Simulation Analysis of PJM CIFP-RA Filing

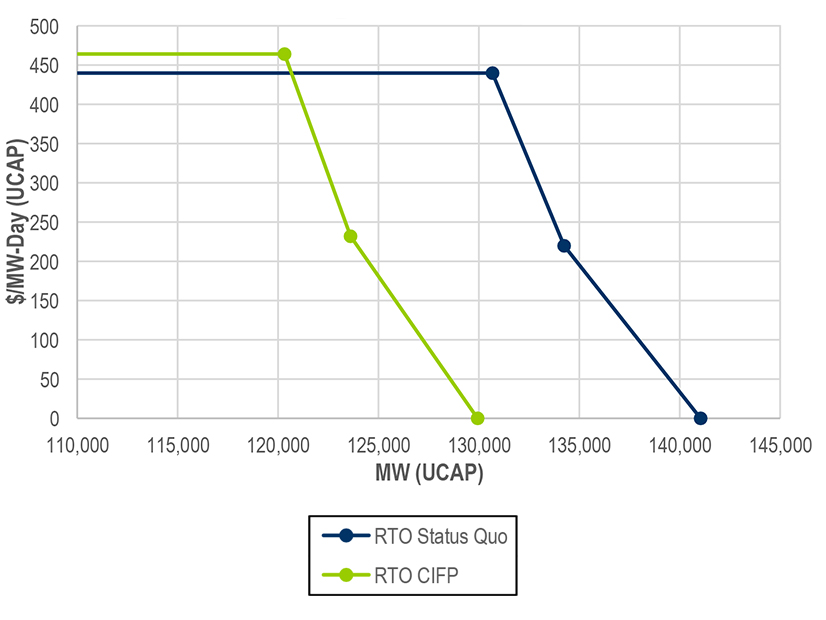

PJM’s Market Implementation Committee discussed the RTO’s analysis of how proposed Critical Issue Fast Path (CIFP) filings before FERC might have impacted the 2024/25 Base Residual Auction results.

The item was originally listed as informational only, but stakeholders voted to add it as a full agenda item for further discussion.

A total of 136,232.7 MW of unforced capacity (UCAP) was procured in the simulated auction, a 11,246-MW decrease from the actual results. However, the cost to procure that capacity increased from $2.2 billion to $2.4 billion. That trend was on display in the “rest-of-RTO” region, where the clearing price increased from $28.92/MW-day to $47.70/MW-day while the amount procured fell. (See PJM Capacity Prices Jump in 5 Regions.)

“There are a lot of moving pieces here. This is in part because the changes in accreditation types hit some regions differently,” Walter Graf, PJM’s senior director of economics, told the MIC during its Jan. 10 meeting.

PJM’s Skyler Marzewski said the CIFP changes are intended to increase the reliability value of a megawatt of accredited capacity, so even with fewer megawatts clearing the auction, reliability could improve as more efficient units received capacity commitments. In regions where capacity prices declined, Marzewski said, the more efficient resources being picked up in the simulated auction could allow for the same degree of reliability at a lower price.

Calpine’s David “Scarp” Scarpignato said that may account for some of the difference, but the sharp drops in some regions indicated there must be other factors. He pointed to the Eastern Mid-Atlantic Area Council (MAAC) region, where the clearing price fell from $54.95/MW-day in the actual auction to $47.70 in the simulation, while the simulation declined 9% from the 39,303 MW actually committed.

“It’s just so overwhelming, the difference … it looks to me like the amount of reliability you’re purchasing is going down,” he said.

Several stakeholders questioned how the resource mix differed in the simulated auction, but PJM said the information was not yet available.

Marzewski said the analysis is not meant to be taken as a trend or indicative of future auction results, which likely are to be influenced by changing market conditions.

Real-time Temporary Exceptions Manual Revisions Proposed

PJM’s Lauren Strella Wahba presented proposed revisions to Manual 11, which pertains to energy and ancillary services market operations, to reflect FERC’s Nov. 30 approval of a process for market sellers to submit temporary exceptions from their unit-specific parameters.

The revisions would replace the real-time values process PJM used for market sellers to submit changes to their ability to operate according to their parameters during the operating day. (See “Temporary Exceptions Supplant Real Time Values,” PJM MIC Briefs: Dec. 6, 2023.)

Wahba said only one temporary exception should be submitted for an issue preventing a resource from operating according to its parameters. If the issue is expected to last more than 30 days, a period exception instead should be submitted with accompanying documentation showing the disruption is persistent. The market seller should notify both PJM and the IMM of any changes in the physical condition of a resource operating with a temporary exception or the ability to return to normal operations.

Because FERC’s order had an effective date of Nov. 30, Wahba said, the manual changes are conforming language codifying a practice put in place last year.

Quick Fix Proposal on Interface Pricing Points

PJM presented a quick fix proposal to revise Manual 11 to reflect existing practices for interface pricing points, a mechanism that groups buses together when calculating LMPs for energy imports to, or exports from, external areas.

The quick fix process allows a proposed solution to be brought and voted on concurrent with a problem statement and issue charge.

The revisions also would include a recommendation from the Independent Market Monitor to monitor all interfaces as needed — language that exists in the Operating Agreement but is not mirrored in the manuals.

Paul Sotkiewicz, president of E-Cubed Policy Associates, questioned the need for using the quick fix process in this instance and said PJM increasingly has been relying on the expedited process, making it difficult to ensure stakeholders fully understand changes being made.

“Here we are again, with yet again another issue that we’re using the quick fix process for without a meaningful discussion of how these changes are going to be made so people can understand them,” he said. “I want to express more and more concern about PJM’s use, and I dare say abuse, of the quick fix process.”