Even meeting half of the projected demand from new data centers in Virginia over the next 15 years will prove difficult, said a report released by a legislative commission.

The Joint Legislative Audit and Review Commission (JLARC) released “Data Centers in Virginia” at a hearing Dec. 9. It included recommendations for legislative and other actions the state could take to deal with the rapid growth in electricity demand.

If the sector continues growing at forecast rates, overall demand in the state is expected to double in the next 10 years, according to an independent forecast JLARC paid for, and that’s in line with PJM’s forecasts.

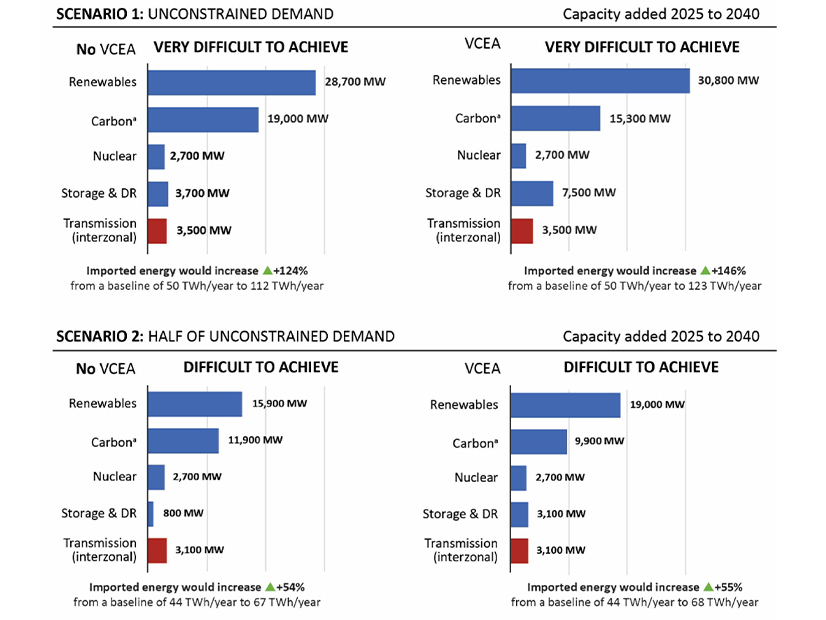

“A substantial amount of new power generation and transmission infrastructure will be needed in Virginia to meet unconstrained energy demand or even half of unconstrained demand,” said the report. Building that infrastructure “will be very difficult to achieve, with or without meeting the Virginia Clean Economy Act (VCEA) requirements.”

New solar facilities would have to be added at double the rate they were this year, more offshore wind than has been secured for even potential development would need to be built, and the state would have to add natural gas plants at a rate faster than the busiest period of their construction, which was from 2012 to 2018 in Virginia, said the report.

“Under Scenario 1, meeting unconstrained demand would require adding 150% more in-state generation capacity, 40% more transmission and importing 150% more energy,” JLARC staffer Mark Gribbin said at the hearing. “Under Scenario 2, which again is only half the demand materializes, we’re still looking at doubling existing generation, 35% more transmission and 55% more imports. In short, either scenario would require a massive increase in energy infrastructure.”

The model predicts some of that infrastructure demand would be needed regardless of data center demand, but they are driving most of it, Gribbin added.

The modeling also included scenarios where the Virginia Clean Economy Act was followed and those where it was not. All scenarios include some new natural gas power plants ranging from 9,900 MW to 11,900 MW in the low demand cases, and 15,300 to 19,000 MW in the high demand cases, with the climate law’s achievement representing the lower numbers.

“If you look at those, they’re not that far apart in terms of what gets built,” Gribbin said. “The reason for that is because those VCEA renewable requirements do not apply to the co-ops.”

While data centers exist in other parts of the state, they’re concentrated in Northern Virginia and in the territories served by co-ops, with JLARC expecting 60% of data centers to be located in co-op territory, he added.

Northern Virginia is the largest data center market in the world, with 13% of all reported global capacity and 25% of capacity in the Americas, said the report. It is nearly twice the size of the second-largest market, Beijing, China, and three times the size of the second-biggest market in this hemisphere, Hillsboro, Ore.

“The region’s role in the early stages of the internet’s development gave it a head start as a key data center hub,” the report said. “In the mid-20th century, early data processing companies contracting with government agencies and high-technology government labs were drawn to the region given its proximity to their federal government customers. The establishment of an internet exchange point in the 1990s further attracted major telecommunications and early internet companies to the region.”

With the growth of the internet this century, the capacity in Northern Virginia, and in other parts of the state, especially along Interstate 95, continued to grow because locating data centers closer together cuts “latency,” which Gribbin said was a key to the sector’s expansion in the area.

“If I have a data center here and a data center across the street, those two data centers can communicate a lot faster,” he added. “So, if I am browsing an internet site, or if I’m doing some sort of financial transaction, basically it speeds up how fast they can communicate. And, so, when you start putting more and more data centers and with more and more business customers next to each other, they can communicate very fast.”

While hosting the largest concentration of data centers comes with issues, it also benefits the state to the tune of 74,000 jobs, $5.5 billion in labor income and $9.1 billion in GDP every year. Most of those benefits accrue during the construction of data centers.

Data centers also can be a major taxpayer for their communities, though some have offered lower rates to attract them, with the report saying they range from between 1 and 31% of localities’ total revenue.

Expanding the facilities away from the I-95 corridor to more economically distressed parts of the state could benefit those communities, but that brings up issues with latency and lack of local infrastructure, the report said.

“However, these localities may be able to compete for data centers running certain artificial intelligence (AI) workloads, such as training,” the report said. “These localities could potentially become more attractive to the industry if they are able to proactively develop industrial sites suitable to data centers.”

The report found that, so far, data centers are not driving bill increases for other classes of power customers, but with the major infrastructure needs on the horizon, that could change.

“Even though current rate structures appropriately allocate costs across customers, data centers’ increased demand will likely increase system costs for all customers, including non-data center customers,” the report said. “This is because current utility rate structures are not designed to account for sudden, large cost increases from the construction of new infrastructure to serve a relatively small number of very large customers.”

The typical residential customer could see their bills rise by $14 to $33 per month by 2040 depending on how many data centers are built, said the report.

“Establishing a separate data center customer class is a first step utilities could take to help insulate residential and other customers from the energy cost impacts of the industry,” the report said.

The report said co-ops treat data centers as their own separate class of customers already. It also suggests that Dominion Energy develop a plan to address the risk of any infrastructure investments being stranded with existing customers should the firm build infrastructure for data centers that do not come.

Another policy lever the state has is its sales tax exemption for new data centers, which provided $928 million in tax savings to the sector last year. The capital-intensive industry views that as a valuable incentive, and other states competing with Virginia support it.

The incentive has been in place since 2010 and is set to expire in 2035, and if the legislature let it lapse, development in the outer years would slow. The report also suggests cutting the incentive or tying it to requirements for data centers to maximize efficiency, or participating in demand response programs.