PJM on Monday released a report detailing a litany of emergency actions taken on Dec. 23 and 24 as a severe winter storm sent temperatures plunging across the region and containing new data on generation and market performance.

The RTO’s analysis of the storm, commonly called Elliott, provides 30 recommended changes to forecasting, modeling, accreditation and market rules. It says that PJM was well positioned in the days leading up to the storm, but a series of unforeseen factors — including a sharper than expected drop in temperatures, an unprecedented amount of forced outages and abnormal consumer behavior around the holiday weekend — led to several emergency actions having to be taken to maintain reliability, including two blocks of performance assessment intervals (PAIs) in which generator underperformance led to $1.8 billion in penalties.

A workshop has been scheduled for July 24 to discuss the report.

“As documented in this report, PJM was prepared for the 2022/2023 winter, as well as Winter Storm Elliott, based on the information available, and conducted extensive preparations and communications with members, adjacent systems and the natural gas industry in advance of the storm, in addition to the regular steps PJM takes each year to prepare for winter,” the report said. “Despite numerous refinements to both the capacity market rules and winter preparation requirements that came out of the 2014 polar vortex, Winter Storm Uri in [February] 2021 and other recent examples of increasingly extreme weather patterns, Winter Storm Elliott created a convergence of circumstances that strained the grid.”

Recommendations

Many of the report’s findings have guided PJM’s recommended changes to the capacity market currently being considered under the Critical Issue Fast Path (CIFP) process, including shifting to a seasonal capacity market, an approach to risk modeling that lays more of the reliability focus on the winter and fuel security requirements. The timing of the report’s release has been viewed as critical by many stakeholders participating in CIFP meetings, with voting on proposals scheduled for next month. (See PJM Completes CIFP Presentation; Stakeholders Present Alternatives.)

The recommendations outside the CIFP process include increasing education and training for members around emergency procedures and reporting requirements; evaluating the expected load reduction that a voltage reduction could yield as load composition changes; and exploring ways of increasing synchronized reserve performance through procurement practices, compensation and the amount procured.

The report also includes several recommendations related to the intersection between the electric and natural gas industry, such as aligning when gas generators are scheduled in PJM’s markets and their fuel nomination cycles, as well as improvements to how they report unit-specific parameters to PJM to improve awareness of their availability. Those proposals are under discussion at the Electric-Gas Coordination Senior Task Force.

The report also states that PJM plans next month to open a stakeholder discussion on whether the reserve market design, including prices and performance incentives, aligns with operational needs.

Generator Performance

The forced outage rate for PJM capacity resources throughout the storm was one of the highest PJM has seen in a severe winter weather event, with 24% of resources being offline — exceeding the 22% forced outage rate seen during the polar vortex. Forced outages peaked at 46 GW at 7 a.m. on Dec. 24 and “remained at an unacceptably high level through Dec. 25.”

Many of the outages were not immediately reported, resulting in the RTO’s operators being told the unit would not be able to operate when they attempted to dispatch the generator.

“While generators are required to provide updates on their operating parameters, including operating status, ramp times and fuel availability, in 92% of generator outages, PJM operators had an hour’s notice or less — in most cases, PJM was informed of outages when dispatchers called generators to request them to turn on,” the report stated.

Gas-fired generators made up about 70% of the outages, with gas supply issues being the single largest cause, followed by freezing and problems with plant equipment.

Natural gas well freeze-offs were a major contributor to generators being offline, with production in Ohio halved and down by about 20% in Pennsylvania, with the impact particularly acute for larger gas generators that require a uniform supply of fuel at high pressure. The timing of the storm falling on a holiday weekend also meant that gas trading markets would not be open for a prolonged period, limiting the liquidity of fuel.

“Many gas buyers, especially [local distribution companies] and other customers with more predictable gas usage levels, purchase their gas supplies on Friday for the Saturday, Sunday and Monday gas days. Gas generators in many cases need to buy their gas supply each day of the weekend period based on their awarded or anticipated dispatch. With the majority of gas traded on Friday, the market for gas commodity can become less liquid, resulting in increased supply scarcity and potentially higher intraday gas prices,” the report said.

Several portions of PJM’s and stakeholders’ CIFP proposals are centered around improving gas reliability by revising their accreditation and creating new fuel requirements. On July 10, PJM presented a proposed dual-fuel status for resources that can start and operate on a backup fuel with at least 48 hours of storage. It also discussed creating additional data reporting around whether gas generators have firm fuel or not and potentially reflecting that in their accreditation.

Coal resources made up about 16% of forced outages, largely because of issues with boilers.

Wind resources overperformed during the storm, contributing 13.7% of the bonus megawatts across the two PAIs, despite only making up 1.9% of installed capacity. Nuclear generators also exceeded their commitments, making up 34.5% of the bonus power while representing 17.7% of capacity.

The gas and coal units that did operate performed well throughout the emergency conditions, providing 29.2% and 17.3% of the bonus power.

Synchronized reserve resources also performed poorly throughout the storm. While the first deployment had a response rate of 86.4%, which PJM attributed in part to the short duration of that event, the average was 47.8% across the five deployments, some of which were hours long. PJM noted that deployments are uncommon, especially clustered in a short time frame.

“Five synchronized reserve events over a two-day period is extremely unusual. All five of the events on Dec. 23 and Dec. 24 exceeded 10 minutes in duration, which is again extraordinary. Since the start of 2021, there have been 47 synchronized reserve events, of which only 17 (36%) were more than 10 minutes in duration, and five of these 17 occurred during Winter Storm Elliott,” the report said.

Demand response resources provided significantly less than curtailment service providers (CSPs) anticipated they could provide when called upon. When PJM dispatched 4,336 MW of DR on Dec. 23, providers estimated they could provide the full amount, but PJM’s analysis of customer load data suggests that only 1.1 GW was delivered. When all available DR was dispatched leading up to the Dec. 24 morning peak, CSPs estimated they could deliver 7,400 MW of the 7,522 dispatched, but PJM said that only 2.4 GW was provided.

“The significant difference between the data provided to PJM about load curtailment capability and the actual performance clearly identify an opportunity and need to improve the rules and processes regarding load management capability estimates,” the report said.

PJM Operations

In the days leading up to the storm, the conditions appeared to be within the norms that PJM had experienced in the past: Temperatures weren’t forecast to be abnormal, and historically loads for the days leading up to Christmas had been overforecast. On the day before the storm’s arrival, PJM increased its load forecast for Dec. 23 from 124.6 GW to 127 GW and procured additional capacity and reserves above what was cleared in the day-ahead market. Actual loads came in at 136 GW and were nearly 10 GW above forecast the following day at 131.1 GW.

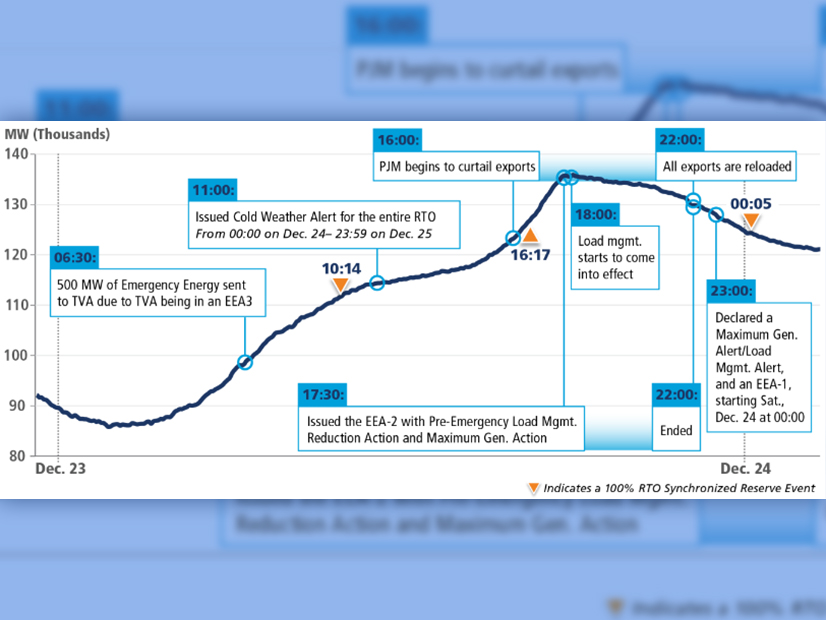

While providing exports to the Tennessee Valley Authority and other neighbors, some of whom were in emergency conditions, PJM entered its first of four synchronized reserve deployments at 10:14 a.m. in part from numerous generators tripping offline and failing to start, causing the area control error (ACE) to fall. As loads ramped up substantially higher than expected for the Dec. 23 evening peak, many of the generators PJM attempted to dispatch were tripping offline or failing to start, with a rate of 1.8 GW per hour at 2 p.m.

“PJM found that it was unexpectedly and rapidly exhausting its operating and primary reserves because of the unexpected generator outages,” the report said.

By 4 p.m. the ACE had fallen to nearly ‑3 GW, prompting PJM to begin curtailing exports. It also issued a pre-emergency load management reduction action to deploy DR resources and implemented a maximum generation action, directing generators to operate above their economic maximum outputs. This began the first block of PAIs, which would last five and a half hours, or 66 five-minute intervals.

PJM remained in emergency conditions until 11 p.m., but the nighttime load “valley” remained unprecedentedly high, 40 GW over the next highest valley in the past decade, limiting the ability for pumped hydro plants to be refilled. PJM provided some exports to neighbors that were in emergency conditions, and synchronized reserve events were called at 12:05, 2:23 and 4:23 a.m. on Dec. 24.

PJM began curtailing load again at 4 a.m. on Dec. 24 and issued a call for consumers to reduce their electric usage until at least 10 a.m. On top of forced outages, about 6 GW that was scheduled to come online for the morning peak failed to start and PJM re-entered emergency conditions at 4:20 a.m. with DR deployments and a maximum generation action five minutes later. At 4:52 a.m. it issued a voltage-reduction alert.

Approaching the morning peak at 8:30, which capped out at 130 GW of load, PJM was receiving emergency imports from NYISO and TVA, and Duke Carolinas and Duke Energy Progress were shedding load. The report states that forced outages around the morning peak amounted to 41 GW and 200 unit trips. PJM issued a voltage-reduction warning at 7:15 a.m. and remained in emergency conditions until it canceled the maximum generation action and DR deployment at 10 p.m.

At 4:58 a.m., an 850-MW generator tripped offline, causing the ACE to fall below 1,500 MW and prompting the start of a NERC Disturbance Control Standard (DCS) event, which requires that PJM recover ACE to at least ‑630 MW within 15 minutes. PJM called for an additional 500 MW of shared reserves from the Northeast Power Coordinating Council, having received 1 GW shortly before the start of the DCS, and was able to recover the ACE after 15 minutes and 52 seconds.

At the height of the emergency, the report said that if PJM lost emergency imports or another large generator tripped, a voltage-reduction action may have been necessary.

“If another large unit was lost or imports from NYISO into PJM were cut, PJM would have considered initiating a voltage-reduction action, which would have resulted in approximately 1,700 MW of relief. … If necessary, this action would have been followed by a manual load dump warning to communicate load dump allocations to transmission owners,” the report said.

Several complaints to FERC related to non-performance penalties accrued during the storm argue that PJM violated its tariff by continuing to export while implementing emergency procedures. The Elliott report laid out a series of instances in which PJM curtailed non-firm exports as conditions in the RTO worsened, but it stated that cutting all aid to its neighbors wouldn’t have prevented PJM from entering emergency conditions and would have likely worsened emergencies in surrounding regions that were in load shed. (See FERC Sends Elliott Complaints Against PJM to Settlement Judge.)

“Even if the operators had cut all non-firm exports, there would have been a deficit of at least 1,789 MW needed to satisfy PJM load and firm exports. Pre-emergency and emergency actions thus would have been necessary to satisfy capacity needs even if all non-firm exports had been cut,” the report said.