Lack of visibility into the contract and availability status of the fleet is causing “inefficiencies” in CAISO’s capacity procurement mechanism (CPM) process, said staff and stakeholders in a two-day Resource Adequacy Modeling and Design Working Group on April 29 and 30.

“For us to be able to effectively do a CPM designation and backstop, we really need to look into what RA is offered to us,” said Abdul Mohammed-Ali, operations engineering manager at CAISO.

In the past, CAISO viewed non-RA shown capacity as available in the market and therefore factored into its CPM decision-making, said Peter Griffes, chief of comprehensive market design at Pacific Gas and Electric. But because of retail structure changes, there isn’t the same assurance of available capacity.

CAISO hasn’t decided whether it should evaluate non-RA resources when determining RA capacity, but without knowledge of what is shown, stakeholders expressed confusion surrounding how and when CAISO decides to CPM and feared that a lack of clarity on availability could lead to unnecessary backstop.

“We think it’s important that [CAISO] maintain some levels of discretion and make the right operating decisions to ensure that it has the capacity it needs to support reliability of the system but also does not engage in unneeded backstop procurement that would ultimately increase the cost for ratepayers,” said Tony Zimmer, assistant general manager of power management at the Northern California Power Agency.

The ISO bases CPM decision-making on shown RA capacity, or resources that appear on supply plans, and Competitive Solicitation Process (CSP) offers, which are voluntary bids into the market from scheduling coordinators up to the soft offer cap. CAISO recently received FERC approval to increase the cap from $6.31/kW-month to $7.34. (See CAISO Receives FERC Approval to Increase Soft Offer Cap.)

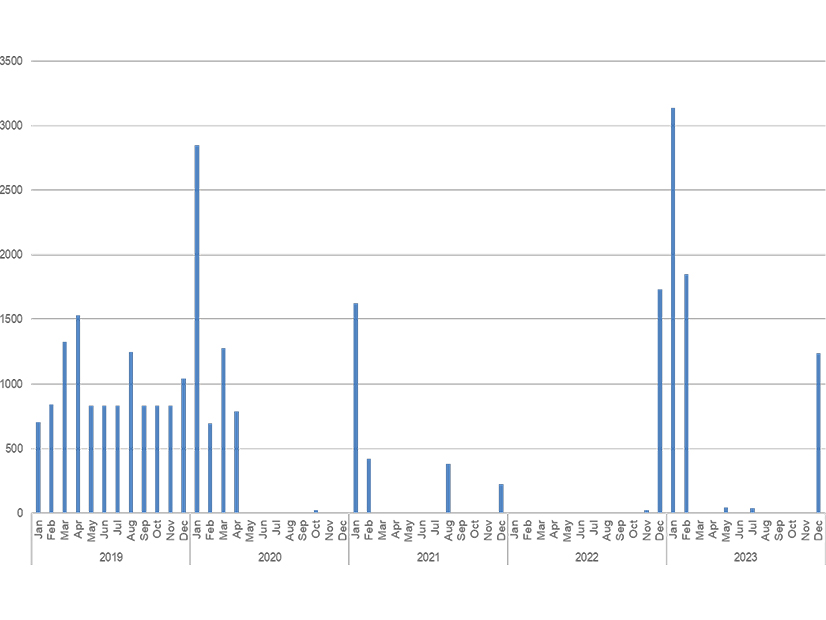

But since 2020, CSP offers have “dried up,” especially in the summer months, said Mohammed-Ali. Prior to the increase, the ISO stated in its RA Discussion Paper that the cap is not cost competitive with bilateral market prices, potentially causing the lack of CSP offers.

“Because of these market dynamics, the ISO hypothesizes that the lack of offers in the CSPs is driven by a combination of most capacity being under contract and sellers of any available capacity having alternatives well above our soft offer cap,” the discussion paper reads. “If the ISO is unable to procure capacity to CPM, the CAISO BA has the direct risk of not having sufficient capacity to reliably operate the grid.”

“That’s one of the main challenges, because now, even if we decided to backstop, this is our pool, and our pool is dry,” Mohammed-Ali said.

In its request to FERC to increase the cap, CAISO argued that it would better reflect inflation and higher bilateral capacity prices.

Another challenge lies in CAISO’s concern that scheduling coordinators may be holding back capacity for outage substitution, which could impact the efficiency of CPM decision-making. But without visibility into the non-RA fleet, it’s unclear. Load-serving entities may choose not to show resources because of the consequences associated with being counted as RA, including being subject to the Resource Adequacy Availability Incentive Mechanism test, must-offer obligations, substitution rules and bid insertion rules.

“If there’s resources that are being held by people for substitution while others are unable to meet RA compliance requirements, and the ISO is unable to meet CPM, we need to understand why people are holding those types of quantities and causing that type of difficulty,” said Eric Little, director of regulatory affairs at CalCCA. “I think we ought to do a better job examining the data and … making publicly available the information so that everybody can see exactly what’s going on in terms of capacity space.”

Solutions

The ISO can better utilize available capacity if it considers resources scheduled to receive a commercial operation date in its CPM decision-making, Perry Servedio, a consultant to the California Energy Storage Alliance, said in a presentation to CAISO.

“If you’re having a lack of offers, why not do something in which you can have more RA available to you even with that lack of offers?” Servedio said. “If folks can show resources that are planning to come online, then that gives you visibility as well, and that would be a showing that’s contracted, and they want to rely on it for RA, but it’s not yet online.”

The timeline is set so that, 30 days (T-30) after RA and supply plans are due, CAISO reviews data and decides whether it needs to backstop. But there is a lot of capacity that comes online between T-30 and T-zero that, because of the compliance timeline, can’t be considered for RA, Servedio said.

“What I’m really driving at here is there’s all these resources that are contracted by loads to provide RA that are not able to be RA in the compliance month due simply to this timeline,” Servedio said.

Nuo Tang, director of asset management at Middle River Power, agreed with Servedio’s emphasis on “frontstop” rather than backstop.

“While we’re focused a lot on backstop procurement, I think we’re missing a big point of what should the ISO do to ensure there’s good incentives for frontstop procurement?” he said.

Also at issue was whether to rely on the ISO’s default planning reserve margin (PRM) and 1-in-10 loss-of-load expectation (LOLE) to inform whether to backstop. Servedio suggested the ISO complete an “LOLE study” to determine reliability and better inform CPM decisions. Tang supported the need for a study and suggested CAISO give information to local regulatory authorities regarding what PRM is needed to prevent unnecessary backstop.

But some stakeholders said CAISO shouldn’t determine the LOLE and reliability standards.

“I fundamentally disagree with the notion that the ISO ought to be responsible for maintaining a 1-in-10 LOLE in the RA program,” Little said. “What we really need is the state looking at how it’s going to meet its reliability needs, which it should be doing through [integrated resource planning] and through RA and making sure those resources are available.”

Consensus held that without visibility into CAISO’s full fleet, none of the other issues can be resolved.

“Until we can solve these types of problems to understand where the capacity is and what’s preventing people from getting it, I don’t know that the ISO’s backstop process is going to be any more or less successful than anybody else out there right now,” Little said.