FERC on May 6 partially reversed a 2023 order allowing PJM to modify a parameter for the 2024/25 Base Residual Auction (BRA) to avoid a substantial increase in capacity prices in the DPL South transmission zone and instructed the RTO to rerun the third Incremental Auction (IA) (ER23-729-002).

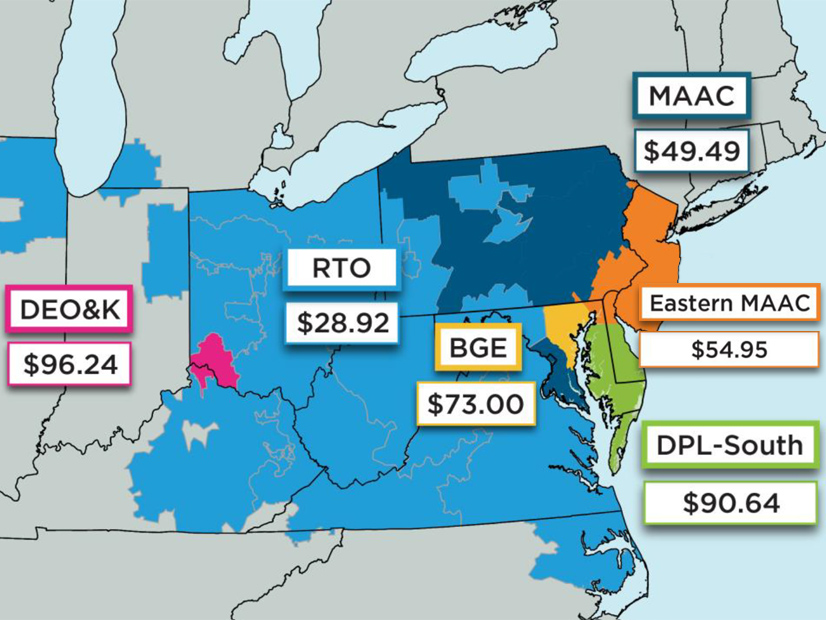

The order increases the clearing price for the DPL South locational deliverability area (LDA) to $426.17/MW-day, up from $90.64 under the auction results PJM posted in February 2023 using the modified parameter. The LDA with the second-highest price is the DEOK region, which cleared at $96.24/MW-day.

In a series of notifications to stakeholders following the order, PJM said it will reopen bids for the third IA on May 10 through May 16; the auction was originally administered Feb. 27 through March 4. Market participants’ original sell offers and buy bids will be the default if no changes are submitted, while all bilateral and replacement transactions made since March 4 have been withdrawn by PJM.

FERC had granted PJM the authority to revise the reliability requirement for the zone, which covers the Delmarva Peninsula, after preliminary analysis of the BRA, held in 2022, showed a nearly fivefold increase in capacity prices because of an unexpected shortfall in offers. The change was made after the auction was run but before the results were published.

But in March, following challenges by several stakeholders, the 3rd U.S. Circuit Court of Appeals ruled that change constituted retroactive ratemaking, a violation of the Federal Power Act, as well as the filed rate doctrine. (See 3rd Circuit Rejects PJM’s Post-auction Change as Retroactive Ratemaking.)

The RTO had requested that the commission allow it to exclude resources that did not enter into the auction from the zone’s reliability requirement and to add tariff language permitting the parameter to be revised when resources expected to offer into the auction prompt the reliability requirement to increase by more than 1% but ultimately do not submit an offer. The court’s ruling and FERC’s order leave the forward-looking tariff language but require the original reliability requirement to be used for the 2024/25 auction and the third IA.

PJM filed a petition arguing that the only way forward would be for it to recalculate the BRA results using the unaltered reliability requirement and asked the commission to allow it to rerun the third IA. Several state commissions, consumer advocates and industrial groups jointly protested, making a case that FERC holds remedial authority and could direct PJM to continue using the revised parameter.

But FERC said the court had tied its hands.

“We find that the court’s opinion vacating the portion of the commission’s orders allowing PJM to apply the tariff amendments to the 2024/2025 BRA indicates PJM ‘was required to use’ the initial LDA reliability requirement,” FERC said. “In particular we note that, in reaching that result, the court reiterated that ‘the equities play no role in its application of the filed rate doctrine.’ Accordingly, while we acknowledge PJM load parties’ concerns about rerunning auctions and the equities implicated by this proceeding, we find that they cannot change the outcome here.”

Commissioners Reluctantly Concur

All three sitting commissioners separately expressed dismay with the outcome.

Chair Willie Phillips criticized the 3rd Circuit’s decision, saying its “broad reading of the filed rate doctrine, and its endorsement of ‘predictability’ as a higher virtue than equity, is beyond troubling and does not represent my views. … One must ask: If the over $100 million result of a ‘faulty assumption’ (and no one in this case argues that it’s not a faulty assumption) is somehow OK, what about a $1 billion faulty assumption, or a $1 trillion faulty assumption? Can we still conclude those are just and reasonable rates?”

Phillips urged “all stakeholders, including both PJM and the generators that will reap the more than $100 million windfall due to the court’s decision, to take all necessary steps to ensure that we never find ourselves in this position again. That includes putting in place controls to ensure that a similar error does not reoccur and, should it somehow happen again, that PJM or the commission has the authority to correct that error and protect customers from such a manifestly inequitable result. Basic equity, and the public interest, demand nothing less.”

Commissioner Allison Clements went a step further, saying that the commission could initiate a proceeding under FPA Section 206 to investigate whether RTOs lacking such protections may produce unjust and unreasonable rates.

“Should PJM and other public utilities fail to affirmatively update their tariffs to provide notice that adjustments can be made, where appropriate, to prevent inequitable outcomes, then it will fall to the commission to cure this failure pursuant to its authority under Section 206 of the Federal Power Act,” she wrote.

Her criticism of the ruling was also broader, saying that “it is only the latest in a string of unjust outcomes stemming from the courts’ narrow view of [the filed rate] doctrine” and citing a previous case. (See DC Circuit Upholds FERC Ruling on SPP Z2 Saga.)

Commissioner Mark Christie said “the complexity of PJM’s capacity market cannot be overstated” and raises the risk of oversights costing consumers.

He quoted his concurrence from earlier this year in FERC’s approval of PJM’s changes to its capacity market, criticizing it as increasingly incomprehensible: “Perhaps PJM should be required to post a warning to every reader who tries to read and comprehend a detailed explanation of how the capacity market construct works (borrowing from Dante): ‘Abandon all hope, ye who enter here.’” (See FERC Approves 1st PJM Proposal out of CIFP.)

“The tinkering and complexities here will assuredly impact consumers — who took no part in this tinkering but will surely pay for the complexities by way of what are estimated to be dramatic rate increases,” he said in his latest concurrence. “This … should require each and every one of us who have played some part in the tinkering (regulators, RTOs and market participants alike) to make certain that it is not consumers who must abandon all hope.”

Consumer Advocate Argues More Could have been Done

Maryland People’s Counsel David Lapp told RTO Insider he believes FERC had the authority to act differently.

“It’s extraordinary that we have three FERC commissioners … acknowledging that this is unfair to customers and customers are being getting hit with the consequences of this error and yet they are not using their authority to address that problem — and they have remedial authority,” he said. “FERC is responsible for setting just and reasonable rates; we know the rates are not reasonable, and yet customers are being forced to pay those rates.”

Without the power to resolve market design errors before rates go into effect, Lapp said he is worried similar circumstances could arise again. His office will be exploring tariff amendments that could be offered in the stakeholder process to empower PJM to correct issues before they hit consumers’ bills.

Lapp noted that the increased capacity costs will go into effect as Maryland ratepayers may be required to pay a share of a $263 million reliability-must-run (RMR) contract to keep the 410-MW Indian River Unit 4 generator online through December 2026. (See PJM Monitor and Consumers Protest Indian River Compensation Settlement.)

“This specific impact [from the capacity market] appears to be around $5/month, and there are additional impacts from the RMR for the Indian River plant retirement,” he said. “Maryland’s customers as a whole are getting hit very hard as a result of the consequences of this error — this error that everyone acknowledges is an error — but also as well as the planning processes, or lack thereof, at PJM.”

The Maryland Public Service Commission also criticized the order, arguing it would produce unjust and unreasonable rates, “though we appreciate each of the FERC commissioners’ expressed reluctance to have to approve PJM’s proposal,” spokesperson Tori Leonard wrote in an email.

“Rates will clearly be unjust and unreasonable. We can only hope this could be rectified somewhat, through the Incremental Auction. That is not to say that our commission is not weighing its legal options on this matter,” Leonard said.

Independent Market Monitor Joe Bowring said PJM’s effort to revise the reliability requirement may not have run afoul of the filed rate doctrine had PJM not sought to create a new rule enshrined in the tariff.

“They didn’t have to make it subject to a rule change. … They could have realized they made a mistake, fixed it and posted the correct numbers,” he said.

Bowring said it’s unlikely that rerunning the third IA will present participants with technical challenges around preparing new offers, which he said will be carefully reviewed to ensure that participants are not taking advantage of insight into how others behaved in the first iteration.

“It’s hard to predict; as always we don’t want people exercising market power. … It gives you an advantage to know what happened,” he said.