PJM detailed changes to the performance assessment structure and risk modeling in its critical issue fast path (CIFP) proposal Aug. 1, followed by presentations from Constellation Energy and Vistra.

While an additional meeting has been scheduled for Aug. 14, several stakeholders expressed concern there would not be enough time to get through the remaining stakeholder presentations and hold a dialogue about them before sponsors propose to the board and the Members Committee votes on the proposals Aug. 23. (See PJM Updates Proposal as CIFP Nears End.)

Paul Sotkiewicz, president of E-Cubed Policy Associates, questioned if it would be possible to delay the Stage 4 presentation to the board and subsequent MC vote to allow more Stage 3 meetings to be held.

“We’re trying to do too much in too short a time, and I just don’t see how we’re going to get through this all,” he said.

PJM Director of Stakeholder Affairs Dave Anders said staff are investigating all the ways of ensuring stakeholders have the information they need to make an informed vote. He told RTO Insider that any delay of the meetings would need to be made at least seven days prior to their scheduled date but that PJM would intend to announce any such changes as early as possible to respect stakeholders’ travel arrangements.

PJM Modifies Performance Assessment Proposal

Presenting how PJM could measure performance during emergencies and how it would determine penalty charges and bonuses, Pat Bruno said the proposal would retain the current capacity performance framework, while making changes to the penalty structure and balancing ratio and creating a new bilateral trading system.

The proposal would use the same performance assessment interval (PAI) trigger as was included in a filing PJM made in May, which allows an emergency to be declared only when there is a primary reserve shortage, voltage reduction warning and at least one of several additional emergency actions, including a manual load dump warning or maximum emergency generation action. The commission approved the filing July 28.

The penalty rate and stop loss will remain status quo under PJM’s proposal. Both were components of a proposal endorsed by the Members Committee in May, but which the board decided not to include in its filing. (See PJM Board Rejects Lowering Capacity Performance Penalties.)

Resources’ performance in the balancing ratio would be capped at their installed capacity (ICAP) rating, meaning a resource with a capacity obligation of 70 MW and 100 MW ICAP would receive a maximum overperformance bonus equal to 30 MW. The status quo rules do not include a cap.

PJM’s Pat Bruno said energy prices likely would be sufficiently high during an emergency to continue to incentivize resources to perform above their ICAP if they are able.

Energy-only and uncommitted capacity resources would be ineligible to receive bonus payments, but the latter would be eligible to take on committed capacity resources’ obligations through a new hourly financial capacity trading option. Capacity resources would be able to sell a portion of their obligation to another resource, so long as the buyer had accredited capacity that was not committed. The buyer would be eligible for capacity performance bonuses and penalties and the seller would be required to indemnify PJM if the buyer could not perform and could not pay the penalty.

David “Scarp” Scarpignato, of Calpine, said PJM’s analysis of the December 2022 winter storm showed that 70% of the overperformance was from capacity resources and generators. Around 30% was from uncommitted capacity and energy-only resources, which are not eligible for bonuses under PJM’s proposed new rules because they are categorically excluded.

Scarp said the “non-committed capacity” resources might find it uneconomical to provide desired emergency energy, especially after the timely gas nomination period has passed.

“I’m not sure you want the uncommitted capacity generator having to make a decision about losing money to help out. The energy market revenues are not enough in some instances, such as when competing for emergency energy imports,” he said. “I’m worried that in adhering to PJM’s strict ‘committed capacity’ theory, we’re ignoring the reality that the huge quantity of energy-only and uncommitted resources are absolutely needed by PJM for reliability.”

PJM also proposed to modify the fixed resource requirement (FRR) penalties by lowering the insufficiency charge from 2 times the cost of new entry (CONE) to 1.75 times net CONE. The daily deficiency charge would be changed from 1.2 times the Base Residual Auction (BRA) clearing price to 1.75 net CONE.

PJM Updates Risk Modeling Calculation

PJM’s Patricio Rocha Garrido presented updated risk modeling figures focused on where the RTO believes the balance between winter and summer risk lies. The new “base case” the proposal uses is based on weather data going back to 1993, does not include any adjustment for climate change, a proposed change in how demand response and storage are dispatched and updated planned outage data.

The latest modeling places 68% of the annual expected unserved energy (EUE) risk in the winter, with the remainder in the summer. The seasonal risk shifts 56% of the risk to the summer if PJM does not include data from the 1994 winter, which included a particularly severe storm in January.

Previous risk modeling proposals included a longer weather lookback to 1973 and adjusted past weather events with a climate change modifier to account for the expectation that temperatures would be warmer if similar weather occurred in the future. PJM’s Walter Graf said the amount of variability PJM saw in the modeling outcomes when implementing the adjustment led it to become less confident in the adjustment.

The new dispatching in the modeling would deploy demand response before storage, which would be ordered so long-duration storage is used before short-duration.

Presenting estimated 2026/27 class average accreditation values, Garrido said storage resources would have significantly higher values during the summer owing to the historical finding that winter outages are likely to be more prolonged. Four-hour storage would have a 90% accreditation during the summer, while 10-hour resources would have 100%; during the winter, however, those resources’ values would be 38% and 69%.

Demand response and solar also see large hits to their accreditation during the winter, which Garrido said is because the times at which their contribution is strongest tend to not align with the peak reliability risks for the season.

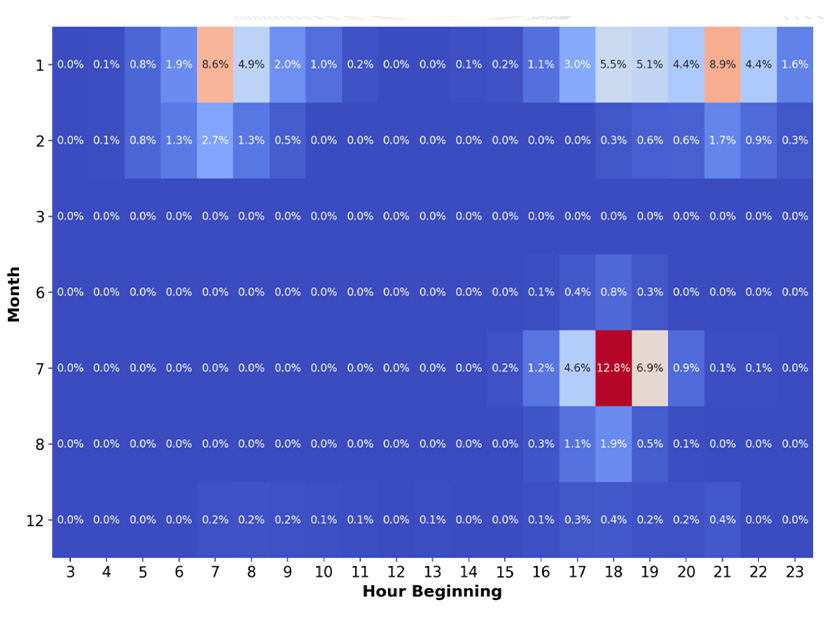

Showing a heatmap of the hours that tend to have the highest risk for each month, Garrido said the bulk of summer risk is concentrated on July days between 5 and 7 p.m. In the winter, risk is split between around 6 to 10 a.m. and 5 p.m. to midnight in January and a smaller share in February following a similar distribution.

James Wilson, a consultant to state consumer advocates, said he was disappointed PJM did not update the resource mix in the modeling, which he said assumed a large increase in solar, inconsistent with the relatively low summer risk and reliability value in the results.

Wilson questioned why PJM has settled on using 1993 as the date to start its weather lookback and suggested the decision may have been made to include 1994 in the dataset and weight the risk modeling toward winter.

Graf said the year was chosen because it’s the starting point for lookback periods PJM uses for other parameters.

Constellation Responds to PJM Proposal

Presenting for Constellation Energy, Adrien Ford said several changes to PJM’s proposal would improve the construct, including using a prompt capacity market with a shorter timeframe between the auction and the corresponding delivery year or season, a minimum number of PAIs per delivery year and a rolling 20-year historical weather lookback.

Ford said the company is planning to update its own proposal in the matrix, but Tuesday’s presentation was meant to add to the wider discourse around other proposals and design components being considered.

A prompt auction design six months to a year forward of the period the capacity is being procured for would improve the data available to market participants, Ford said. That would include the potential for a more accurate forecast of supply and demand, and reflect changes in the amount of time it takes to build generators.

Ford also said Constellation is considering an earlier capacity performance proposal from PJM where a minimum number of intervals each year would be examined for performance, with the 10 highest load hours each season used to meet the threshold at the end of the year. The changes to the PAI trigger likely will reduce the number of emergencies generators experience, which she said increases the need for regular evaluation of resources’ contribution.

Constellation supports PJM’s proposal to derive the reliability requirement from EUE analysis, rather than the status quo loss of load expectation and using marginal effective load carrying capability for accreditation.

Vistra Suggests Changes to PJM Proposal

Vistra’s Erik Heinle said the company supports much of PJM’s proposal but is concerned with several provisions, including limiting bonus payments to committed capacity resources, generators’ ability to reflect the risk of being assigned penalties in their market seller offer cap and the ability for the CIFP process to result in an adequately fleshed-out seasonal auction model.

Not allowing a wider range of resources to receive bonus payment for overperforming reduces the incentive for investments that can support reliability and increases the risk for those considering whether to make upgrades to allow them to qualify as capacity resources. If such a resource makes significant reliability upgrades but doesn’t clear, Heinle said it would be deprived of both capacity revenue and the opportunity for bonuses.

While he said the hourly capacity obligation trading proposal improves the ability to mitigate risk and improve transparency, he also said more work is needed to ensure that generators can represent all the risks that come with taking on a capacity obligation. The company also supports PJM’s decision to maintain the current capacity performance penalty rate and stop loss limit, as well as exempting intermittent and storage resources from offering into the capacity market.

Heinle suggested that PJM include the seasonal capacity model in its filing but delay its implementation to allow more time to allow stakeholders to make changes and understand how the changes would play out.