BRETTON WOODS, N.H. — Government officials, RTO leaders, industry representatives and climate protesters from New England and beyond descended upon the Mount Washington Hotel in New Hampshire’s White Mountains for the 21st annual NEPOOL Participants Committee summer meeting June 25-28.

During a multiday stretch of extreme heat just days prior to the meeting, the ISO-NE grid hit its highest demand of the year at 23,324 MW, which caused the RTO to issue an abnormal conditions alert that extended across three days. The outage of a large generator as the system approached the daily peak on June 19 forced the RTO to dip into its operating reserves to stabilize the grid.

The peak loads throughout the heat wave were significantly reduced by the recent progress of behind-the-meter solar in the region. Preliminary data from ISO-NE indicate BTM solar reduced the peak on June 20 by about 2,500 MW, while also shifting the peak later in the day.

But the proliferation of distributed renewables is not without its challenges for grid operators. Previewing the RTO’s preliminary 2025 budget, ISO-NE CFO Robert Ludlow projected a 13.5% increase — a $37 million bump — in ISO-NE’s annual revenue requirement, largely because of increasing demands of the clean energy transition.

This increase would result in a 17.1% increase in the per-kilowatt-hour rate charged to consumers, or an approximately 25-cent increase in the monthly charge to the average ratepayer.

“The main driver of the 2025 budget is the need to add personnel to the organization to address the modeling, analysis, processing, operational and communication needs directly resulting from the clean energy transition,” Ludlow said.

The preliminary budget proposal comes on the heels of a 21% revenue increase for 2024, which also was based on needs associated with the changing resource mix. (See ISO-NE Proposes 21.5% Budget Increase for 2024.)

Ludlow said the energy transition creates new technology and cybersecurity needs and requires better modeling and forecasting “to account for net load characteristics and trends that have rapidly evolved in recent years and are anticipated to change even more significantly in the coming decades.”

ISO-NE’s ongoing work to significantly reform its capacity market, along with a greater focus on long-term transmission planning, also contributed to the proposed budget increase, Ludlow said. (See Stakeholders Support ISO-NE Long-term Tx Planning Filing, with Caveats.)

Recommendations from the External Market Monitor

David Patton of Potomac Economics, ISO-NE’s External Market Monitor, presented his annual report on the markets along with several recommendations for improvements.

“We find that the markets performed competitively but identify key improvements that will be increasingly important in the coming years,” Patton said, adding that there was “no market power abuse or manipulation affecting clearing prices.”

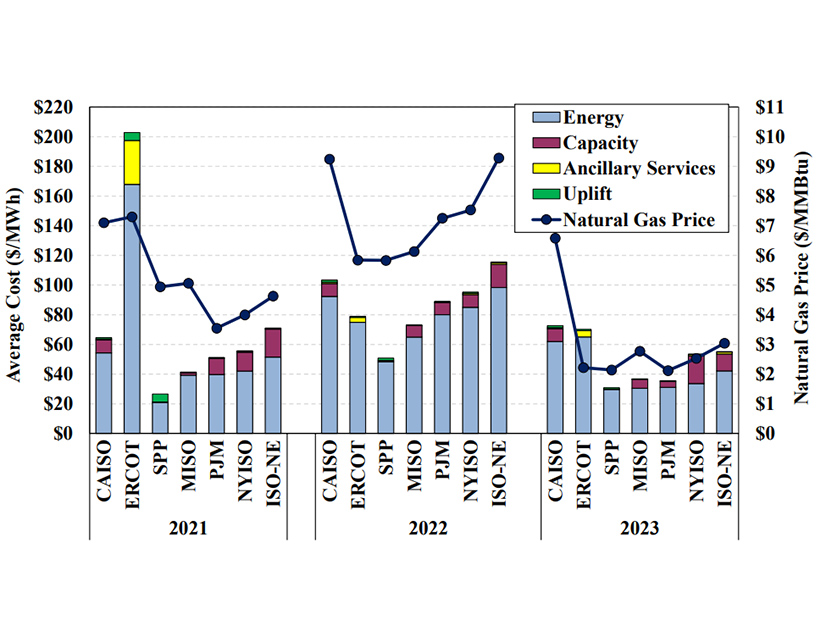

He noted that New England has high energy costs relative to other RTOs because of higher gas prices, along with higher capacity costs “because of over-forecasted demand ahead of the [Forward Capacity Auctions], which are slow to correct in the” capacity market.

Congestion costs remain extremely low in the region because of transmission investments made in the past 10 years, although this has led to significantly higher transmission costs, Patton said.

Patton added that ISO-NE’s wholesale markets are “fundamentally robust and structured to handle” the increasing influx of intermittent renewable generations because of “efficient shortage pricing” and the ongoing work to improve the accreditation of resources in the capacity market.

He said ISO-NE could drive more efficient prices by adopting a “look-ahead dispatch model to optimize multiple hours into the future.” Such a model could provide important signals for slower-ramping resources to prepare to come online and for storage resources to optimally dispatch, Patton said.

Patton also provided a pair of recommendations based on the assessment of a capacity deficiency event in July 2023, which was triggered by the shutdown of a Hydro-Québec transmission line because of nearby wildfires. (See Canadian Wildfires Trigger ISO-NE Capacity Deficiency.)

While ISO-NE curtailed some exports during this event, the structure of the Pay-for-Performance (PFP) pricing enabled some generators to profit while simultaneously exporting their power to neighboring regions. To close this loophole, the Monitor proposes charging all exports the PFP rates, effectively canceling out any PFP profits they could make from New England for exported power.

He also said ISO-NE should adjust how it scales PFP prices, arguing that “fixed, escalating PFP rates and shortage pricing together set prices much higher than efficient levels during most shortages, incenting suppliers to self-commit high-cost units inefficiently and retire longer-lead-time units inefficiently.”

With winter risks projected to surpass summer risks in the 2030s, Patton said ISO-NE’s proposed transition to a prompt and seasonal capacity market will help the region cope with winter challenges. However, he stressed the importance of ISO-NE’s ongoing resource capacity accreditation (RCA) changes to mitigate winter reliability risks.

Patton said the RCA project should rely on “conservative assumptions” related to LNG inventories to account for historical inventory variability associated with LNG prices. He said this would increase incentives for generators to enter firm fuel contracts.

Finally, Patton said ISO-NE’s proposed accreditation model does not explicitly include fuel inventories, and that this could lead to reliability issues during extended winter cold snaps. Failing to model fuel inventories would cause the capacity market to significantly overestimate the winter value of storage resources and undervalue the contributions of offshore wind, Patton said.

The inventory recommendation spurred some concern from NEPOOL members representing storage companies, who have stressed that the accreditation framework already outlined would result in a major reduction in capacity revenue for storage resources, potentially undermining state policy objectives regarding storage. (See ISO-NE: RCA Changes to Increase Capacity Market Revenues by 11% and Panel Provides Update on Energy Storage in Mass.)

Operations Report

ISO-NE COO Vamsi Chadalavada reported that the May energy market value was up by about 12% compared to May 2023, and by about 9% relative to this April.

His report also noted that 832 MW of solar and battery storage projects were added to the ISO-NE interconnection queue, which now totals over 47,000 MW.

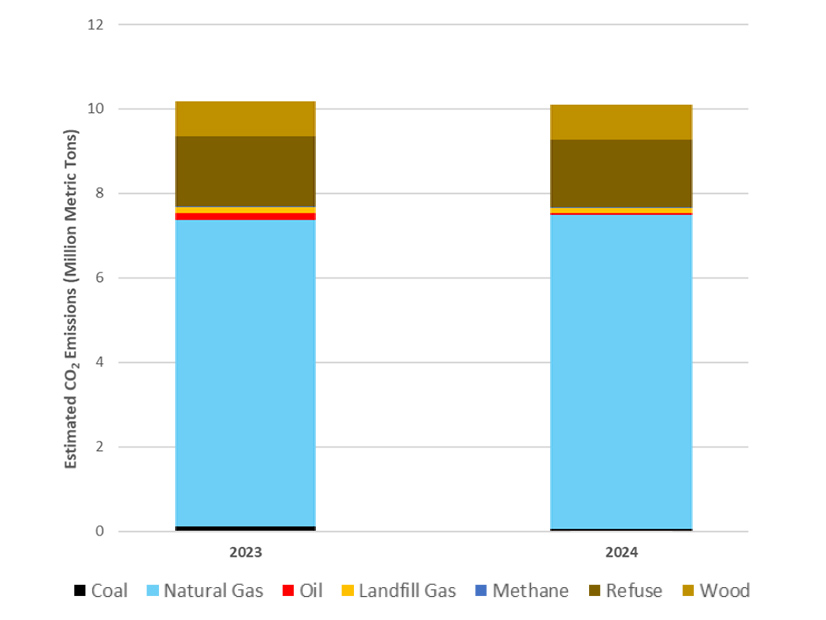

New England power sector emissions for this year are tracking at a similar level as 2023 emissions, at just over 10 million metric tons of CO2 equivalent through mid-May. Coal and oil emissions are down significantly, while natural gas emissions have increased, Chadalavada’s report said.

Climate Activists Join the Party

NEPOOL members were joined at the Mount Washington Hotel by several climate activists from the organization No Coal No Gas. They attended because “FERC sent us,” they said.

The commission recently denied No Coal No Gas’ petition of the results of FCA 18, ruling that the activists’ concerns about a structural bias of the auction in favor of fossil fuels were outside the scope of the proceeding (ER24-1290). (See FERC Accepts Results of New England Capacity Auction.)

Instead, these concerns should be raised in the stakeholder process, FERC wrote. Because NEPOOL is the official stakeholder advisory group for ISO-NE, the activists pitched in for a hotel room to bring their concerns to the summer meeting, they said.

The activists largely refrained from interfering with the NEPOOL goings on, instead distributing informational fliers in front of the meeting room about their capacity market concerns and sat at the periphery of the catered dinner and open bar eating trail mix.

They did, however, take aim at NEPOOL’s annual golf tournament. Eluding security guards by taking cover in the marshes surrounding the golf course, the activists left notes and planted coins and saplings in golf holes to express their disapproval of the grid’s continued reliance on fossil fuels and the lack of public transparency into NEPOOL meetings.