Dozens of states have adopted emission-reduction targets aimed at fighting climate change. But how should RTOs account for those initiatives when their effects are delayed, uncertain, expensive for consumers or all of the above?

In New York State Public Service Commission v. FERC (No. 23-1192), the D.C. Circuit is poised to address that question — with potentially significant implications for climate-change laws, energy markets, and the approval process for RTO and ISO tariff amendments going forward.

New York’s Climate Act Spurs NYISO Action

In 2019, New York’s Climate Leadership and Community Protection Act (Climate Act) set a target date of 2040 to eliminate all greenhouse-gas emissions from the state’s energy grid. The act ordered the New York Public Service Commission (NYPSC) to promulgate regulations implementing that target date, but it also authorized NYPSC to create exceptions if necessary for reliability. To date, NYPSC has not promulgated any implementing regulations.

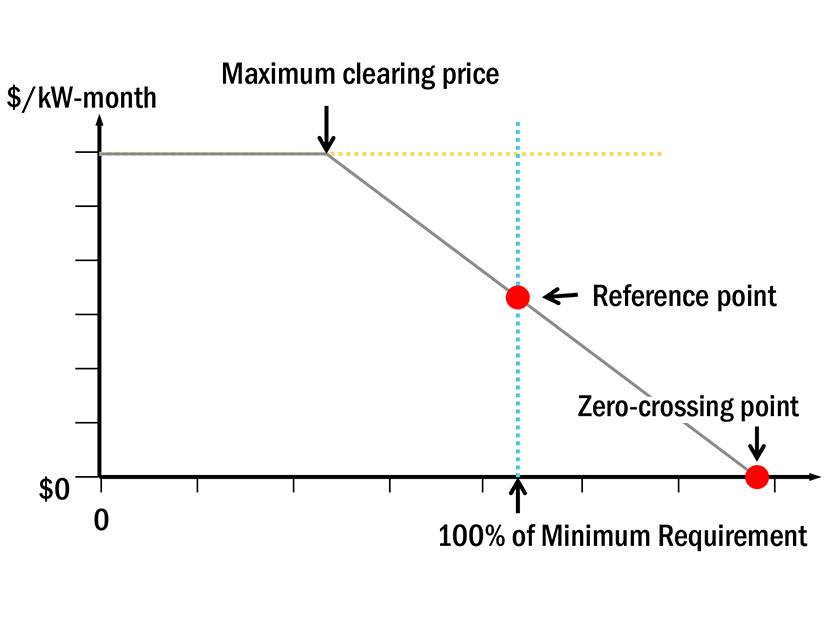

In response to the new law, NYISO proposed a revision to the Net Cost of New Entry (“Net CONE”) figure used in its capacity market. Net CONE is an annualized estimate of new-entry costs, calculated by dividing a hypothetical new gas-fired power plant’s lifetime expenses by an “amortization period,” i.e., the number of years in the plant’s viable economic life. NYISO historically has used a 20-year amortization period, but given uncertainty that gas-fired plants would be viable after 2040, NYISO proposed shortening the amortization period to 17 years.

That proposal comes with a cost. To incentivize market entry in the event of a supply shortfall, NYISO factors Net CONE into its capacity demand curve. Shortening the amortization period (and thereby increasing Net CONE) also would thus increase capacity clearing prices, to the tune of more than $100 million annually.

FERC Approves NYISO’s Proposal — on Take Three

For nearly four years, NYISO’s proposal has been tied up in proceedings before FERC and the D.C. Circuit, generating multiple FERC orders and a D.C. Circuit opinion in between. In FERC’s most recent, third order (the one now before the D.C. Circuit), FERC approved the amendment.

Opponents of the proposal, including NYPSC itself, have made two main arguments. First, they have argued that NYISO made an impermissibly speculative assumption that gas-fired plants must close by 2040 when it relied on the Climate Act’s target date to justify its proposal. They have contended that NYPSC can create exceptions to the act, or new retrofitting technology might enable plants to operate past 2040. Second, opponents have argued the nine-figure spike in capacity costs (and, ultimately, an increase in consumer prices) means the amendment is not just and reasonable.

Although FERC initially adopted those arguments, the D.C. Circuit expressed skepticism in the case’s first trip to the appellate court. See Independent Power Producers of New York, Inc. v. FERC, No. 21-1166, 2022 WL 3210362 (D.C. Cir. Aug. 9, 2022). On remand, FERC now has fully rejected the challenges to NYISO’s proposal. N.Y. Independent System Operator, Inc., 185 FERC ¶ 61,010 (Oct. 4, 2023). The amendment, FERC found in its most recent order, is a reasonable response to the Climate Act and is not impermissibly speculative, since the only law on the books all but requires zero emissions after 2040. The proposal’s opponents, in FERC’s view, are speculating about yet-unknown regulatory and technological developments.

FERC also found the increase in capacity prices effectively irrelevant. The amendment was limited to changing the Net CONE amortization period (which FERC found reasonable); it did not change the broader capacity-auction structure that incorporated Net CONE into capacity prices (which FERC previously approved as reasonable). Prices resulting from a reasonable rate design using reasonable components, FERC concluded, are necessarily reasonable too.

The D.C. Circuit Petition for Review Raises Issues of Nationwide Significance

FERC’s order now is before the D.C. Circuit on NYPSC’s petition for review. Chief Judge Srinivasan and Judges Randolph and Childs heard argument Feb. 20, 2024 — and the judges’ questioning suggests a pro-FERC majority. Srinivasan and Randolph signaled strong agreement with FERC’s view that relying on the Climate Act’s target is not speculative, while Childs seemed more skeptical, pressing FERC’s counsel to defend the agency’s treatment of the proposal’s effect on prices. If oral argument is a guide, the court could be poised to deny the petition and approve FERC’s reasoning.

Whatever the outcome, the ruling could have nationwide consequences. New York is not the only state with an emissions mandate, and NYISO is not the only RTO trying to account for those laws. And even beyond the climate-change context, the court’s ruling on the “speculation” question will send a signal to FERC and to RTOs about how to deal with regulatory uncertainty more broadly.

How the D.C. Circuit treats FERC’s dismissal of NYPSC’s cost concerns could be even more significant. FERC has argued that price increases caused by a proposed amendment’s interaction with a broader, FERC-approved rate design need not be considered in the just-and-reasonable inquiry. Instead, in FERC’s view, challenges based on resulting price changes must be made using Section 206 of the Federal Power Act. If the court agrees, Section 206 complaints could become routine when stakeholders oppose a tariff amendment because they contend its relationship with existing tariff elements could lead to unjust and unreasonable prices. If the court disagrees, the case likely will return, once again, to FERC. And from there, it might come back again.

Jennifer Fischell is a partner at MoloLamken with a practice focusing on energy and administrative law, appeals and other complex civil litigation. She has clerked for judges at all levels of the federal judiciary, most recently for Justice Elena Kagan of the U.S. Supreme Court.

Jackson Myers is an attorney at MoloLamken with a practice focusing on appeals, complex civil litigation and white-collar matters. Prior to joining MoloLamken, he clerked for Judge Dennis Jacobs of the U.S Court of Appeals for the Second Circuit and Judge John Bates of the U.S. District Court for the District of Columbia.