Deep decarbonization of the New England grid will pose major challenges related to resource adequacy and market administration, ISO-NE concluded in the final report of its Economic Planning for the Clean Energy Transition (EPCET) study, released Oct. 24.

The RTO emphasized the importance of developing dispatchable zero-carbon resources to ensure reliability during extended periods of low wind and solar generation, and said new mechanisms likely will be needed to support dispatchable resources that run only in extreme scenarios.

ISO-NE previously outlined its key findings at its Planning Advisory Committee in August, when it told stakeholders it plans to consider “future market rule enhancements to support the ongoing reliability and economy of the region’s grid.” (See ISO-NE: New Mechanisms May be Needed to Ensure Future Grid Reliability.)

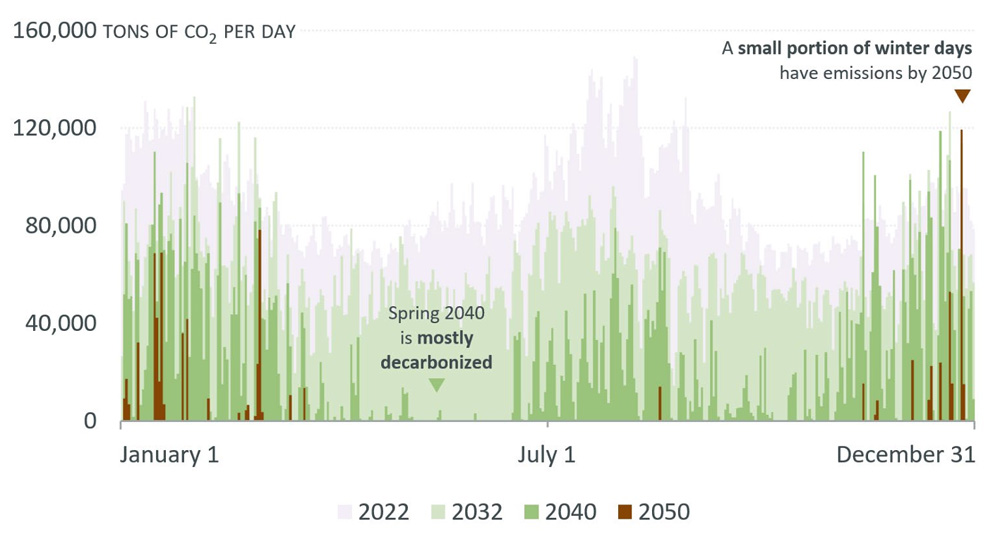

One of the main issues New England will face as it approaches full decarbonization is increasing variability of both demand and supply, with electrified heating and intermittent renewables both highly impacted by extreme weather events, ISO-NE wrote.

“The magnitude of the annual peak will vary dramatically from one year to the next, depending on how cold or how mild a winter the region sees,” ISO-NE wrote. “As a result, some resources needed to maintain reliability during the harshest conditions may only run once every few years.”

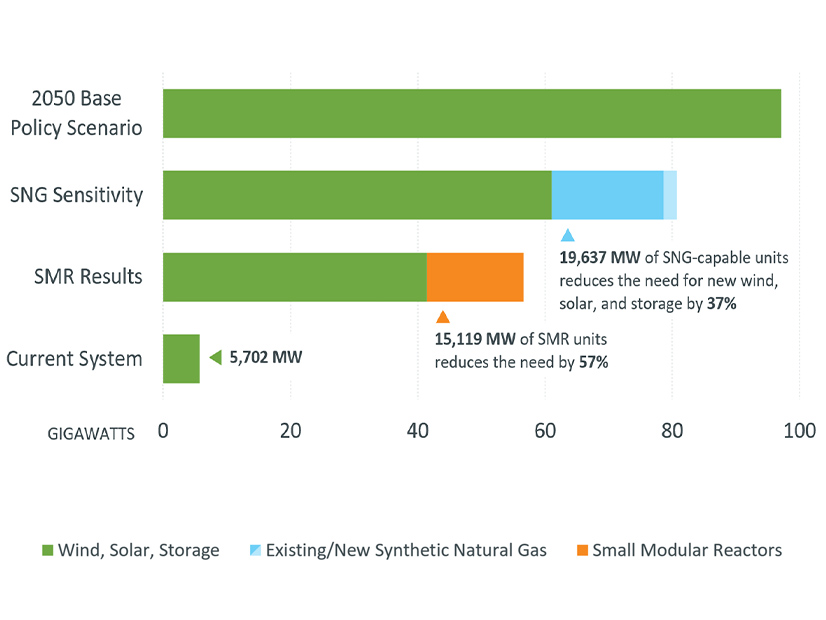

Without significant dispatchable resources, decarbonization will require a significant overbuild of wind, solar and batteries, which would come at a significant cost to consumers and have a large land-use impact, ISO-NE said.

The RTO estimated the region would need to add a staggering 97 GW of renewable capacity by 2050 to meet state goals, equating to an average annual addition of 1,293 MW of offshore wind, 268 MW of onshore wind, 955 MW of solar and 952 MW of batteries.

As the proliferation of renewables eliminates power system emissions from increasing amounts of the year — first in the spring and fall seasons, followed by the summer and eventually the winter — the value of new renewables will decrease, the modeling found.

“Fundamentally, as decarbonization accelerates, but remains highly correlated with the seasons, zero-carbon resource additions will produce surplus energy for increasing periods of time, and their cost per MWh will rise,” ISO-NE said.

The declining value of additional renewables will correspond with the increasing need for dispatchable resources and long-duration storage, ISO-NE said. The RTO found 100-hour batteries — such as those planned for development in Maine — will become particularly valuable as the region approaches 2050.

“However, even with a significant penetration of 100-hour batteries, the later years of this sensitivity still experience stretches of time when 100-hour batteries become depleted and significant fuel-secure dispatchable generation is needed to satisfy demand,” ISO-NE said.

To address these gaps, ISO-NE highlighted low-carbon fuels such as synthetic natural gas (SNG), clean hydrogen and renewable diesel, as well as small modular reactors (SMRs), as potential options.

The RTO specifically modeled SNG, noting that it could make use of the existing gas transmission network, while hydrogen likely would require significant amounts of new storage and transportation infrastructure.

It found that including 19,637 MW of SNG resources “achieves the states’ 2050 decarbonization targets while requiring 37% less new renewable capacity,” with high SNG fuel costs offset by the diminished need to overbuild renewables.

ISO-NE also modeled the effects of including SMRs, finding that “a renewable-dominant build-out that also includes 15.1 GW of SMRs achieves the states’ 2050 decarbonization targets while requiring 57% less new renewable capacity.”

The RTO emphasized that cost projections for SMRs remain highly uncertain, but estimated the inclusion of SMRs could reduce overall capital costs by 33% relative to the base case, and said the SMR case still outperformed the base case when the model doubled the SMR cost assumption.

The report did not include a focus on how increased interregional transmission could affect the system. Multiple studies have found increased transmission between Québec and New England to reduce the cost of deep decarbonization in the Northeast by enabling Québec’s hydroelectric resources to balance out intermittent renewables. (See Québec, New England See Shifting Role for Canadian Hydropower.)

Massachusetts Institute of Technology researchers have found that increased bi-directional transmission between the U.S. and Canada would cut overall decarbonization costs by reducing the need to overbuild renewables. The researchers estimated that 4,000 MW of additional transmission between New England and Québec would reduce the overall costs of full decarbonization by 17-28%.

ISO-NE also noted that increased demand flexibility, which has been a top priority for consumer and climate advocates in the region, likely would not provide significant benefits during extended winter periods of low wind generation.

“While EV charging or heating could be delayed by a few hours, heating in particular cannot be delayed for longer time periods,” ISO-NE wrote.

Minimum Load Concerns

The RTO also noted the proliferation of behind-the-meter solar could create minimum-load issues for resources that are not able to quickly ramp down their production.

“All weather years in the modeled 2032 system experience days in which the net load falls below this threshold,” ISO-NE found.

It noted that flexible load — such as demand from electric vehicle charging — could be incentivized to alleviate these issues, or the region could increase its exports if other regions are not facing similar conditions.

Market Challenges

Beyond the technical challenges of developing adequate dispatchable zero-carbon resources to support system reliability, significant changes to the current market structures likely will be needed to support these resources, ISO-NE said.

While the energy market currently is ISO-NE’s largest market “by a large margin,” RTO projects overall revenue from the capacity market and from state power purchase agreements (PPAs) to surpass the energy market by 2035. Meanwhile, the proliferation of resources with PPAs — which often still can profit when bidding negative prices into the energy market — could threaten the viability of baseload resources that lack PPAs.

“Baseload nuclear resources are at particular risk of exposure to periods of negative [locational marginal prices], since they cannot increase or decrease their output quickly,” ISO-NE said.

Meanwhile, dispatchable resources needed to ensure reliability may not be used at all within a given year, putting more pressure on the capacity market to provide them with the necessary revenue. ISO-NE officials previously expressed apprehension about relying too heavily on the capacity market, which frequently is subject to intense stakeholder debates.

“Current market rules and other revenue structures may not scale well in a renewable-heavy grid, and the ISO is exploring alternate market structures within its jurisdiction,” ISO-NE wrote.

ISO-NE CEO Gordon van Welie has frequently expressed his support for developing a price on carbon within the wholesale markets but has said this would require full support from all six New England states. The EPCET study noted that zero-carbon dispatchable resources likely would need a price on carbon, or some other incentive, to compete economically with fossil alternatives.