PJM stakeholders approved an updated issue charge for the Resource Adequacy Senior Task Force (RASTF) at last week’s Markets and Reliability Committee meeting after debating its out-of-scope items, including demand response.

Members approved the issue charge in a sector-weighted vote of 3.08 (61.6%), passing the necessary 2.51 threshold. The RASTF endorsed the draft issue charge with 59% support at its Dec. 7 meeting. The task force itself was approved by the MRC in October. (See “Resource Adequacy Charter Approved,” PJM MRC MC Briefs: Oct. 20, 2021.)

Pat Bruno, PJM | © RTO Insider LLC

Pat Bruno, PJM | © RTO Insider LLC

The scope of work in the RASTF is meant focus on a list of the issues identified by stakeholders at workshops held throughout 2021, as well as topics identified in the letter issued by the PJM Board of Managers on April 6, Pat Bruno, senior lead market design specialist in PJM’s market design and economics department, said in presenting the updated issue charge.

While the RASTF’s work will be “holistic,” solutions for any of the topics to be discussed may be advanced for a vote in their own or in conjunction with other topics, Bruno said. A series of “check-ins” will also be scheduled periodically to assess whether any proposed solutions for the topics should advance for an earlier implementation date.

The key work activities approved in the issue charge include determining:

- whether a forward procurement of clean resource attributes should be pursued and investigate the inclusion of the social cost of carbon in PJM markets (A separate issue charge for the appropriate stakeholder venue will be developed for consideration by the MRC if the determination results in additional scope.);

- the types of reliability risks and risk drivers to be considered by the capacity market and how they should be accounted for;

- the desired procurement metric and level to maintain the desired level of reliability;

- the performance expected from a capacity resource;

- the qualification and accreditation of capacity resources;

- the desired obligations of capacity resources;

- if there are needed enhancements to the capacity procurement process;

- any remaining design details for a seasonal capacity market construct not addressed in other key work activities;

- if supply-side market power mitigation rules in the capacity market need to be enhanced; and

- if the fixed resource requirement (FRR) rules need to be synchronized with any changes made.

The issue charge also included three out-of-scope items. Those are:

- topics related to the minimum offer price rule, beyond those needed for consistency with the work in this issue charge;

- elimination of the FRR option; and

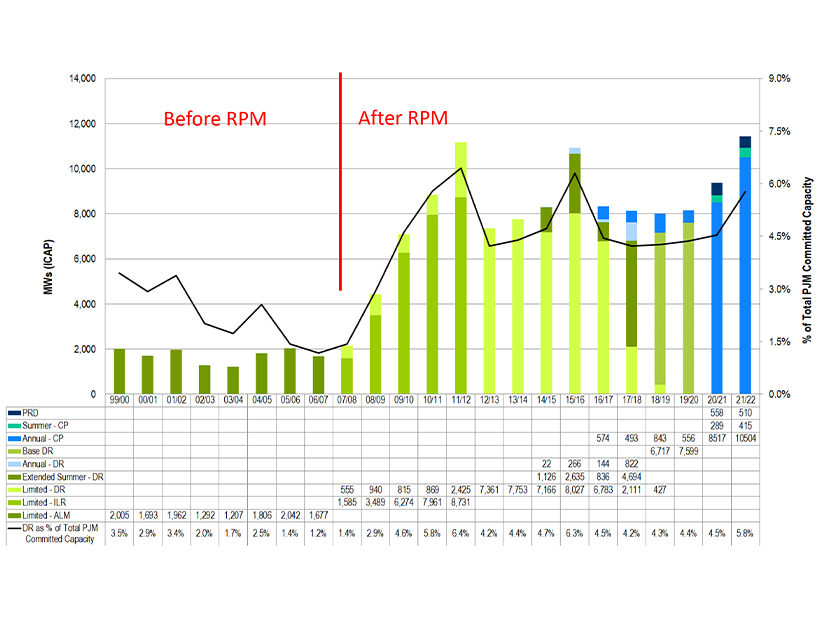

- removing DR as a supply resource.

Work in the RASTF is expected to be completed by the last quarter of 2023 in time for implementation in the 2027/28 Base Residual Auction in May 2024.

DR Debate

Steve Lieberman, AMP | © RTO Insider LLC

Steve Lieberman, AMP | © RTO Insider LLC

Steve Lieberman, vice president of transmission and regulatory affairs for American Municipal Power, presented an alternative issue charge removing DR as a supply resource from the out-of-scope items in the issue charge.

Lieberman said AMP supports DR participation in the Reliability Pricing Model and recognizes its benefit to consumers. He said discussion would not be “an attack on DR” or an attempt to end the DR business model.

AMP contends that the review of the capacity market should be a “holistic one,” Lieberman said, and that excluding an “essential and important component” from the discussion like DR “does not serve our collective best interests.” Lieberman said PJM members have expressed concerns that DR is a contentious issue, but that shouldn’t be a qualifier for discussions in the stakeholder process.

“I get concerned when we start to carve out things that are in scope and out of scope, and in my mind, we are picking winners and losers,” Lieberman said. “If indeed items that are deemed to be divisive and time consuming are out of scope, I think a lot of us are going to be on the bread line.”

Paul Sotkiewicz, E-Cubed Policy Associates | © RTO Insider LLC

Paul Sotkiewicz, E-Cubed Policy Associates | © RTO Insider LLC

Paul Sotkiewicz of E-Cubed Policy Associates said he agreed that excluding DR could be “discriminatory.” He said it “sets a very dangerous precedent” in the stakeholder process by eliminating discussion of a key issue.

“If it’s divisive and time consuming, it probably means it’s worth exploring at the end of the day,” Sotkiewicz said.

Aaron Breidenbaugh, director of regulatory affairs for Centrica Business Solutions, said eliminating DR as a supply resource would be “tantamount to eliminating DR from the capacity market.” Seeking to remove DR as a supply resource would be like expecting generation owners to support the total elimination of the capacity market, he contended.

Breidenbaugh asked what the point would be in considering something that has no chance to win approval by PJM stakeholders or at FERC. “This rises to an entirely different quantum of controversial as far as our side of the business is concerned.”

Susan Bruce, PJM ICC | © RTO Insider LLC

Susan Bruce, PJM ICC | © RTO Insider LLC

Susan Bruce, counsel to the PJM Industrial Customer Coalition, said she would welcome a discussion on new ways DR can participate on the demand side. But removing DR as a supply source is an “existential issue” for those involved in DR, she said. There are too many large issues to deal with at the RASTF, including the market seller offer cap and clean procurement, to spend time on a discussion that could “bring down the ship.”

“I fear it will become something that is too much of a distraction to allow for focused conversations on the things that we have that are immediately before us,” Bruce said.