MARLBOROUGH, Mass. — ISO-NE is targeting March 2025 for the launch of its Day-Ahead Ancillary Services Initiative (DASI) and predicting that its increased energy market costs will be offset by capacity market savings.

ISO-NE analyst Ben Ewing and economist Andrew Withers presented the RTO’s analysis of DASI’s impact to the Markets Committee on May 9.

DASI’s revised market design is intended to procure and price the ancillary services needed for a reliable next‐day operating plan with increasing renewable penetration.

DASI will cover any gaps when the day‐ahead market’s physical energy supply awards are below the RTO’s forecast real‐time load. It also will procure day-ahead flexible response services to ensure the system can recover from sudden generation losses and respond quickly to fluctuations in net load. (See ISO-NE Outlines More of Plans for Capacity Accreditation, DA Ancillary Services.)

“With DASI, these reliability requirements will be satisfied within the clearing of the day-ahead market (DAM),” the RTO said.

Ewing said the RTO had been considering a launch between December 2024 and March 31, 2025, but settled on March 1 because of stakeholders’ desire to gain experience with the design before the winter, which has a higher potential for stressed conditions. If the deadline is met, the final procurement period for the Forward Reserve Market (FRM) will be Oct. 1, 2024 to Feb. 28, 2025.

Stakeholder votes on the proposal are expected in July and August.

Impact Assessment

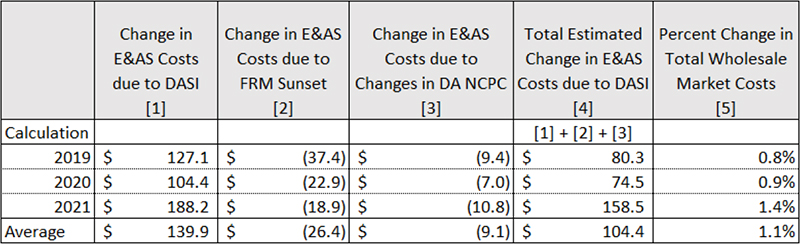

Withers said DASI is estimated to increase energy and ancillary services (E&AS) costs by $100 million (1.1%) annually, with a commensurate reduction in capacity costs.

The elimination of 10-minute non-spinning reserve (TMNSR) and 30-minute operating reserve (TMOR) credits with the FRM sunset is expected to reduce E&AS costs and revenues.

Eliminating the FRM’s failure to reserve and failure to activate penalties will increase E&AS costs and revenues. The RTO’s analysis did not quantify potential changes to real-time (RT) costs, which are expected to be small relative to the change in FRM payments and would be difficult to estimate.

Based on an analysis of 2019-2021 data, ISO-NE expects energy and ancillary services costs to increase by about $100 million (1.1%) annually from the Day-Ahead Ancillary Services Initiative (DASI). The RTO expects the increase to be largely offset by reduced capacity costs. | ISO-NE

Based on an analysis of 2019-2021 data, ISO-NE expects energy and ancillary services costs to increase by about $100 million (1.1%) annually from the Day-Ahead Ancillary Services Initiative (DASI). The RTO expects the increase to be largely offset by reduced capacity costs. | ISO-NE

For the 2019–2021 study period used by the RTO, eliminating the FRM is expected to reduce E&AS costs by $26.4 million annually.

Under DASI, suppliers of DA energy and ancillary services will receive payments for a new DAM constraint, the forecast energy requirement (FER) and new DAM products: energy imbalance reserve and flexible response services (FRS), including day-ahead 10-minute spinning reserve, day-ahead 10-minute non-spinning reserve and day-ahead 30-minute operating reserve.

The RTO projects will reduce DA net commitment period compensation (NCPC) uplift payments by $9.1 million (74%), to between $2.6 million and $3.7 million annually.

ISO-NE expects to consider changes to NCPC rules from DASI next year. “These rules have not yet been assessed or designed,” the RTO said.

Capacity Costs

Withers said the RTO expects the $100 million E&AS increase to be “roughly” offset by reduced capacity costs in the long run, reflecting the reduced “missing money” that resources need to recover.

“In the short run, however, predicting changes to capacity costs is more difficult,” the RTO said.

The RTO also said that the effects of DASI on E&AS revenues would vary based on resource types, which could impact which resources are impacted by capacity clearing prices, as well as lead to changes in net cost of new entry.

Tariff Changes

The proposed tariff changes borrow from those in the Energy Security Improvements (ESI) proposal in 2020. FERC rejected the ESI proposal in October 2020, saying it would add substantial costs “without meaningfully improving fuel security” (ER20-1567). (See FERC Rejects ESI Proposal from ISO-NE.)

The RTO said the new DASI mitigation rules included in the tariff changes “reflect the most significant tariff redline additions to those introduced with ESI.”

These included updates to day-ahead ancillary services (DA A/S) offer requirements, format and strike price determination, and FRS and FER constraint demand quantity specifications.

Mitigation

Parviz Alivand, senior economist for ISO-NE, presented on mitigation enhancements proposed by the RTO, noting that “closeout and certain avoidable input costs associated with DA A/S are not explicitly addressed by current tariff provisions.”

The RTO is looking for stakeholder feedback on mitigation-related cost recovery, which it is requesting by May 19. Alivand said the RTO would publish the tariff language for stakeholders before the June meeting of the Markets Committee.

The FERC filing process for recovery of losses would remain unchanged.

Alivand said ISO-NE opposes mandating that participants net real-time market profits against DA A/S losses.

“A participant that expects to make a cost recovery claim related to DA A/S mitigation would have incentive to raise its RT offers to show smaller RT profits,” Alivand said.

The RTO did not rule out netting profits and losses between different DA energy and DA A/S products, saying that this should be reviewed on a case-by-case basis.

“It is possible that DA A/S mitigation increases the DA energy profits, suggesting netting is appropriate, or that DA A/S mitigation decreases, or does not change the DA energy profits, suggesting netting is not appropriate,” Alivand said.

IMM Analysis

Economist Michael Redlinger and supervisor Jacob Grindal of ISO-NE’s Internal Market Monitor presented their analysis of the DASI mitigation design, saying the Monitor supports the conduct and impact framework for mitigation proposed by the RTO.

“The proposed conduct and impact approach is intended to balance the risks of under-mitigation and over-mitigation,” Redlinger said. “The conduct and impact test thresholds appear reasonable, but it will be important to monitor the appropriateness of the thresholds over time and make adjustments if necessary.”

Consultation will be a key aspect in aligning the expected costs of participants and the IMM reference level and the conduct thresholds. To update reference levels for a market participant, the participant would need to provide the Monitor with detailed cost data backing up the change.

Redlinger also stressed the importance of consultation between generators and the IMM over justifications for physical withholding. He said that detailed consultation could help prevent — but not preclude — a participant from being referred for withholding.

Next Steps

The Markets Committee will consider any design changes to the RTO’s proposal at its meeting in June.

The RTO hopes to have a Markets Committee vote on its proposal and any proposed stakeholder amendments in July, with a Participants Committee vote in August.