NYISO last week presented the Installed Capacity/Market Issues Working Group (ICAP/MIWG) with the anticipated schedules for its Installed Capacity market, energy market and new resource integration projects for this year.

The ISO plans to return to stakeholders each quarter to share status updates on each project. (See “Four Projects in 2023 Budget from Consumer Impacts Analysis,” NYISO Details 2023 Budget & Compensation Updates.)

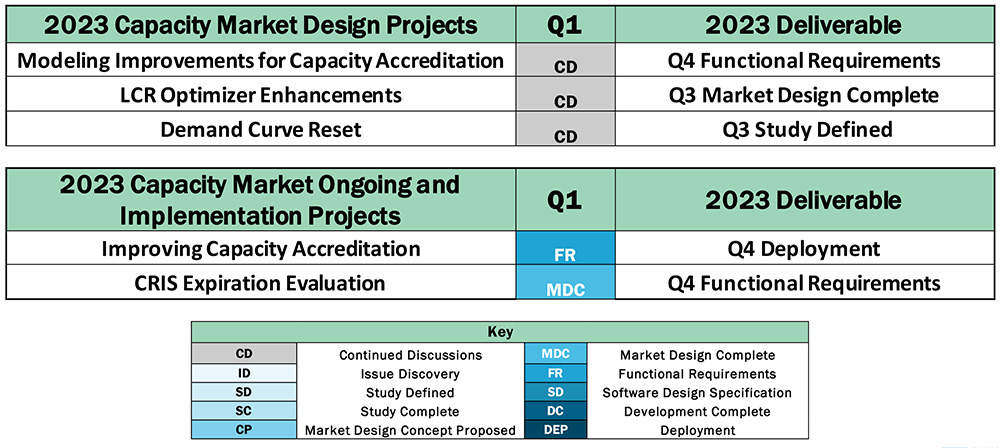

Maddy Mohrman, NYISO capacity market design specialist, overviewed the capacity market design projects, including their anticipated first-quarter schedules and deliverables for this year.

The first project is modeling improvements for capacity accreditation, necessitated after NYISO discovered limitations within its resource adequacy analysis software, GE MARS.

NYISO will work with stakeholders and the New York State Reliability Council to improve the software by the fourth quarter. The updates should enable more accurate calculations for resource adequacy requirements, capacity accreditation factors and capacity accreditation resource classes.

The ISO will also work to improve the methodology for its LCR Optimizer software, which establishes the locational minimum installed capacity requirements (LCRs). It will spend the first quarter investigating the need for and developing any necessary enhancements to the software to improve the stability and transparency of LCRs, with an anticipated completion in the third quarter.

Another project relates to the 2025-2029 demand curve reset (DCR), a comprehensive review to determine the necessary assumptions for developing the ICAP demand curve. The project will be ongoing until 2025, but NYISO plans to post the DCR schedule in the first quarter of this year, select an independent consultant to conduct the study during the second quarter, and spend the rest of the year defining the inputs and methodology for the study.

Other software updates are needed to implement NYISO’s new capacity accreditation procedures and capacity resource interconnection service (CRIS) expiration rules.

NYISO has begun making the updates for capacity accreditation but anticipates they won’t be deployed until the fourth quarter and only become operational in 2024. It expects the upgrades for CRIS to be finished by the fourth quarter. (See NYISO Capacity Accreditation Implementation Worries Stakeholders and NYISO Finalizes CRIS Tariff Revisions.)

Energy Market Projects

Amanda Myott, NYISO energy market design specialist, detailed the energy market projects, including a project to rethink how to balance system needs as more intermittent renewables, energy storage resources (ESRs) and distributed energy resources come online.

The ISO anticipates proposing a market design concept by the end of the year based on previous studies of grid characteristics, resource attributes and new market products necessary to reliably maintain system balance.

Another project includes developing potential software and market rules that would enable NYISO to dynamically schedule reserves or procurements, which would better align market outcomes with system conditions by determining reserve requirements within a given region (See Study: NYISO Dynamic Reserves Could Lower Congestion, Costs.)

NYISO will spend the first quarter overviewing the project plan, looking through scheduling and pricing examples in the day-ahead-market and examining if updates are required to the posting of reserve requirements. It anticipates completing the market design by the third quarter.

Another project centers on creating more transparency around emissions data, which the ISO believes will help end users and other market participants optimize their electricity usage. It expects to finish the necessary functional requirements and start publishing emissions rate data by the end of the year.

Mark Younger, president of Hudson Energy Economics, asked if this effort would be impacted by the cap-and-invest program proposed by New York Gov. Kathy Hochul, but NYISO said the project was an independent initiative. (See Hochul Highlights Cap and Invest in State of the State Address.)

William Acker, executive direct of the New York Battery and Energy Storage Technology Consortium, said that there’s a strong need for the project because it will help New York City buildings comply with Local Law 97 by better understanding how they can shift their energy consumption based on their emissions profile. (See NYC Proposes Rules to Implement Building Emissions Law.)

NYISO’s energy market team will also work to enhance the software for internal bilateral transactions, which currently does not enable ESRs to be a sink.

Stakeholders had indicated this project as a priority as the demand for ESRs to use bilateral transactions to contract output from specific resources has increased. The ISO expects software design specifications to be completed by the end of the year.

NYISO will also conduct a fuel and energy security study, which stems from a recognition that New York’s fuel supply mix is rapidly evolving and extreme weather events have become increasingly disruptive. This study is expected to be completed by the fourth quarter and will be a refresh from a similar 2019 security study, which examined future reliability standards, resource mix and load patterns, and resource requirements.

Chris Wentlent, of the Municipal Electric Utilities Association of New York State, asked if the study would be New York-specific or also investigate neighboring grid operators, including in Canada.

Myott replied that NYISO is considering including their neighbors in the study.

The last planned energy market project focuses on creating an operating protocol for the Long Mountain phase angle regulator (PAR) installation, a planned 345-kV intertie between NYISO and ISO-NE. The plan is to complete and vote on a joint operating agreement by the end of this year, though if discussions with ISO-NE extend beyond the third quarter, the project could be delayed.

An ongoing project relates to updating software to implement constraint-specific transmission shortage pricing, which would help NYISO to alleviate short-term constraints by dispatching suppliers more efficiently. The ISO plans to deploy these updates in October, after the relevant DER updates are finalized, and will file the previously approved project modifications with FERC in the first half of the year.

New Resource Integration Projects

Finally, Harris Eisenhardt, NYISO market design specialist, presented an overview for the new resource integration projects.

While waiting for a final ruling from FERC on its Order 2222 compliance, the ISO has worked in other ways to integrate DERs. (See NYISO Justifies Unpopular 10-kW DER Aggregation Min. Requirement.)

By the end of this year, NYISO anticipates delivering a market design concept that will enable its DER participation model to be fully compliant with FERC Order 2222 requirements by incorporating any additional market features that were not included in the deployment scope.

Howard Fromer, who represents the Bayonne Energy Center, sought confirmation that FERC approved NYISO’s request to extend the deadline for DER deployment until 2026, which Eisenhardt confirmed, saying the ISO would spend the next three years scoping out the DER software, getting the market design finished and building out the deployment plan.

Another project that concerns the demand side to identify new ways that demand response and DER programs can be improved to increase consumer engagement in NYISO’s markets. The ISO believes that improving demand-side programs will enable consumers to assume greater control of their energy use and push New York toward zero emissions by better balancing increasing penetration of intermittent generation.

The ISO anticipates presenting a final report, which summarizes both external and internal stakeholder feedback and identifies gaps in existing programs, in the fourth quarter.

James W. Brew, principal at Stone Mattheis Xenopoulos & Brew, and Kevin Lang, partner at Couch White, both emphasized the importance of NYISO soliciting feedback from experienced individuals and talking directly with end-use consumers.

Finally, Eisenhardt discussed the project to assess whether storage resources can be considered transmission assets.

NYISO expects to share its findings during the fourth quarter, spending the earlier part of the year reviewing how other grid operators treat storage resources and discussing operating rules for market participation.