ISO-NE is ramping up its work on incorporating ancillary services in the day-ahead energy market.

In a recent memo and at the NEPOOL Markets Committee meeting Tuesday, officials from the RTO laid out the scope and timing of the project, which is a much anticipated addition to the market.

“Broadly, the day‐ahead ancillary services project seeks to procure and transparently price the ancillary service capabilities needed for a reliable, next‐day operating plan with an evolving generation fleet,” the memo says.

The proposal includes two components. One is an Energy Imbalance Reserve (EIR) feature that would incorporate load forecasting into the day-ahead market and procure energy to cover the gap when physical energy supply awards are below the forecast real‐time load.

The other is Flexible Response Services (FRS), which would procure 10- and 30-minute fast‐start and fast‐ramping capabilities in the day‐ahead market.

Longer-duration ancillary services, like the previously proposed Replacement Energy Reserves, will be deferred while ISO-NE focuses on the former two.

Much of the grid operator’s work to develop the new market features was completed as part of the Energy Security Improvements proposal that was ultimately rejected by FERC. (See FERC Rejects ESI Proposal from ISO-NE.) But ISO-NE is finishing up some calculations and technical work, as well as preparing to redo its impact analysis and market power evaluation for the new proposal.

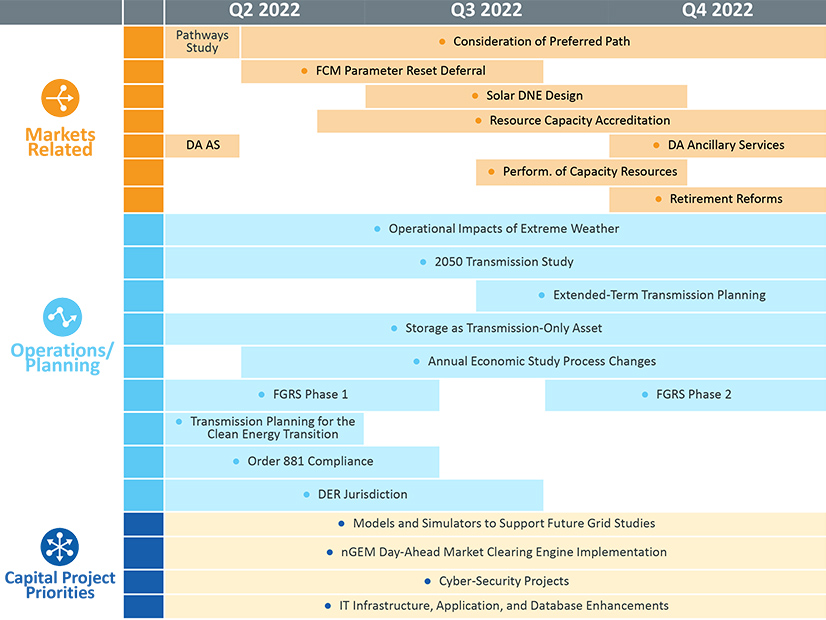

The RTO is planning to work on the proposed new day-ahead services throughout this year and next, filing it with FERC by the end of 2023 with an implementation date either at the end of 2024 or beginning of 2025.

Still no Go for Proposed FA Changes

The MC again declined to recommend changes to the ISO-NE financial assurance policy that are being proposed by Competitive Power Ventures.

CPV’s Joel Gordon had brought forward more changes to his proposal to, among other things, address concerns with the amount of financial assurance that would be required for solar projects.

The proposal is designed to penalize companies that don’t meet development milestones, a timely topic after the fiasco surrounding Killingly Energy Center earlier this year. But like at the February MC meeting, it failed to get enough support from the committee to recommend advancing it to the Participants Committee.