Committee Declines to Recommend Additional FA Changes

The NEPOOL Markets Committee on Tuesday voted against recommending two pieces of a proposal from Competitive Power Ventures to change ISO-NE’s financial assurance rules.

The meat of the proposal, aimed at increasing the consequences for projects that don’t meet development milestones required for participation in the Forward Capacity Market, is under consideration by NEPOOL’s Budget and Finance Subcommittee. It would create new financial assurance requirements for projects that fail to meet certain milestones and add penalties for projects that fail to deliver physically by their commitment date.

But a new addition to the proposal voted on by the MC — to allocate forfeited financial assurance to all buyers and sellers in the market (rather than just sellers) — failed to get the support required for a committee recommendation. Also rejected were changes to the critical path schedule provisions in the proposal.

It was an especially timely conversation this week as a late court ruling on the Killingly Energy Center, which has challenged an RTO determination that it failed to meet development milestones, threw Monday’s Forward Capacity Auction 16 into chaos. (See Killingly Stays Alive After DC Circuit Halts FERC’s Termination Order.)

Committee Discusses ‘Mothball’ Option

The MC also continued work on a proposal by Sigma Consultants to make changes to the resource retirement process.

At Tuesday’s meeting, the discussion was specifically around whether ISO-NE needs a mechanic for resources to “mothball,” or exit service in a way that would later allow them to return from retirement. Sigma’s idea is to remove the “repowering rule,” which requires a minimum investment to re-enter service.

But Sigma’s Bill Fowler acknowledged in his presentation that major questions remain around the plan, including whether it should apply to permanent delists as well as retirements, and how retirement bids should be restructured.

The committee ultimately did not vote on the proposal. Fowler expressed frustration with a lack of responsiveness from ISO-NE.

“At the January MC, the ISO made clear that they are unable to support new stakeholder-driven proposals that are not in the work plan — at least for the foreseeable future,” his presentation said. “To resolve the bidding question, as well as ensure that the overall rule does not raise other concerns, we need ISO support.”

IMM Presents Fall Markets Report

Donal O’Sullivan of the ISO-NE Internal Market Monitor presented highlights from the IMM’s Fall Quarterly Markets Report to the committee.

Electricity costs in New England this past fall were up 67% over 2020. | ISO-NE

Electricity costs in New England this past fall were up 67% over 2020. | ISO-NE

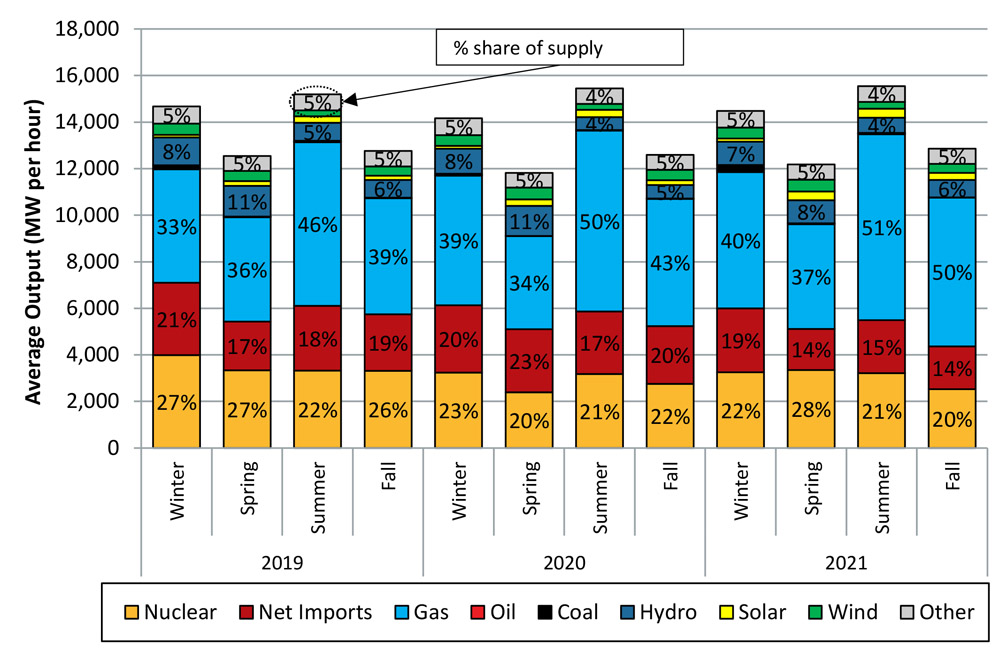

Fall 2021 saw large increases in wholesale market and energy costs over the same period in 2020, driven by higher gas prices and slightly higher loads.

A big increase in gas generation over fall 2020 offset a decline in net imports and nuclear generation in 2021.

Real-time reserve payments were up substantially last year over 2020, and uplift payments increased slightly but remained relatively low.