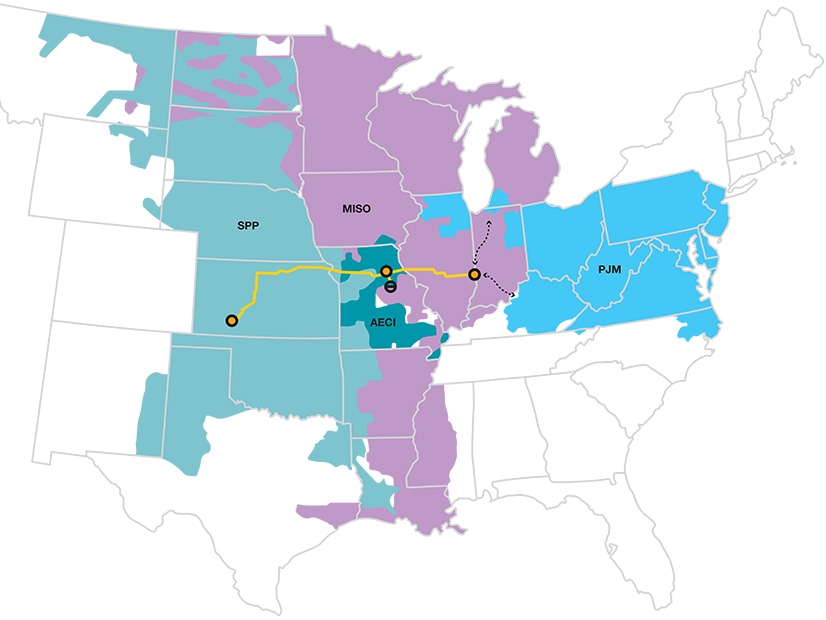

FERC on Feb. 16 approved a MISO transmission connection agreement for the $7 billion, 5-GW Grain Belt Express HVDC transmission line despite protests from developer Invenergy over a three-year construction lag contained in the contract (ER24-715).

FERC disagreed with Invenergy Transmission that it should order MISO to insert a limited operation provision into the Grain Belt transmission connection agreement to allow it to begin partial operations in 2027. The commission said the agreement aligns with MISO’s current interconnection rules for merchant HVDC generation and approved it unexecuted.

Invenergy argued the transmission connection agreement for Grain Belt is unfair because it doesn’t include an option for a limited operation of the line while Ameren Missouri completes network upgrades necessary for the merchant HVDC line. Invenergy said it began negotiations on the transmission connection agreement with a 2027 in-service date and MISO notified it in September that it must use a Dec. 1, 2030, in-service date.

The transmission developer argued that other generators that gain injection rights on the MISO system are eligible for limited operations until they can be fully accommodated.

However, FERC said Grain Belt’s agreement “appropriately reflects” the state of MISO rules and noted the agreement could be modified with a limited operation provision if a new rule is agreed on through the RTO’s stakeholder process.

FERC said while it has allowed nonconforming interconnection agreements, they either must be necessary for reliability, raise a fresh legal issue or be required by “other unique factors.”

“Grain Belt does not allege specific reliability concerns, novel legal issues, or other unique factors sufficient to show that the provision is necessary. Rather, Grain Belt states that, absent the nonconforming provision, there will be broad ‘adverse impacts on [Grain Belt] and on the customers that would otherwise benefit from the reliability, economic and public policy benefits that the GBX Line will provide,’” FERC wrote, adding that Invenergy’s arguments “merely highlight” the potential benefits — not essentials — that limited operation could provide.

Grain Belt is the first merchant HVDC customer to proceed through MISO’s interconnection queue, and Invenergy has said the status of the line means it and MISO inevitably will discover hiccups in the merchant HVDC interconnection queue rules and bring them forward for solutions in the stakeholder process.

Invenergy said MISO told its employees it could initiate stakeholder discussions on adding limited operation options to merchant HVDC interconnections in the future but that the RTO didn’t commit to a timeline for introducing the issue in its stakeholder committees.

“Under MISO’s timetable, by the time it starts stakeholder proceedings in a few years, develops a tariff proposal, and files it with and obtains commission approval, Grain Belt’s desired 2027 in-service date will have come and gone and MISO’s promise to look into this will not be a delay, but will amount to a denial of service,” Invenergy argued.

The company said the RTO should have offered the same accommodations it would have for other interconnection customers, including limited operations provisions. It pointed out that both generation and merchant HVDC will transfer energy from their projects onto the grid and should be treated comparably under Order 2003.

MISO responded that FERC’s Order 2003 was meant for generating facilities interconnection to the grid and doesn’t extend to merchant HVDC projects. It said Grain Belt was attempting to justify “nonconforming revisions with nonexisting policies.”

Invenergy said that MISO’s rejection of a limited operations arrangement is wrong “given the urgent need for transmission in the U.S. and the harm to Grain Belt and MISO loads.”

The transmission developer also claimed that “some amount of connection service and associated injection rights,” varying from 158 MW to 1,491 MW, could be supplied prior to the completion of Ameren’s system upgrades.

Ameren Missouri maintained that it wouldn’t have given Grain Belt an impression of how much below the requested injection rights it could flow over its system because it’s up to MISO, not a transmission owner, to make that call. MISO said a possible amount of interim injection rights is irrelevant because Grain Belt didn’t meet FERC’s standard of addressing reliability concerns of unique operational issues.