ISO-NE touted its role in New England’s clean energy transition on Tuesday as it announced the finalized results of Forward Capacity Auction 17, for the 2026-2027 procurement period.

Non-emitting generators secured nearly a quarter of the auction’s total obligations, the RTO said.

“The 7,620 MW of obligations secured by these resources represents an 11% increase over the 6,844 MW of obligations secured by non-carbon-emitting resources in the 12th Forward Capacity Auction, held in 2018,” the grid operator said in a press release.

Solar and wind generation accounted for 3.5% of all obligations in FCA 17, and battery storage accounted for another 3.5%.

In that vein, the auction may also signal that an end to the use of coal for generation in New England is near: The region’s last remaining coal-fired plant, Merrimack Station in Bow, N.H., submitted a dynamic delist bid and did not win a capacity supply obligation.

In its detailed explanation of the auction, the grid operator said that its reviews of delist bids, including three permanent ones totaling 12.5 MW and two retirements worth 7.8 MW, did “not show the need to retain for reliability any resources”; all of the bids were therefore accepted.

Among the significant delist bids were two oil units at the Middletown plant in Connecticut and the Millennium gas plant in Massachusetts.

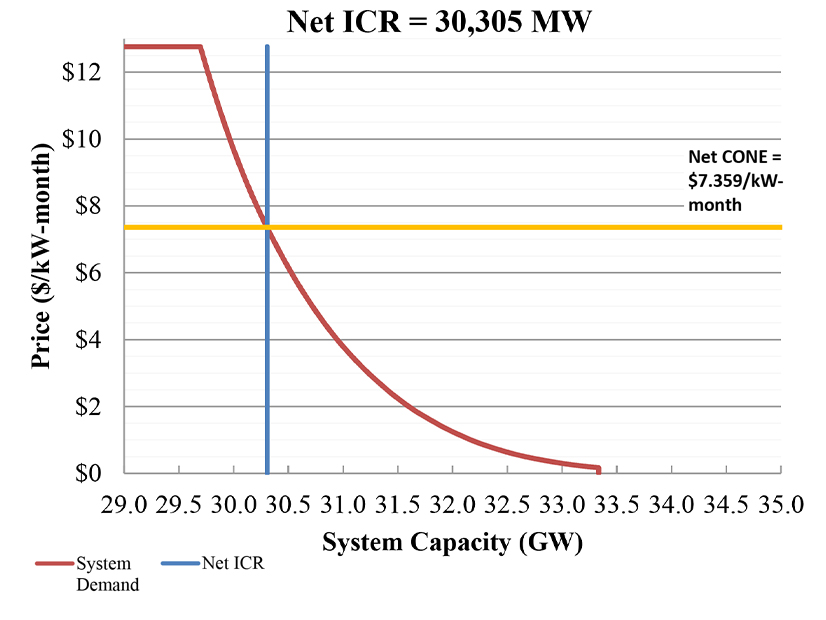

ISO-NE also confirmed that the clearing prices it listed in its initial announcement were accurate: $2.59/kW-month in all zones and import interfaces except for the New Brunswick interface, which cleared at $2.551.