ISO-NE projects it will have enough energy resources to maintain the grid throughout mild and moderate weather conditions this winter, the organization announced Dec. 4. Under more severe winter conditions, ISO-NE indicates some capacity deficiency actions may be required, but shortfall remains “unlikely.”

While the RTO said it does not anticipate the need for controlled power outages, it cautioned that even in a mild winter, extended cold snaps still could stress the grid.

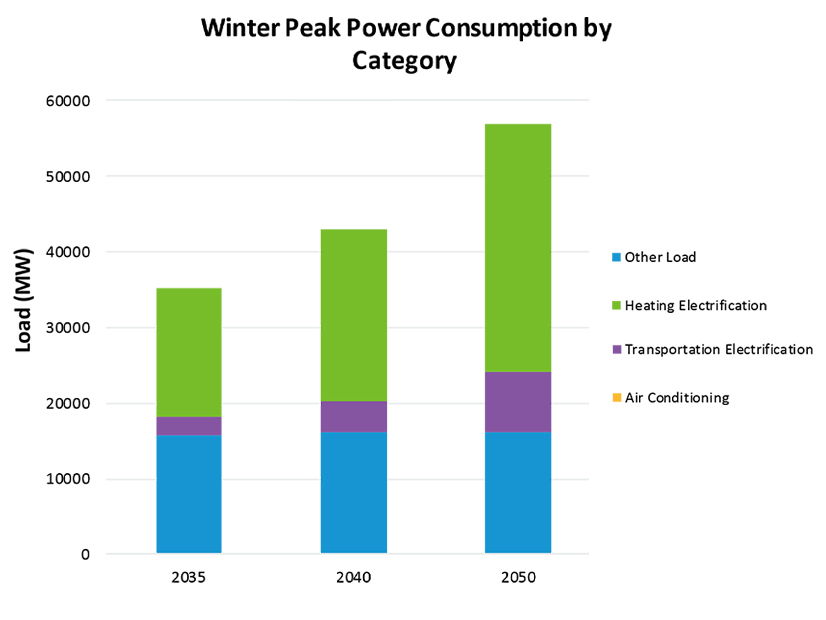

The organization forecasts a peak demand of 20,269 MW under average weather conditions, and a 21,032-MW peak under below-average temperatures. This would be an increase compared to last winter’s 19,529-MW demand peak. ISO-NE anticipates winter peak demand increases will accelerate in the coming years due to electrification, surpassing 26,000 MW in 2032 and potentially reaching about 57,000 MW in 2050.

For this winter, ISO-NE noted the National Oceanic and Atmospheric Administration projects above-average temperatures in New England, with more precipitation than usual in Southern New England and average precipitation in Northern New England.

Temperature and weather patterns can impact both supply and demand on the grid, making weather “the largest driver of energy use and resource availability in New England,” according to the RTO. The organization touted its 21-day energy supply forecast, which it uses to anticipate and preempt supply constraints.

“Seeing what’s coming is crucial to navigating any potential power system challenges, and our 21-day energy supply forecast is an operational tool that serves this very purpose,” ISO-NE CEO Gordon van Welie said in a statement. “It gives us situational awareness on energy adequacy over the operating horizon, allowing us to identify potential energy shortfalls while there’s still time to prevent them or lessen their impact.”

The RTO has several out-of-market mechanisms in place intended to ensure grid reliability. This winter will feature the rollout of the Inventoried Energy Program (IEP), which will compensate generators for keeping up to three days of stored fuel on-site.

The IEP is intended to be a short-term reliability solution, set to run for just two winters. It has been criticized by environmental groups as an unnecessary handout to fossil generators, while ISO-NE has argued it is an important reliability backstop for the region. (See FERC Upholds Ruling on ISO-NE’s IEP Payments.)

This winter also will be the second and final year of the Mystic Cost-of-Service Agreement (COSA), which has delayed the retirement of the Mystic generation station. Mystic is the main customer of the Everett LNG import terminal, and Mystic’s retirement would necessitate a new source of funding to keep the import terminal open. The generator is set to retire when the COSA expires at the end of May 2024, after which the future of Everett is uncertain.

Officials from FERC, NERC and ISO-NE have expressed concern about the indirect impacts the retirement of Everett would have on electric reliability. (See FERC, NERC Leaders Voice Concern About Loss of Everett Marine Terminal.)

However, there is little appetite in the region to extend the Mystic Agreement, which has been characterized by high costs and, according to some stakeholders, minimal grid reliability benefits. (See NE Stakeholders Debate Future of Everett at FERC Winter Gas-Elec Forum.)

According to an ISO-NE report released in September, the agreement has cost ratepayers in the region over $572 million from its start in June 2022 through August 2023. Over this period, Mystic’s operational conditions have been characterized by the RTO as “in-merit operation” for just one month, compared to nine months of “tank congestion management” and five months where the facility was characterized as “predominantly offline.”

ISO-NE’s modeling for 2027 and 2032 has indicated the presence of Everett would not provide significant reliability benefits to the grid. (See ISO-NE Study Highlights the Importance of OSW, Nuclear, Stored Fuel.)

In the coming years, the region could see several new clean energy resources come online that likely will boost winter reliability. The 806-MW Vineyard Wind 1 project aims to achieve commercial operation by the end of 2024, while the 1,200-MW New England Clean Energy Connect transmission project expects to be in service by 2025.

In the longer-term, ISO-NE’s ongoing Resource Capacity Accreditation project is intended increase capacity revenues for resources that provide reliability attributes to the grid, particularly during periods of winter stress. Under the RTO’s current schedule, these updates will be implemented in time for the winter of 2028/29.