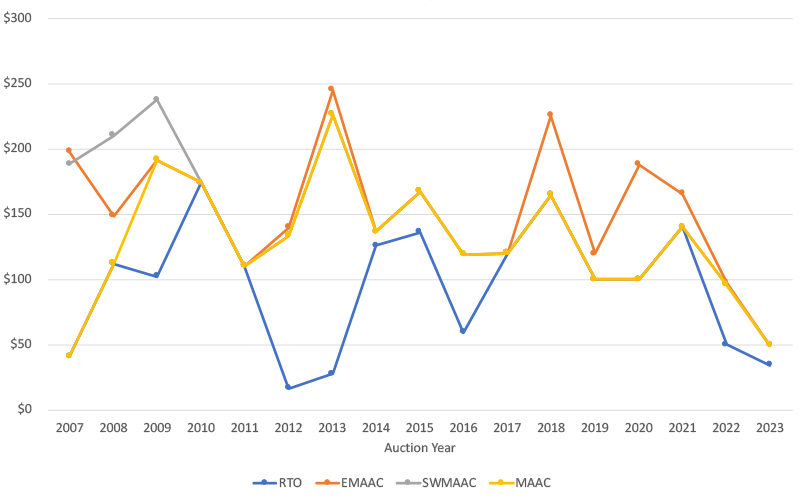

Capacity prices dropped by one-third to almost one-half in PJM’s Base Residual Auction for 2023/24, likely depressed by the effective elimination of the minimum offer price rule (MOPR), a tougher cap on generator prices and robust forward energy prices, which reduced revenue pressures on generators.

|

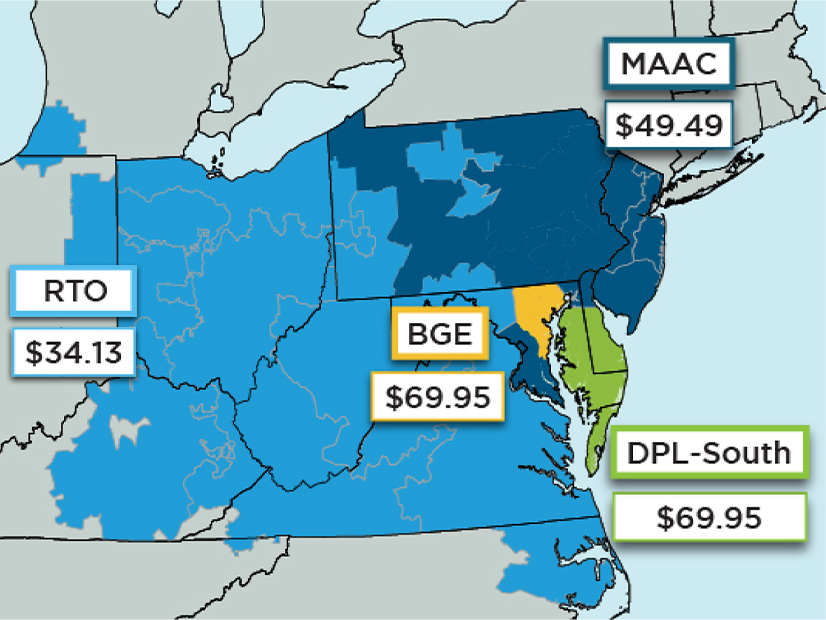

Prices in most of the MAAC region (Atlantic City Electric, Jersey Central Power & Light, Met-Ed, PECO Energy, Penelec, Pepco, PPL, Public Service Electric and Gas, PPL, Rockland Electric and Delmarva Power’s northern territory) dropped to $49.49/MW-day, a nearly 50% drop, while those in rest-of-RTO fell to $34.13, a nearly one-third reduction.

Two transmission zones within MAAC, Baltimore Gas and Electric and Delmarva Power’s south separated at prices of $69.95, which PJM attributed to transmission limitations.

PJM procured 144,871 MW of resources for the year beginning June 1, 2023. Including the fixed resource requirement (FRR) obligation of 31,346 MW, the RTO will have a 20.3% reserve margin, well above its 14.8% requirement.

PJM’s total capacity bill for the year is $2.2 billion, down from about $4 billion for the 2022/23 delivery year. It was the second year in a row that capacity prices have fallen, following last year’s sharp drop. (See Capacity Prices Drop Sharply in PJM Auction.)

“I did not see anything in this auction that was, ‘Wow. I didn’t expect that to happen!’” PJM Senior Vice President of Market Services Stu Bresler said at press conference to announce the results Tuesday. “I think the prevailing wisdom out there was that we were going to see lower clearing prices in this auction than we had in the last auction … given some of the rule changes; given some of the external things that have occurred in various states in PJM. I just don’t think any of us were really surprised by many of the results.”

Nuclear Resurgence, New Gas and Solar

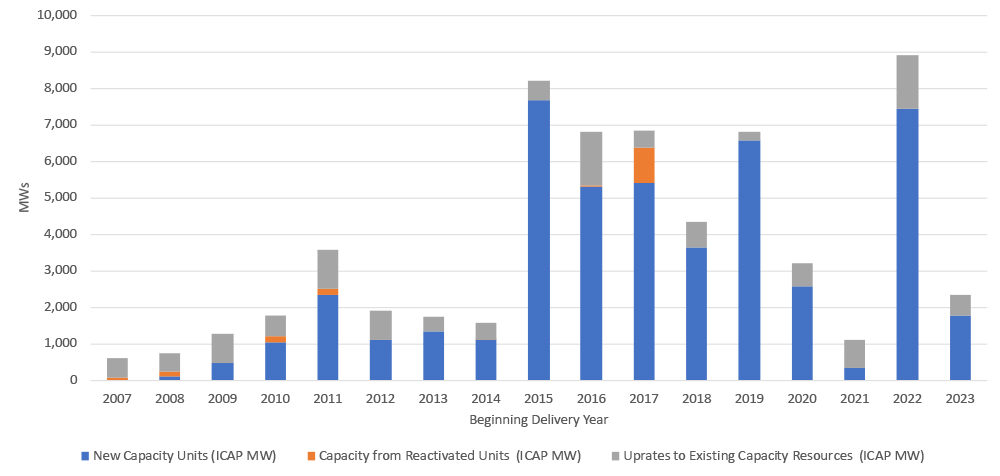

Nuclear plants were big winners in the auction, clearing an additional 5,315 MW than last year.

Solar resources increased 25% to 1,868 MW, while wind resources cleared only 1,294 MW, a reduction of 434 MW, as fewer resources participated.

|

Natural gas resources cleared an additional 1,685 MW, with more efficient combined cycle units boosting their share by 3,627 MW and less efficient combustion turbines falling 1,012 MW. Combined cycle units cleared a total of 48,030 MW in the auction, and CT units cleared 19,080 MW.

Cleared capacity of steam units (primarily coal) dropped by 7,186 MW to 27,682 MW, reflecting a decrease of 7,813 MW offered into the auction because of plant retirements.

Energy efficiency resources jumped 660 MW to 5,471 MW, while demand response dropped 716 MW to 8,096 MW.

Hydro dropped from 4,157 MW to 3,677 MW.

New Variables

Bresler noted several rule and timing changes that may have impacted the results.

It was the first auction using the less restrictive MOPR, which was applied to only seven resources totaling 76 MW that had failed to file for exemptions in time.

The auction also used a lower unit-specific market seller offer cap to counter market power and a historical, rather than a forward-looking, energy and ancillary services revenue offset.

“I think the prevailing wisdom is that the impact of this implementation of the very narrow, less restrictive minimum offer price rule could have had a downward impact on prices in this auction,” Bresler said.

The replacement of the net cost of new entry-based offer cap with a unit-specific cap based on net avoidable costs “could have served to reduce the offer prices that some resources would have offered into this auction,” he added. “However, in both of these cases … it’s extremely difficult, if not impossible, for PJM to say what resources would have offered if they hadn’t offered what they did. It would be purely speculative. So we don’t know the magnitude of any impacts.”

Also new was the application of the effective load-carrying capability method for determining the capacity value of wind, solar and storage resources.

“It could result in a lower capacity value for certain resources,” he said, suggesting it might have impacted the reduction in wind generation offerings.

Futures Prices

Bresler said spark spreads and dark spreads — respectively, the difference between the wholesale market price of electricity and its cost of production using natural gas and coal — have increased, especially in the forward markets. “You would expect, if market sellers are anticipating higher net revenues in the energy market, that they will be able to offer less into the capacity market,” he said.

Timing

Bresler said the reduction in demand response could have been a result of the shortened auction timeline.

The 2023/24 auction was originally scheduled for May 2020 but was delayed while FERC considered approval of new market rules, leaving only a one-year lead time to the delivery year instead of the usual three.

“Most of the time we’re [three] years in advance; even the last auction was more than a year in advance of the delivery year, which gives curtailment service providers the opportunity to offer planned demand response that they can then … go out and sort of sell to customers.”

The next BRA, for the 2024/25 delivery year, will be held in December to return to a three-year-forward basis.