. 3 protest to FERC, NTE called the RTO’s action “premature” and said it had kept the project moving despite “challenges beyond its control, including the COVID-19 pandemic and an ultimately unsuccessful 29-month challenge to its state siting certificate.” ISO-NE responded on Dec. 20, saying the only question facing FERC was whether the plant can reach commercial operation by June 1, 2024. “The answer … is ‘no,’” said the RTO.

“There is also no dispute that to terminate Killingly’s capacity supply obligation — a valuable asset worth hundreds of millions of dollars — ISO-NE’s tariff requires the ISO to prove that Killingly would not enter service before the June 1, 2024 deadline,” NTE responded Dec. 28. “Despite its burden, to date, the ISO has offered only speculation about what might happen — repeating in its answer that it just ‘lost confidence’ in the project.”

FCA 16 also will see the end of the seven-year price lock for new entrants. FERC ruled in late 2020 that the rules, which had been in effect since the FCA began in 2006, resulted in “unreasonable price distortion” and that locked-in prices are “no longer required to attract new entry.” (See FERC Orders End to ISO-NE Capacity Price Locks.)

Prices in FCA 15 cleared at $2.48 to $3.98/kW-month — the high in Southeast New England nearly doubling 2020’s record-low figure.

Turbulent Year for Avangrid

2021 was a turbulent year for Avangrid (NYSE:AGR), the parent of Central Maine Power (CMP) and United Illuminating in Connecticut.

In May, the Bureau of Ocean Energy Management approved the final permit for 800-MW Vineyard Wind I, a joint venture of Avangrid Renewables and Copenhagen Infrastructure Partners. The first commercial-scale offshore wind project in the U.S., Vineyard Wind broke ground in November and is expected to begin commercial operation in 2023. In December, Massachusetts said it would purchase 1,200 MW of OSW from Vineyard Wind’s Commonwealth Wind project. (See Mass. Adds 1,600 MW to OSW Portfolio in Latest Procurement.)

Avangrid faced two setbacks late in the year, however.

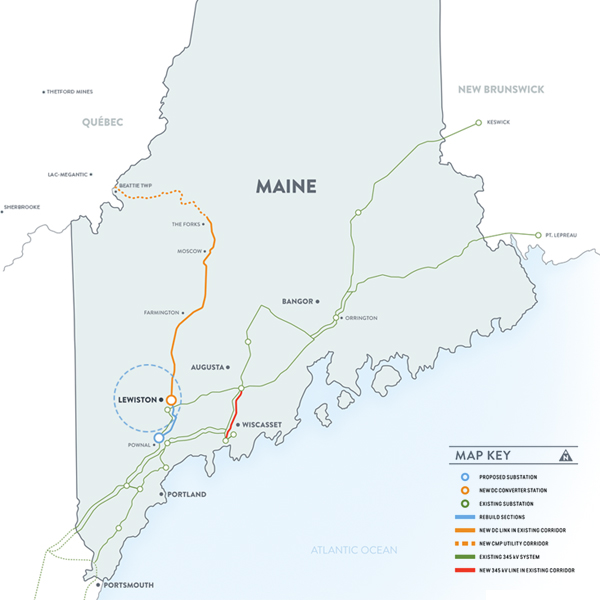

In November, CMP halted construction on the NECEC transmission project in response to Maine voters’ approval of a referendum to block it. Avangrid filed a lawsuit challenging the constitutionality of the referendum. On Dec. 16, a judge rejected the company’s request for an injunction to block the impact of the referendum.

Central Maine Power halted construction on the New England Clean Energy Connect transmission line in November following Maine voters’ approval of a referendum to block the project. | New England Clean Energy Connect

Central Maine Power halted construction on the New England Clean Energy Connect transmission line in November following Maine voters’ approval of a referendum to block the project. | New England Clean Energy ConnectIn December, New Mexico regulators rejected Avangrid’s proposed $8.3 billion acquisition of PNM Resources (NYSE:PNM), citing Avangrid’s “demonstrated record of poor performance” in other states, including its stewardship of CMP.

The New Mexico Public Regulation Commission’s 5-0 vote also followed allegations by a former cybersecurity contractor that the company conspired with suppliers to buy “tens of millions” in overpriced and unnecessary security equipment and services to boost profits. (See NM Regulators Reject Avangrid-PNM Merger.)

Regulators in Connecticut and Maine said they would review the allegations, which came six months after Maine Gov. Janet Mills vetoed legislation to create a publicly owned utility to replace CMP and Versant Power, calling it “hastily drafted.” (See Mills Tells Maine Legislature to Slow Down on Plan to Replace IOUs.)

Annual Work Plan

ISO-NE’s Annual Work Plan lists several additional projects and timelines for 2022:

- The RTO is expected to file a proposal with FERC by the end of 2022 revising resource accreditation in the capacity market, to be effective in FCA 18, with a second filing by the end of 2023, targeting FCA 19.

- The RTO will focus in 2022 on proposals to co-optimize reserves in the day-ahead energy markets.

- Beginning in the first quarter and extending into 2023, the RTO will work with stakeholders and the Electric Power Research Institute on ways to model high-impact reliability risks (tail risks) related to extreme weather events, an initiative prompted by the outages in Texas during the February 2021 winter storm.

- The RTO expects to file changes with FERC in 2022 allowing solar resources to take electronic dispatch instructions in the real-time energy market under the Do-Not-Exceed model currently used by wind resources. The change would be effective in the second quarter of 2023.

- ISO-NE plans to begin discussing tariff changes in the first quarter to allow storage-as-transmission solutions for needs assessments or public policy transmission studies.

- It also hopes to complete its two-year nGEM Day-Ahead Market Clearing Engine Implementation project this year. The day-ahead clearing engine is expected to be in-service Q1 2023.

- The RTO will complete three projects in 2022 concerning identity and access management; security information and event management; and a refresh of the hardware and software supporting the collection of network traffic data that feed the Network Intrusion Detection system and the Security Information and Event Management analysis system.