Pennsylvania is a net exporter of electricity, but the narrowing reserve margin in PJM led the state’s Public Utility Commission to hold an all-day technical conference Nov. 25 to discuss resource adequacy.

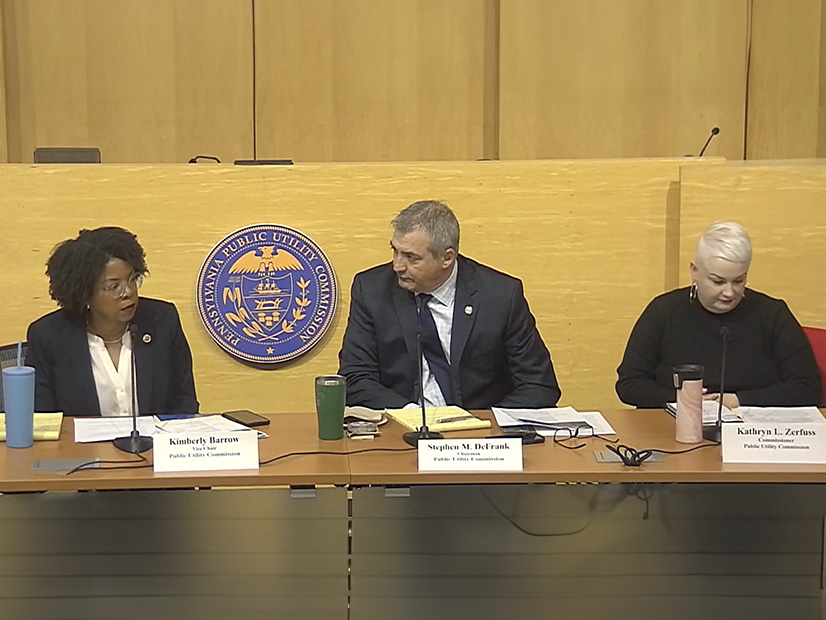

While this past summer’s capacity auction showed spiking prices amid rising demand and retiring power plants, PUC Vice Chair Kimberly Barrow said she started focusing more on resource adequacy during winter weather events like the polar vortex a decade ago and Winter Storm Elliott in December 2022. (See PJM Capacity Prices Spike 10-fold in 2025/26 Auction.)

“What I’m very worried about now is those challenges occurred at a time when we were not facing the kind of load growth that we’re facing right now,” Barrow said. “The load growth we’re facing is unprecedented, and I do not know if we are bringing resources on quick enough to face that load growth.”

Pennsylvania is a restructured state, so the PUC has limited authority over power generation, but it is still responsible for ensuring reliability and affordability on the distribution system, she added.

Demand growth, driven mostly by large data centers coming online, is working alongside retiring power plants and a slow pace of adding new supplies to cut into what for years was a healthy reserve margin, PJM Executive Vice President Stu Bresler said.

“PJM really started in an enviable position, from the standpoint of the reserves that we had available in the system than we do today, but these trends that we are seeing, obviously, are causing that to change and change significantly,” Bresler said. “Overall, we believe that the structure of our wholesale electricity markets remains sound. We believe that those markets will continue to stimulate resource development and resource additions.”

But there is going to be a transitional period with narrow reserve margins, as evidenced by the last capacity auction, he added. PJM’s adoption of effective load-carrying capability (ELCC) to measure resources’ capacity also contributed to the last auction’s outcome, but Bresler said that method should encourage the kind of firmer resources the grid needs going forward.

PJM Independent Market Monitor Joe Bowring said properly designed ELCC rules would help the region maintain reliability, but it and other rules should be changed.

“I don’t think the current design will get us there, but I think that we need to move forward and do a rethink of ELCC and make it more sophisticated at the point where it really will reflect supply and demand,” Bowring said.

ELCC has an “excessive” focus on natural gas plants’ performance during several historical hours in winters when PJM was still learning about gas notification periods, Bowring said. The rule understates the value of thermal resources, especially combined cycle natural gas plants and combustion turbines.

While Pennsylvania has restructured, that does not mean the industry relies entirely on PJM’s wholesale power markets for its revenue, said Travis Kavulla, NRG Energy vice president of regulatory affairs.

NRG owns generation and a competitive retail business that serves about 10% of the demand in the Eastern restructured markets, which means it must hedge the latter with bilateral contracts with generators, he said.

“NRG, when it signs up a retail customer, engages in a policy called back-to-back hedging. On Day 1 of our service under that contract, we estimate a customer’s load, make adjustments for extreme weather and then bilaterally buy energy supply that covers that estimated load on the part of the customer,” Kavulla said. “These bilateral contracts are a major source of revenue to our counterparties, the power plants of PJM.”

Sometimes those bilateral contracts can be more important to generators — though less visible to the public — than income from PJM’s markets, he added.

“These markets were designed with the idea that the bulk of trades would be bilateral transactions and self-supply,” Bresler said. “It was not intended that either suppliers would invest, or consumers would ride the spot market based on spot market prices. The fact of the matter is, though, these markets are unforgiving.”

PJM’s goal is not for prices to be high, but to signal the market that supply is needed, which will encourage suppliers and customers to enter into new long-term contracts, he added.

Kavulla said one thing the PUC could do under its authority would be to encourage longer-term contracts in the retail market. Even residential customers can get prices locked in for five years, at lower rates than default service.

One major recent example of those bilateral deals directly leading to new supply on the grid was the contract Constellation Energy struck with Microsoft to bring Three Mile Island’s recently retired reactor back to service to supply a new data center, said Adrien Ford, Constellation’s director of wholesale market development.

“It’s our partnership with Microsoft that’s bringing the Crane Clean Energy Center back online,” she said, referring to TMI’s new name, “not the PJM one-year print.”

Another way Constellation hedges its generation is by participating in the default service auctions that restructured states run, which secure supply for most small customers that do not shop for competitive supply, she said.

Policy Changes and the Supply Chain

With a new political party taking over the White House and EPA, some of the retirements that PJM has been forecasting could be significantly delayed, said Calpine’s Joe Kerecman.

EPA’s plans to regulate carbon dioxide will certainly change with the new administration, and other rules could also be tossed out, which will mean existing coal plants stay running longer.

That could help because Kerecman and other representatives of independent power producers noted that building new natural gas plants takes longer than it used to.

“I think you can get gas turbine deliveries by 2027 certainly. … You got to write some big checks, which differentiates a company like Calpine, because we have 27,000 MW,” Kerecman said. “We have well established relationships with [original equipment manufacturers] and EPC [engineering, procurement and construction] contractors as well.”

The domestic industry has to compete with growing demand for power plant equipment from the Middle East, along with generally stressed supply chains, he added.

If a developer sent the first milestone payments to an OEM now, they would not get delivery of equipment until mid- to late 2028, and then it would need to spend an additional 12 to 18 months actually building a power plant, Talen Energy Chief Development Officer Darren Olagues said.

“It’s obviously a global queue, but it’s one of the reasons we need to get this right now and inspire the confidence for developers to start to put down the milestone payments,” Olagues said. “You’re talking tens of millions of dollars per turbine.”

It’s also hard to plan for a power plant with continuous discussions about changing PJM’s capacity market, he added.

The industry’s bankers would “love a steadier signal,” LS Power Senior Vice President Marjorie Philips said.

“But I think there’s a couple of things to think about,” Philips said. “One is, the data centers are ignoring the capacity markets. They are paying astronomically more. There’s a reason why we are all looking to supply them. They value the electricity a lot more than we’re valuing it in the capacity market.”

The other factor is that constant regulatory interventions in the market do not help build investor confidence, she added.

“The commodity fluctuations are less troubling than the regulatory interventions,” Philips said. “But I think long term, if we let the market work and understanding that it’s very unpalatable that we’re going to have to deal with high prices, and that, candidly, falls on your shoulders, how to manage the retail rates, and we are not unsympathetic to it, but that is the political reality.”

It takes “two or three” price signals for developers to invest in new supply as they have in the past, she added.

Potential State Responses

While Pennsylvania is a restructured state, Consumer Advocate Patrick Cicero said it was still the PUC’s responsibility to ensure resource adequacy.

“I would just submit that I think that no one should question that is the job of the Public Utility Commission,” Cicero said.

State law requires the PUC to ensure reliable, affordable electricity, and part of that includes the generation issue facing the PJM region, he added.

“The fact that we’re a restructured state means that generation is no longer rate regulated, but it does not mean that the Public Utility Commission does not have the authority and tools necessary to ensure continued reliability,” Cicero said. “I assure you that if something happens, you will be blamed, and so consequently, if you will be blamed, then you should have the tools necessary to fix this problem.”

PJM’s market is not a failure, but it is leading to resource adequacy problems for Pennsylvania right now, PPL Electric Utilities President Christine Martin said.

“I really do think that we need to keep an open mind [and] not let the past dictate the future; not let a law passed almost 30 years ago define our future,” Martin said.

PPL supports changing the law to allow utilities to invest in generation, but Martin said that would not have to completely upturn Pennsylvania’s history with the markets. It is mainly focused on getting new resources online in the commonwealth.

“We are not insulated from Maryland or New Jersey or Delaware or D.C.,” Martin said. “We don’t have that luxury. So, when we think about resource adequacy and economic development and keeping the lights on, the type of generation [and] the location of generation does matter.”

GT Power Group President Glen Thomas, a former Pennsylvania PUC chair, cautioned commissioners from turning away from the markets too quickly. Given that generation investments are lumpy, PJM has faced these kinds of debates in the past — including 15 years ago when Maryland and New Jersey tried to get new natural gas built with state-backed contracts, which were ultimately found unconstitutional by the U.S. Supreme Court.

One of the contracts that New Jersey signed would have paid a plant $286 to $432/MW-day, well above the $270/MW-day the last auction capacity auction cleared at, Thomas said. It would have added over $1 billion over the term of the contract, which proved unneeded as the three plants New Jersey tried to support are all still operating today without any subsidies.

“They made a very critical mistake that would have cost their consumers a lot of money, but for the fact it was litigated and determined to be unconstitutional,” Thomas said. “So, it’s great to think about these plans. It’s great to think about the future, but it’s very hard to predict the future with these markets. These markets are cyclical.”