PJM on Wednesday proposed moving the upcoming Base Residual Auction originally scheduled for later this month to the end of June to comply with FERC’s order partially reversing its decision on the RTO’s energy price formation revisions.

Pete Langbein, of PJM’s capacity market and demand response operations, updated the Market Implementation Committee on the capacity auction dates, saying FERC recognized the RTO will need to delay the BRA to implement a revised energy and ancillary services (E&AS) offset, a key variable in calculating the net cost of new entry (CONE) for resources in capacity auctions.

PJM must submit a compliance filing with the commission by Jan. 21 proposing a new schedule for the BRA and subsequent capacity auctions impacted by the delay. FERC reversed its approval of PJM’s forward-looking E&AS offset on Dec. 22 (EL19-58). The commission said PJM must now revert to the previous, backward-looking offset. (See FERC Reverses Itself on PJM Reserve Market Changes.)

Langbein said FERC is not requiring PJM to rerun capacity auctions that utilized the forward-looking offset because doing so would “undermine the expectations of the parties who are making commitments for the 2022/23 delivery year.”

“This is a little bit of a rock and a hard place based on the holiday gift we got from FERC,” he said. The switch will impact net CONE for the reference resource used in the variable resource requirement curve, the market seller offer cap (MSOC) and the minimum offer price rule. PJM plans on making the compliance filing “as straightforward as possible,” Langbein said.

“We want to make sure we allow time for any activity that gets impacted by the E&AS change.”

PJM needs to maintain the current 120-day time frame for the MSOC unit-specific review process, Langbein said. The RTO also plans to allow sellers to maintain previously submitted and approved gross avoidable-cost rates.

The auction delay will also result in an update to calculations of the capacity emergency transfer objective and capacity emergency transfer Limit and the load forecast. Langbein said the updates impact the reliability requirement, the fixed resource requirement commitment and the elimination of one additional energy efficiency installation period.

Langbein said pre-auction activities not impacted by the E&AS change or updates in the load forecast will maintain existing information that was already submitted for the auction.

Updated Auction Schedule

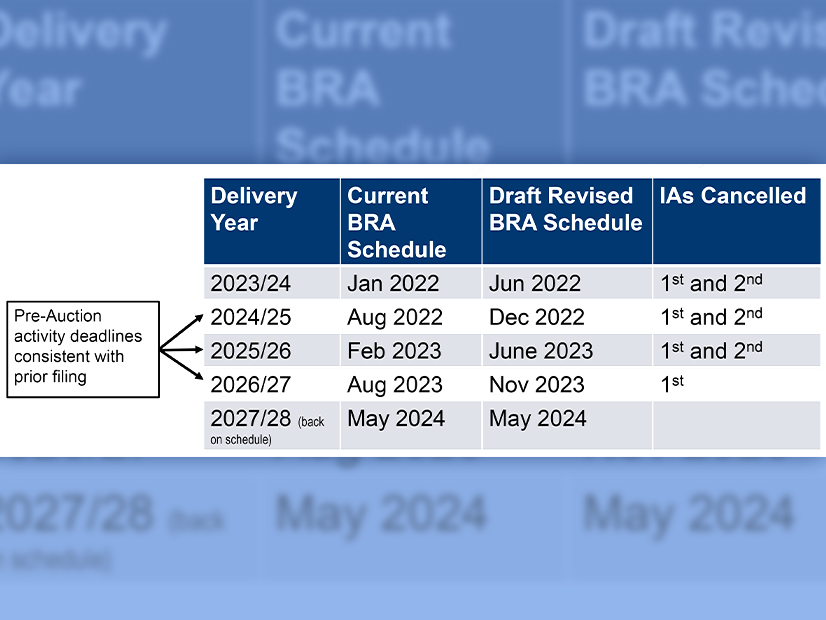

PJM is attempting to get back to the normal auction schedule by the 2027/28 BRA, Langbein said, and the proposed schedule will allow that to happen.

Langbein said PJM has proposed conducting the 2022/23 third incremental auction (IA) based on the existing schedule of Feb. 28 and continuing to use the forward-looking E&AS offset, as it was used in the 2022/23 BRA.

The RTO wants to compress the timeline between auctions from 195 days to 175 days. The 2024/25 BRA would move from August to December; the 2025/26 auction would move from February 2023 to June 2023; and the 2026/27 auction would move from August 2023 to November 2023. The 2027/28 BRA would be back on schedule in May 2024.

The first and second IAs would be canceled for the 2023/24, 2024/25 and 2025/26 BRAs. The first IA would be canceled for the 2026/27 BRA.

Langbein said the proposed schedule has not been finalized.

“We’re still collecting input,” Langbein said. “But based on what we have today, this is what the schedule would look like.”