SPP’s Board of Directors approved stakeholders’ recommendation to issue a notification to construct a 345-kV double-circuit transmission project in New Mexico.

Members Approve SPS Tx Project over Staff’s Recommendation

SPP’s Board of Directors last week approved stakeholders’ recommendation to issue a notification to construct for a 345-kV double-circuit transmission project in eastern New Mexico.

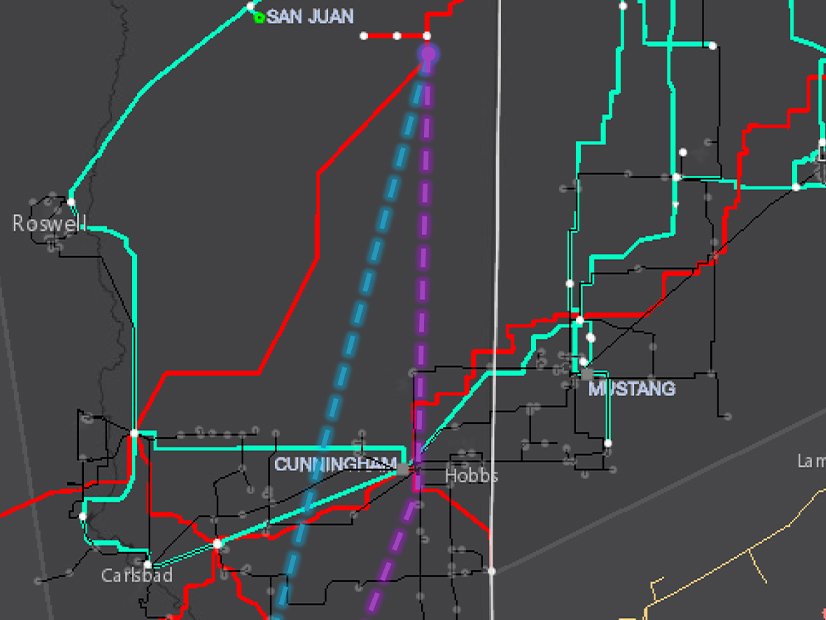

The Crossroads-Hobbs-Roadrunner project, proposed by Southwestern Public Service as an alternative to a previously identified project in the 2021 Integrated Transmission Plan, was recommended by two stakeholder groups following its re-evaluation after load-projection errors were discovered in the original solution.

At $395 million, Crossroads-Hobbs-Roadrunner is $15 million cheaper than the original Crossroads-Phantom project and offers SPS operational flexibility. It solves reliability concerns in a load pocket in the state’s petroleum-rich Permian Basin region and could lead to additional renewable development there. The line, about 150 miles long, runs from Crossroads to Roadrunner. SPS, the incumbent transmission owner, added a substation in Hobbs that SPP staff said gives more access to operating reserves in the load pocket.

The line also saves about $6 million by eliminating four EHV crossings that the original line, recommended by staff, would cross.

The Markets and Operations Policy Committee found both projects address the area’s reliability needs and economic congestion and endorsed both as potential solutions during its meeting earlier in July. But it pointed out that Crossroads-Hobbs-Roadrunner provides better net benefits over its 40-year life of between $2.8 billion to $3 billion, and that could increase to between $3.1 billion and $3.2 billion once the area’s residual congestion is mitigated. (See “MOPC Keeps SPS’ Tx Alternatives Alive,” SPP Markets and Operations Policy Committee Briefs: July 11-12, 2022.)

“We see a lot of benefits from routing line through Hobbs,” SPS’ Jarred Cooley said during the July 26 board meeting. “It’s in the high-growth load in New Mexico; generation is located in close proximity; and it gives a path to the southern part of our territory. Lingering congestion issues … [are] something that can be further investigated in future studies. We see Hobbs as more reliable … with the ability to adapt to more load growth.”

Staff recommended Crossroads-Phantom during the ITP study, saying it solved the majority of load and voltage issues at the Phantom substations. However, it agreed Crossroads-Hobbs-Roadrunner creates more flexibility for other interconnections.

“These projects are very similar. We can’t give a real strong preference to either project,” said Antoine Lucas, SPP’s vice president of engineering. “It depends on what happens next. We know there are potential new loads looking to interconnect to the southern end of the SPS system, but at this stage, those things are speculative. They don’t meet the level of certainty in our normal ITP processes.”

The Members Committee’s advisory vote passed unanimously with five abstentions: American Clean Power, Dogwood Energy, Golden Spread Electric Cooperative, Liberty Utilities and Oklahoma Municipal Power Authority (OMPA).

“I can’t help but wonder about the direction we’re going,” OMPA General Manager Dave Osburn said. “We have a load pocket that needs transmission because of a lack of generation. How long can we build out transmission with other regions paying for it without getting new generation built? It seems like we’re fixing a problem we could fix locally.”

Staff will now assess both upgrades to determine whether either qualifies as a competitive project. If they don’t, SPS will be awarded the NTC.

“There’s a good chance both could be competitive,” SPP General Counsel Paul Suskie said.

NextEra Energy Resources’ Matt Pawlowski pointed out that recent competitive projects have shown cost savings of 30 to 50% in the initial phase. Board Chair Larry Altenbaumer agreed, saying that it is an issue that haunts him.

“At the end of the day, the real determinant over which is the better project will be the competitive proposals that come forward with actual costs,” Altenbaumer said. “Those differences in [benefit-to-cost] ratios are the noise range. What we’ve seen historically is that competitive projects seem to bring improvements in actual costs to the table than what are frequently determine in planning estimates.”

Summer of ’22 ‘Wild One’

Calling this summer a “wild one,” CEO Barbara Sugg detailed for the board and stakeholders just how wild it’s been during her quarterly CEO’s report.

SPP has set six new records for peak demand this month, with the latest — 53.2 GW on July 19 — being a 4.23% increase over the previous mark of 51.04 GW set last year, she said.

Sugg said the RTO has sold more generation over the first six months of the year than ever before. The grid has recorded all-time highs for five of those months. Staff said load assumptions for the rest of year could result in a $6.8 million over-recovery that will be used to reduce next year’s recovery.

Sugg said the RTO has issued six resource advisories and one call for conservative operations in its 14-state balancing authority in the Eastern Interconnection. She noted that the grid operator’s footprint has spent 21 days under a resource advisory, nine under conservative operations, since May 1.

Make that 22 days under a resource advisory. Following the board meeting, SPP issued its seventh such advisory of the summer for July 27.

“Summer is far from over,” Sugg said. “Hot summers are becoming more of a regular thing.”

Sugg also welcomed the RTO’s three newest members: Oklahoma’s People’s Electric Cooperative, Colorado’s United Power, and the National Resources Defense Council. They raise SPP’s membership count to 113.

Search on for 2 Board Directors

The Corporate Governance Committee will bring nominations for two board vacancies to October’s meeting. SPP already has one opening for a director’s seat with Julian Brix’s retirement; a second will open up at year-end when Mark Crisson’s term expires and he retires.

The board will lose longtime members Altenbaumer and Joshua W. Martin III in December 2023, when both will retire. They have 34 years of experience between them, with Martin serving 18 and Altenbaumer 16.

The bylaws limit SPP to nine independent directors, but Sugg said the CGC could bring two recommendations for the vacancies in October because of the expected steep learning curve.

“The search is highly focused on the competencies we’ll be losing,” she said of Altenbaumer’s and Martin’s experience.

Western RC Calls 2 EEAs for EPE

SPP had to twice place El Paso Electric (EPE) under energy emergency alert (EEA) status in June when two of the utility’s 345-kV transmission lines tripped offline within a week of each other.

Senior Vice President of Operations Bruce Rew told the board and stakeholders that EPE was pleased that SPP, the reliability coordinator for it and 14 other utilities in the Western Interconnection, was “able to respond and get through it.”

“We were able to provide assistance over [a] DC tie,“ Rew said. “It was only 200 MW, but when you’re short or really close, 200 MW is 200 MW.”

Early in the morning on June 10, the West Mesa-Arroyo line in Eastern New Mexico tripped, causing a derate on EPE’s import capability because of the risk of overloading an underlying 115-kV line. When the utility said it had concerns about meeting its contingency reserve obligation later that afternoon, SPP West RC placed the EPE balancing authority in a Level 1 EEA while working to determine projected system conditions.

At 2:42 p.m. CT, SPP raised the EEA to Level 2 because it and EPE agreed interruptible demand was necessary to compensate for the lack of local generation and its import capability given the load forecast. The EEA was called off when load dropped off that night.

At 6:50 p.m. June 16, the Luna-Diablo line out of El Paso into New Mexico tripped offline, causing a derate for the same reasons as the June 10 event. The RC placed EPE in EEA 1 over concerns it could not cover its most severe single contingency and then an EEA 2 because of the use again of interruptible loads. The event ended at 8:36 p.m. when load dropped and additional generation was supplied over the Artesia DC tie.

SPP’s Western Energy Imbalance Service (WEIS) market is also active in the Western Interconnection, balancing generation and load in real time for eight participants. That will grow to 12 when Colorado Springs Utilities joins Aug. 1 and Black Hills Energy, Platte River Power Authority and Xcel Energy-Colorado join next April, Rew said.

“It’s encouraging to see the continued growth of SPP’s energy services in the west,” Rew said in a press release issued Monday. “Organized markets save utilities and their customers money, make the delivery of electricity to customers more reliable, and help utilities and states achieve clean energy goals.”

“Participation in the [WEIS] is a significant step in our pursuit of clean energy goals and sends a strong signal that we’re doing everything possible to secure a reliable electric grid and reduce energy-related costs for our customers,” CSU CEO Aram Benyamin said.

The RTO’s Integrated Marketplace lost a couple of financial-only participants during the second quarter, leaving 184 in that category, Rew said. SPP’s markets have 103 asset-owning participants and 287 overall. They’ve been drawn by the markets’ bountiful wind resources, which have grown from 24 GW of installed capacity two years ago to 31.85 GW in 2022.

Board Approves DC Tie Solution

The board’s consent agenda included a congestion-hedging solution for three DC ties that will connect the SPP’s Eastern and Western interconnection footprints. The DC ties are owned by members of SPP’s Western Energy Imbalance Service market, providing up to 510 MW of capacity for RTO operations.

The measure was previously endorsed by the Regional State Committee on July 25. (See related story, SPP Regional State Committee Briefs: July 25, 2022.)

By passing the consent agenda, the board also approved:

- bylaw revisions that clarify RSC membership is only available to regulatory agencies in states within SPP’s footprint that receive RTO services;

- filling vacancies on the Strategic Planning Committee (Matt Caves, Western Farmers Electric Cooperative) and Human Resources Committee (Matt Dills, ITC Great Plains);

- creating a third withdrawal deposit category to allow certain non-load-serving entities to terminate their membership without providing a withdrawal deposit;

- forming the 18-person industry expert pool that will evaluate competitive transmission proposals in 2022;

- sponsored upgrades studies for NextEra of terminal equipment on two 161-kV lines near Warrensburg, Mo.; Invenergy’s proposal to build a 345-kV line between two substations in West Texas and its upgrade of two 345/230-kV transformers in South Dakota to a 581-MVA rating; and Oklahoma Gas & Electric’s reconductoring of a 69-kV transmission line to increase their normal and emergency ratings of the lines while replacing aging assets;

- a revision request (RR452) adding a standardized process for evaluating projects proposed by transmission owners for reasons other than meeting SPP regional criteria or a limited subset of local planning criteria evaluated in the planning process;

- the 2023 operating plan that describes SPP’s high-level objectives and initiatives for next year (strategic opportunities, implementing FERC orders 881 and 2222, addressing two major FERC proposals related to transmission-planning processes, and responding to the 2021 winter weather event) and serves as the foundation for the annual budget process; and

- removing the suspension earlier this year of an NTC, originally awarded in 2018 to Nebraska Public Power District, for a 115-kV project valued at $53.8 million.