The Natural Resources Defense Council finds that PJM’s backlogged interconnection is challenging states' renewable portfolio goals; PJM is committed to continuing to improve.

The Natural Resources Defense Council released a study Thursday finding that the pace of resources clearing PJM’s backlogged interconnection will challenge the ability for states to meet their renewable portfolio standards.

“States throughout PJM set ambitious RPS goals to cut emissions, lower costs and boost reliability, but years of delays at PJM threaten to derail these plans,” Dana Ammann, policy analyst at NRDC and the study’s lead author, said in an announcement of the report. “PJM needs to work with the states to reach their renewable goals and do its part to build the clean grid we need. Without changes, PJM will likely fall short of state renewable targets.”

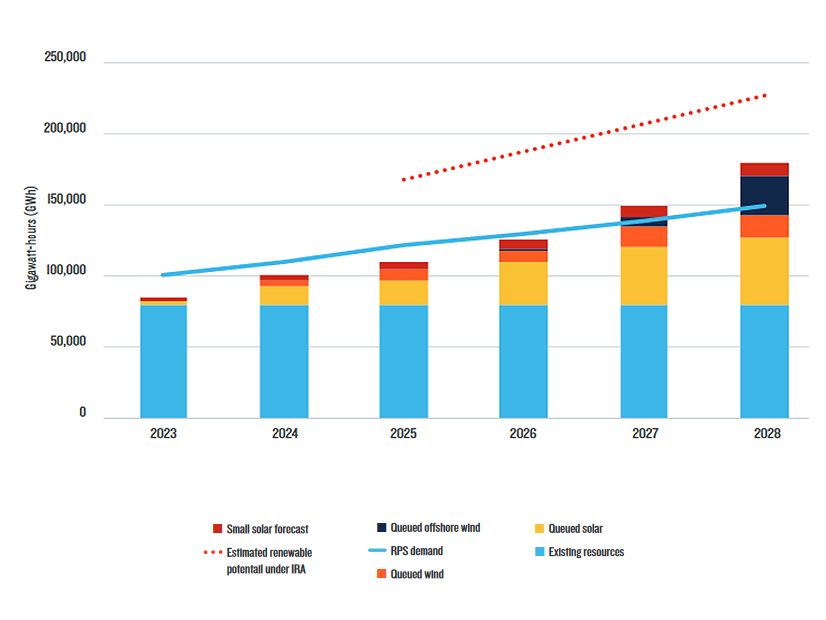

Drawing off PJM estimates of the number of projects that will clear the queue and enter development, the report projects that aggregate RPS goals for states within the PJM footprint will overshoot available renewable supply between 2023 and 2026, while individual states could struggle to procure enough clean energy to meet their goals even longer. Ammann said the study considers only existing RPS and policies; future legislation or regulations could further limit states’ ability to meet their goals.

“There is little doubt that RPS targets and broader policy goals will be constrained by the speed and efficiency of the interconnection queue,” the report states.

PJM spokesperson Jeff Shields said an overhaul of the way new projects are studied will be implemented this summer to speed projects through the queue faster, and that the RTO is committed to continuing to work with stakeholders to identify ways to continue to improve the process. (See FERC Approves PJM Plan to Speed Interconnection Queue.)

“PJM advanced landmark reforms to speed the interconnection queue that were overwhelmingly approved by PJM stakeholders and the Federal Energy Regulatory Commission. These reforms will begin this summer, and by 2026 we expect to study the interconnection of more than 200,000 MW of mostly renewable resources,” he said. “Currently there are 44,000 MW of mostly renewable generation resources that have cleared the PJM study process but have yet to be built due to factors unrelated to PJM, including supply chain and siting.”

NRDC Senior Advocate Tom Rutigliano said PJM needs to take action in the short term to allow resources to enter development. Easing the ability for generation owners to transfer their capacity interconnection rights from deactivating fossil fuel resources to new renewable generators, a move discussed during last week’s Planning Committee, is one change that could expedite development. In the long term, he said, a new approach to planning transmission upgrades to support state goals and new developments is needed.

The State Agreement Approach presents one avenue for states to skirt the queue to push through projects to meet their RPS goals, Ammann said, citing New Jersey’s 7,500 MW of approved offshore wind projects. The report also states that New Jersey has been leading the way in developing small-scale resources that can bypass PJM’s queue.

“Growth in small-scale solar (i.e., distributed solar) is especially important for meeting RPS in states with strong solar incentives. For example, in New Jersey, existing small-scale solar projects and forecasted distributed solar growth represents 69 to 85% of total annual solar energy available in the state from 2023 to 2030,” the report states.

Though distributed energy resources are not subject to RTO interconnection queues, the report notes they do go through utilities’ interconnection processes, which can vary in their bandwidth for clearing projects. It points to Xcel Energy, which has more than 300 projects awaiting approval, and cited an analysis finding it would take 260 years for Xcel to clear its queue at its current pace.

“Utilities have been generally slow to keep up with demand and upgrade the distribution network to accommodate distributed resources,” the report says.

The states with the toughest road ahead could be those requiring that their clean energy targets be met with resources sited in-state, such as the Illinois Climate and Equitable Jobs Act (CEJA). The report states that the legislation will both limit Illinois’ ability to procure renewable energy credits (RECs) from out-of-state resources and tighten the REC supply for neighboring states.

“As the supply and market for RECs tighten, CEJA may create tension between resources used for Illinois’ future targets and those used to meet regional demand,” the report states.

In addition to limiting how quickly projects can be built, the report states that the long timeline for new projects can limit their ability to take advantage of existing incentives, which may no longer be available when projects are ready to be built, increasing investor uncertainty and leading to rising costs. It cites a Lawrence Berkeley National Laboratory study finding that costs for projects in the interconnection queue have been rising. Rutigliano said projects submitted after Oct. 1, 2021, are unlikely to be studied until 2026. (See Berkeley Study Finds Rising PJM Interconnection Costs.)

“These factors may lead to much needed new renewable generation being delayed, not developed at all or unable to take advantage of new incentives under the” Inflation Reduction Act, the report states.