MISO officials this week answered questions about the more confusing aspects of the Midwestern shortfall and expensive prices in last week’s capacity auction while stakeholders asked for more supply data from before the auction.

The RTO’s 2022/23 Planning Resource Auction (PRA) resulted in the Midwestern zones, 1 to 7, being deficient by 1.2 GW of their collective planning reserve margin requirements and clearing at the $236.66/MW-day cost of new entry (CONE). (See MISO’s 2022/23 Capacity Auction Lays Bare Shortfalls in Midwest.) However, on the zonal level, only zones 4 to 7 — which include parts of Illinois, Lower Michigan, Indiana, Missouri and western Kentucky — couldn’t meet their local clearing requirements, and they couldn’t find extra supply from the other Midwestern zones.

MISO’s transfer limits between its subregions also kept the Midwest from accessing additional supply from the South that could have counteracted the regional capacity shortage.

Eric Thoms, MISO senior manager of resource adequacy operations, said the RTO’s auction clearing engine uses subregional resource zones and includes the marginal cost of a binding subregional flow limit in prices. In the case of this year’s auction, the South-to-North transmission limit bound. MISO used a 1,900-MW South-to-North limit and a 3,000-MW North-to-South transfer limit in the auction. The RTO begins with the usual 3,000-MW southbound and 2,500-MW northbound limits and subtracts firm service contracts to arrive at the transfer limits used in the auction.

MISO also used Zone 3’s $236.66/MW-day CONE to price the entire Midwest because it is the cheapest of the CONE prices, and the auction is designed to apply the lowest CONE when an entire region is short. The CONE values differ by zone because the cost of building new generation varies regionally.

“The objective of the multi-zone optimization methodology is to minimize the overall costs of capacity,” Thoms explained to stakeholders in a Resource Adequacy Subcommittee teleconference Wednesday.

Stakeholders asked MISO to telegraph a better feel of supply in the weeks and months leading into the auction. They said there was a large delta between confirmed unforced capacity and what was ultimately converted into zonal resource credits. Ahead of the 2022/23 planning year, MISO anticipated a 121-GW coincident systemwide peak, with 157 GW in total installed capacity and just short of 128 GW in total unforced capacity to cover it.

Stakeholders asked if MISO could have disclosed a level of accelerated suspended or retired megawatts ahead of the auction so market participants could have reacted and made more supply available.

Apex Clean Energy’s Richard Seide said the auction results were “astonishing.”

“I know things were getting tight, but if you read the data going into this year’s auction, you didn’t think it was going to go this way by a few hundred megawatts. You thought we were going to slide by again,” Constellation Energy’s John Orr said.

MISO Director of Resource Adequacy Coordination Zakaria Joundi said that while the RTO can’t reveal unit-specific data, it is reviewing the usefulness of the preliminary PRA data it posts.

“I think the process should be more transparent, so that choices to bring more capacity to the market can be viable,” Power System Engineering’s Tom Butz said.

Taylor Martin of the Independent Market Monitor, Potomac Economics, said the IMM tries ahead of time to project what will be unavailable but is bound by multiple confidentiality rules. But he said the Monitor found no evidence of economic or physical withholding.

Thoms also said no market participants this year elected to pay a capacity deficiency charge to MISO. According to MISO rules, load-serving entities can opt to pay out all or a portion of their planning reserve margin requirement.

The auction results are emblematic of the tricky situation MISO faces in navigating its members’ portfolio transition.

The 2022/23 capacity results brought longstanding criticisms of MISO bubbling back to the fore, including its lack of sturdier transmission connections between its South and Midwest regions, a bevy of thermal generation retirements and MISO’s use of a vertical demand curve over a sloped demand curve in the auction.

MISO said members in recent years have been replacing retiring thermal generation with even more megawatts from new intermittent resources.

The auction results come as Consumers Energy — Michigan’s largest electric utility — and stakeholders this week announced that they reached an agreement to close all coal plants by 2025, which could make it one of the first large utilities in the nation to eliminate coal use. The proposal still needs the blessing of the Michigan Public Service Commission. (See Consumers to End Coal by 2025 in IRP Deal with Mich. AG.)

Michelle Bloodworth, CEO of coal lobbying group America’s Power, said EPA’s recent crackdown on coal ash could also idle a little more than 2 GW of coal-fired generation in MISO Midwest as early as the fall. She said MISO should also factor that development into its supply picture.

Stakeholders said it seemed that a lot of the new capacity that MISO and the Organization of MISO States were expecting per their annual resource adequacy did not manifest. Some wondered if the RTO needs to recalibrate its expectations of generation that will complete the interconnection process.

Monitor: Sloped Demand Curve, Please

Monitor David Patton said the auction shortage reinforces the need for a sloped demand curve in the auction, a call he’s been making for 12 years now.

During the Market Subcommittee’s meeting Thursday, Patton said MISO undervalues capacity, sending “bad signals” to market participants. He said MISO’s long history of “near-zero” clearing prices spur too-early unit retirements.

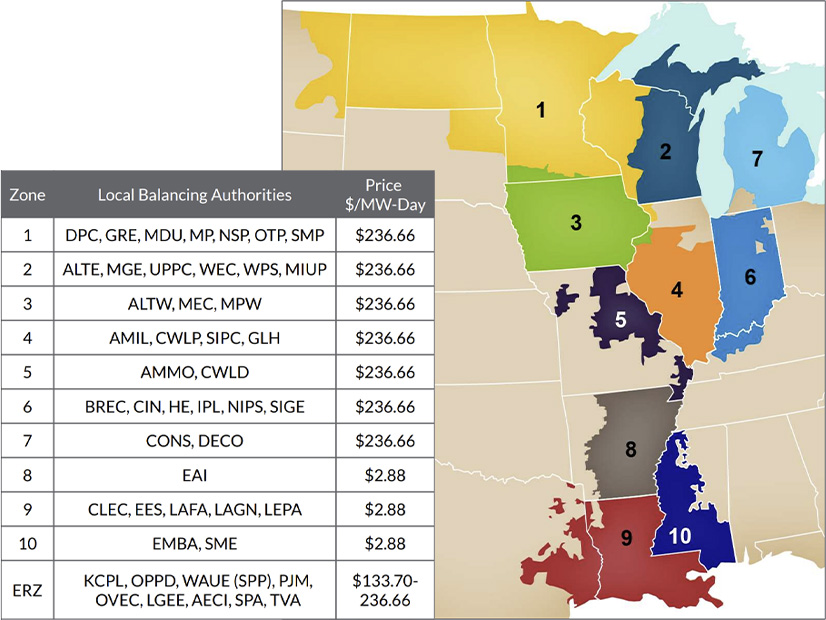

Zonal clearing prices in the 2022/23 MISO capacity auction | MISO

Zonal clearing prices in the 2022/23 MISO capacity auction | MISO

“Since 2019, MISO lost almost 5 GW of capacity in the Midwest that would have been economic if the PRA had set efficient clearing prices,” he said. “Most of these retirements were by unregulated merchant suppliers that rely on the market signals to make investment and retirement decisions.”

2nd Regional Resource Assessment in the Works

MISO will pull together another long-term resource assessment by the end of this year, this time with assistance from its members.

Last year’s first regional resource assessment showed a need for members to add almost 140 GW of new capacity within the next 20 years. (See MISO Resource Assessment: 140 GW Needed Within 20 Years.)

Last year, MISO relied only on public data it independently searched. The regional resource assessment this year will include data sourced directly from members to get a better picture of protracted resource trends. The RTO said it has collected generation information from 75% of its load for the 2022 assessment.

MISO said preliminary results show a lower level of nuclear retirements 20 years out; net neutral natural gas retirements and additions over two decades; and the same 35 GW of coal plant retirements by 2040 that it originally expected last year. It also foresees a 65% reduction in emissions from 2022 levels by 2040.