MISO executives on Friday told stakeholders that the capacity market still needs fixing, warning that the surplus gained from last week’s auction is fleeting without long-term changes.

Todd Ramey, senior vice president of MISO markets and digital strategy, said that given the current vertical demand curve and enough capacity to go around for this year at least, the auction “predictably produced relatively low prices.” (See related story, 1st MISO Seasonal Auctions Yield Adequate Supply, Low Prices.)

“Anytime we have adequate capacity, prices tend to go lower,” Senior Director of Resource Adequacy Durgesh Manjure said.

Manjure said the dearth of capacity and expensive clearing prices in MISO Midwest last year appears to have influenced offer behavior this year. The results simply buy the grid operator more time to work out improvements to its resource adequacy construct, including applying a downward-sloping demand curve in the auction, he said.

“This year’s outcome is just that: an outcome for this year. The long-term risk, driven by the resource transition, continues,” Manjure warned. “A lot of these changes in capacity appear to be temporary.”

Some stakeholders said the auction outcomes seemed diametrically opposed to NERC’s recently released 2023 Summer Reliability Assessment, which said MISO, among other regions, faces supply shortfall risks during upcoming hot weather. (See related story, NERC Warns of Summer Reliability Risks Across North America.)

“We understand it’s a big difference from last year,” MISO Executive Director of Resource Planning Scott Wright told stakeholders. But he added that even though “there’s good reliability value” to capacity beyond requirements, MISO’s current auction setup is not equipped to put a value on it.

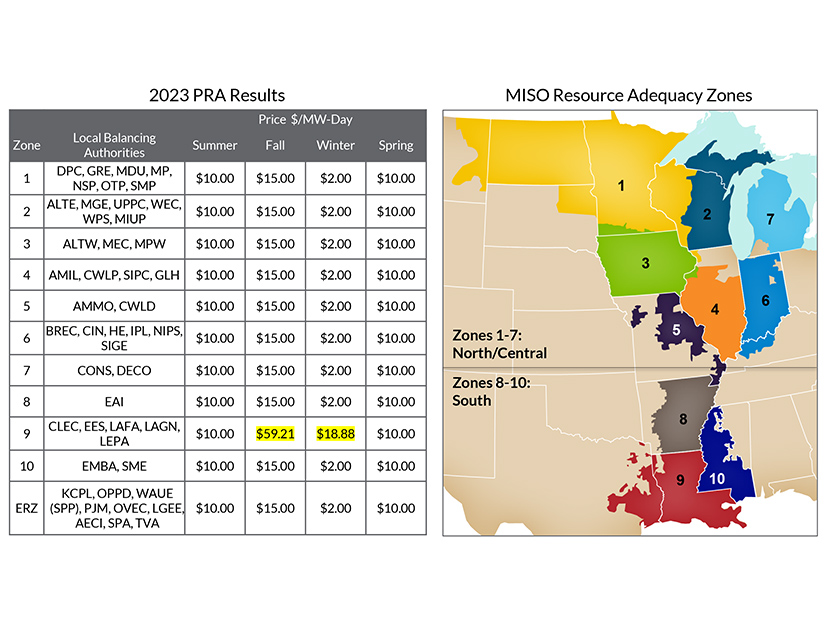

The auction was the first under MISO’s new seasonal construct. Energy consultant Kavita Maini said she was “intrigued” that the highest prices were for the fall.

Manjure said MISO cannot “speculate or pinpoint” what exactly drives market participants to submit higher offers in a particular season, though it can surmise that maintenance outages were a factor.

Bill Booth, consultant to the Mississippi Public Service Commission, said he is interested in learning how accredited capacity values of thermal resource classes changed year over year, given MISO’s new accreditation process. He said the information would be especially helpful in figuring out why Zone 9 had to clear higher-cost generation to meet its supply requirements.

MISO staff promised a breakdown of capacity accreditation changes by fuel type for the summer. They said it would take more time to calculate those differences.

Far from MISO’s view of the auction results not being an indication of what’s to come, Toba Pearlman, senior attorney for the Natural Resources Defense Council, said the clearing prices show that the RTO can maintain reliability while incorporating lower-cost wind, solar, energy storage and demand response to the grid.

“MISO’s auction sent an important signal last year, and the region’s utilities and energy resource providers took steps to meet capacity needs,” she said in an emailed statement. “As new generation is built and other plants retire, NRDC looks forward to working with MISO and other stakeholders to ensure a reliable system. Solutions should increase available capacity, lower costs and enable more clean energy to come online.”

Pearlman said MISO should continue to concentrate on “bedrock” transmission solutions necessary to support capacity expansion.